The Causes of Rural Hospital Problems

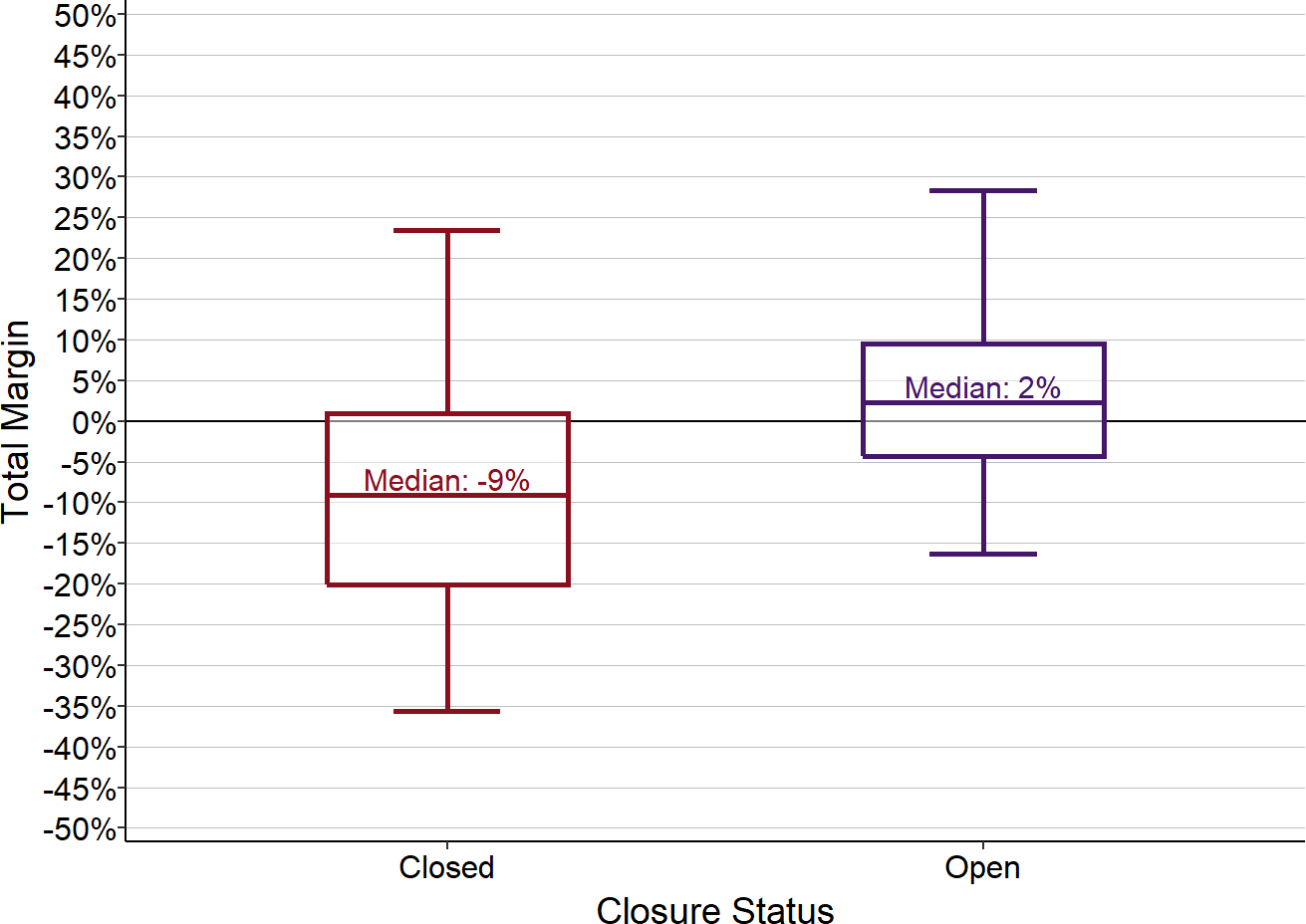

Rural hospitals are being forced to close because they are not paid enough to cover the cost of delivering care to patients in rural areas. Half of the small rural hospitals that have closed in recent years had losses of 9% or more in the year prior to closure, and over one-fourth had losses greater than 20%.

The primary causes of losses at the hospitals that closed were inadequate payments from both public and private health plans and inability of patients to pay their share of treatment costs. Most of the hospitals that closed had losses on patients with private health insurance as well as on Medicare, Medicaid, and uninsured charity care patients, and they did not have any other sources of income sufficient to offset these losses.

More than one-third of the rural hospitals that remain open have been losing money. Over 700 rural hospitals lost money in 2024, and nearly 400 had losses of 5% or more.

Small rural hospitals experienced greater financial losses on patient services during the pandemic, but they were able to continue operating because of the special federal pandemic aid that was available. However, this assistance was only temporary, and losses on patient services are likely to worsen in the future due to continued increases in costs.

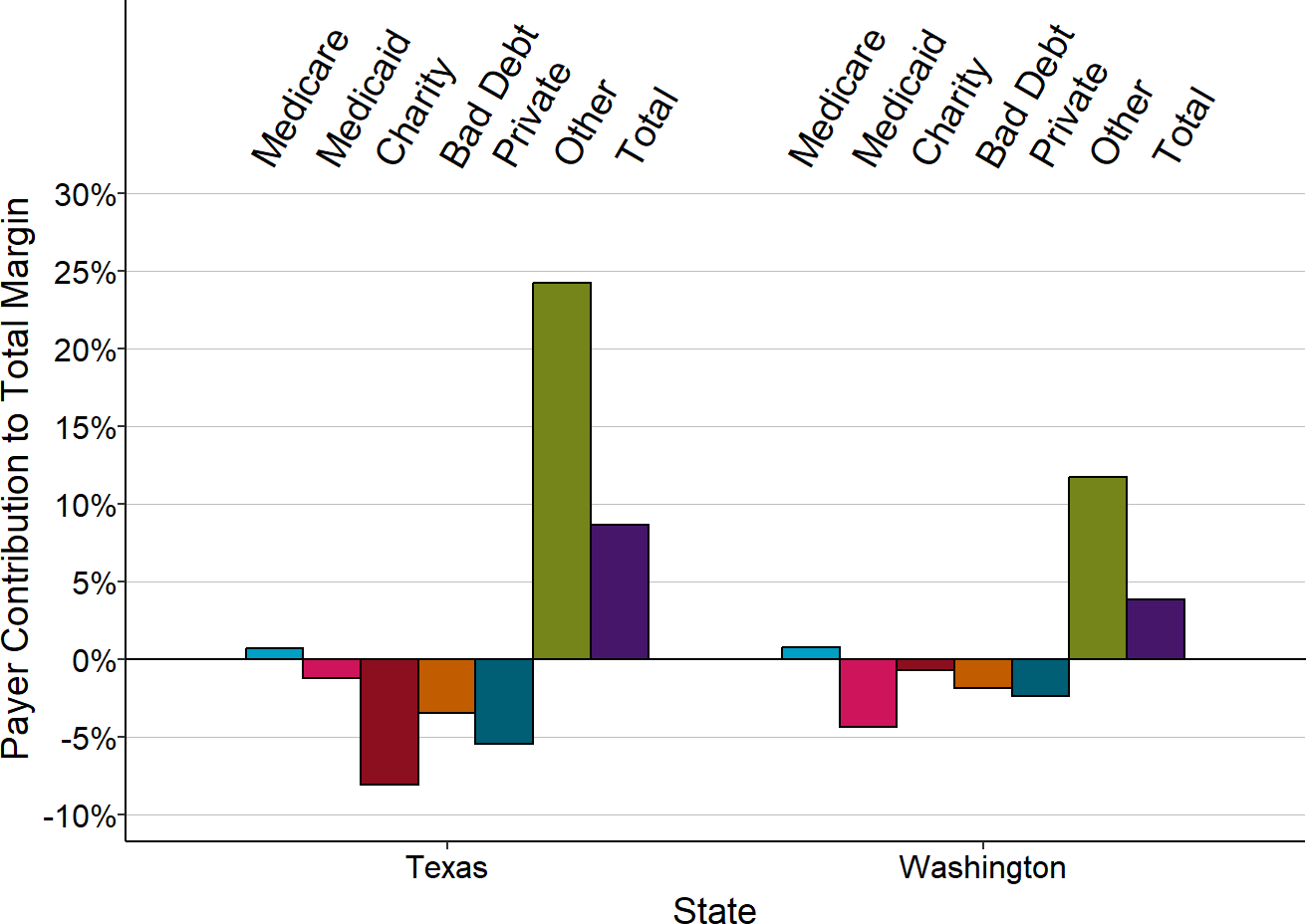

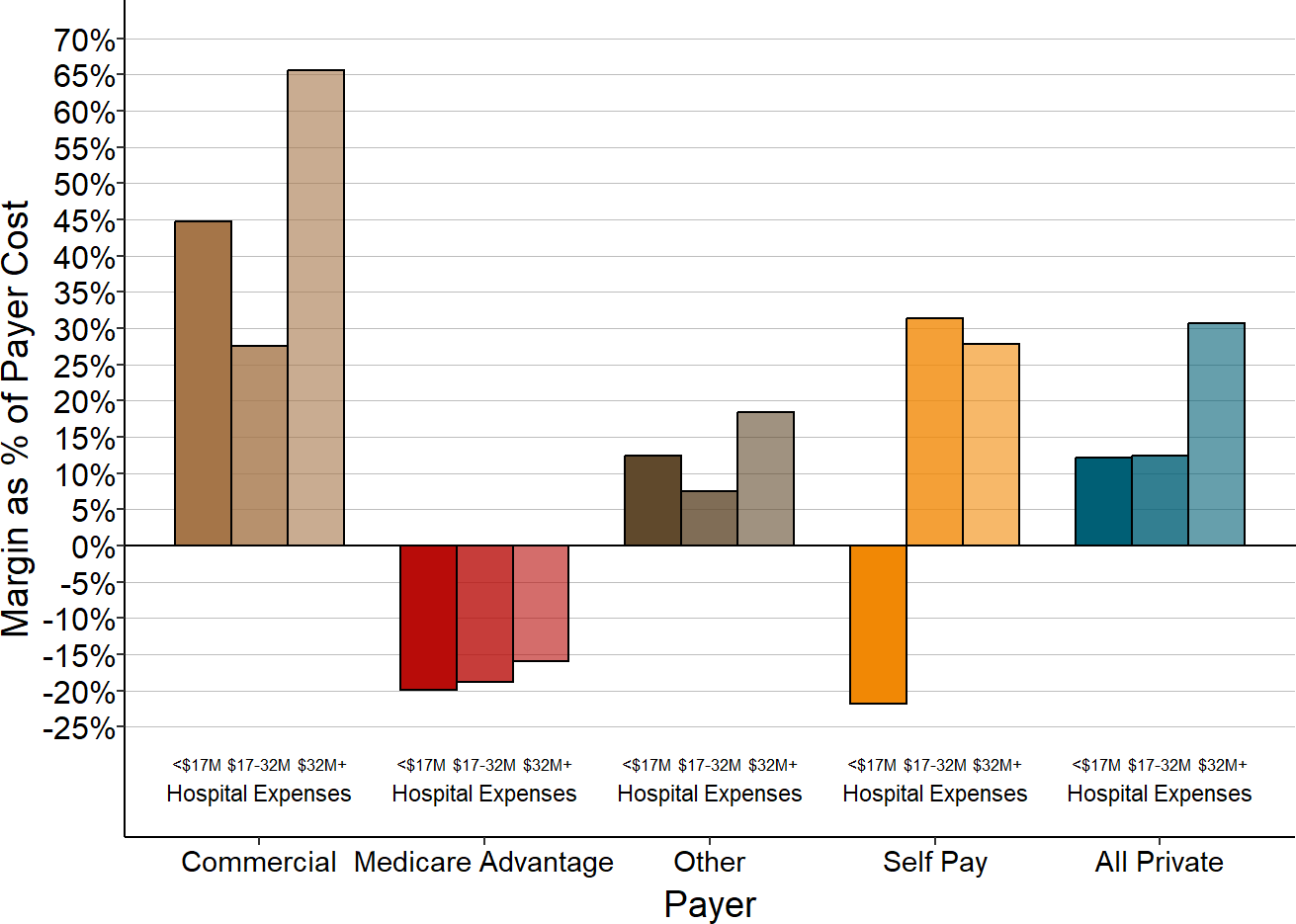

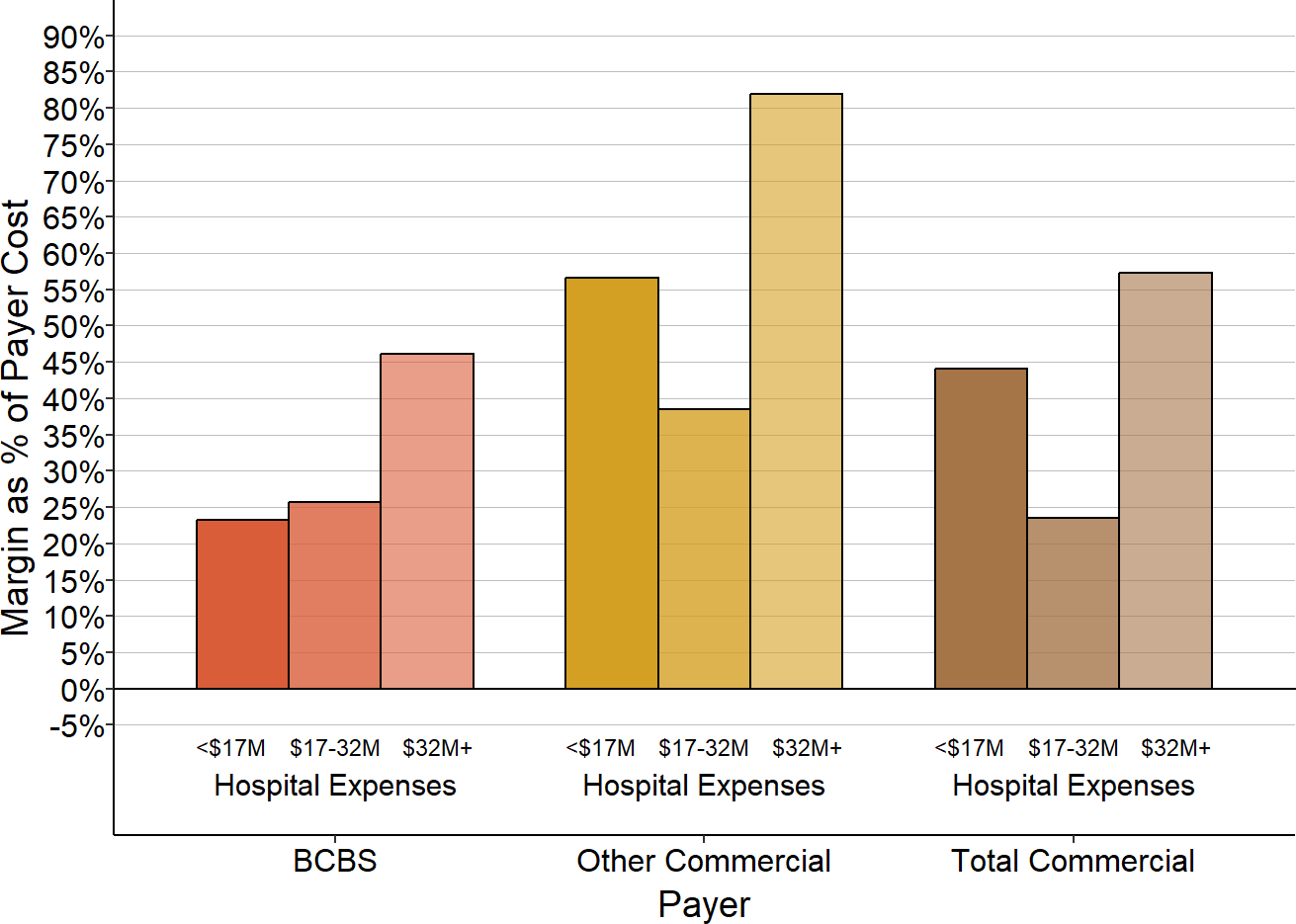

Low payments from private health plans and patient bad debt are the primary causes of losses at small rural hospitals. At the majority of small rural hospitals, losses on patients with private health insurance plans and self-pay patients were greater than losses on Medicare, Medicaid, and uninsured charity care patients combined, although the magnitude of the losses varies significantly across states. Private health plans pay small rural hospitals less than they pay larger hospitals for the same services, and Medicare Advantage plans appear to be among the worst payers at small rural hospitals. Most small rural hospitals operate one or more Rural Health Clinics, and the low payments for primary care services from private payers are a major cause of losses at these hospitals.

The majority of rural hospitals lose money on Medicaid patients. The losses on individual Medicaid patients are generally larger than the losses on patients with private insurance. However, the much smaller proportion of Medicaid patients means that the overall impact on the hospital due to private insurance losses is still larger. In states that expanded Medicaid, hospitals experienced smaller losses on uninsured patients and bad debt, but losses on services to Medicaid patients increased due to low payments for services.

Medicare payments do not cause significant losses at most small rural hospitals. Most small rural hospitals are classified as Critical Access Hospitals and receive cost-based payments from Medicare.

Many small rural hospitals remain open only because they receive significant supplemental funding from local taxes or state grants. Two-thirds of small rural hospitals lose money on the delivery of patient services, but half of those hospitals receive enough revenue from other sources to maintain a positive overall margin. Small rural hospitals in some states are organized as public hospital districts, and residents of these communities tax themselves to offset underpayments by private health plans and Medicaid.

There is tremendous variation across the country in both the magnitude of losses and the causes of losses at small rural hospitals. In many states, low payments from private insurance plans are the primary cause of financial problems in small rural hospitals, but in other states, low Medicaid payments and low rates of insurance coverage are the largest single cause of losses. In some states, state grants or local taxes reduce or eliminate losses at small rural hospitals, while there is little or no such assistance for hospitals in other states.

Changes in payments from all payers will be needed to eliminate losses at small rural hospitals. No individual payer (Medicare, Medicaid, or a private insurance plan) is the sole cause of financial losses at small rural hospitals, and the relative magnitude of the contributions of each type of payer varies from state to state and hospital to hospital, so multi-payer solutions will be needed to solve the problem of rural hospital closures.

The Magnitude of Financial Losses at Rural Hospitals

Losses at Rural Hospitals That Closed

Most of the rural1 hospitals that have closed were forced to do so because the hospital could not afford to pay for the staff and supplies needed to continue delivering services to patients. The rural hospitals that closed since 20122 had a median loss of 9% in the year prior to closure, and one-fourth had losses of 20% or more.3 In contrast, the majority of rural hospitals that have not closed have had small but positive total margins.4

Figure 1

Total Margin (Profit/Loss) in Rural Hospitals

Closed hospitals include all rural hospitals that closed since 2012. For open hospitals, the margin (i.e., profit or loss as a percentage of total expenses) for the most recent year is used. For closed hospitals, the margin for the most recent year before closure is used. The bottom of each box shows the 1st quartile (i.e., 25% of the hospitals have a margin lower than this amount), the top of the box shows the 3rd quartile, and the center line represents the median value for the category (i.e., 50% of the hospitals are above or below this amount). The ends of the “whiskers” above and below each box represent the 5th and 95th percentiles, i.e., the margins for 90% of the hospitals in the category are between these amounts.

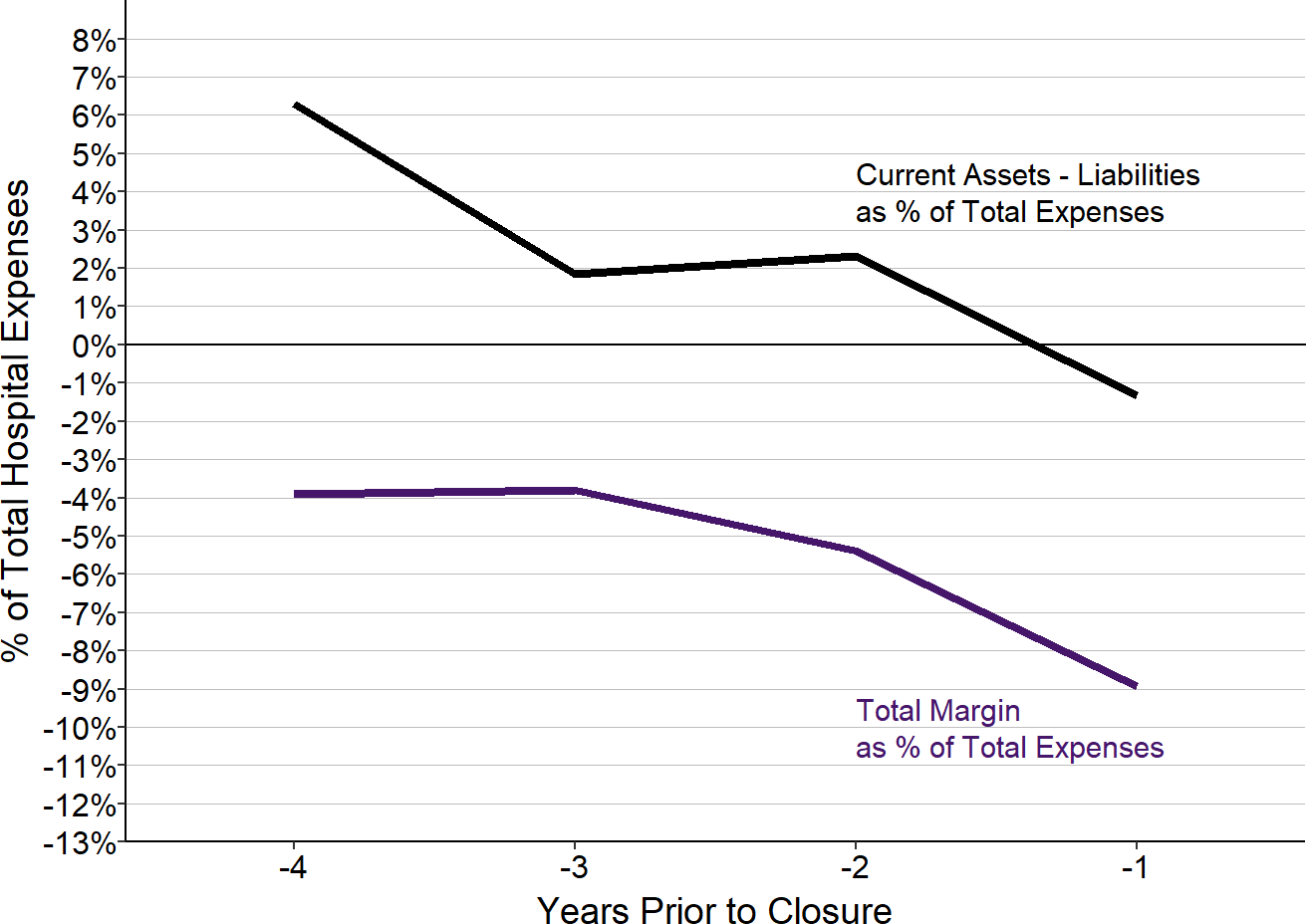

Closures do not occur suddenly or because a hospital loses money in one single year. Instead, hospitals that close typically experience losses for several years and reach the point where they no longer have sufficient financial reserves available to cover their losses and no method of paying their staff or creditors.

In the rural hospitals that have closed since 2015, persistent annual losses in the years prior to closure had reduced the hospitals’ resources to the point where the majority had current liabilities that exceeded current assets5 in the year before they closed.

Figure 2

Financial Trend Prior to Closure of Rural Hospitals

Values shown are the median amounts for rural hospitals that closed after 2015.

Several of the rural hospitals that closed were owned by EmpowerHMS, a company that was indicted for fraudulent billing.6 However, these were originally community hospitals that only became part of EmpowerHMS because the hospitals were struggling financially and EmpowerHMS promised to rescue them.7 Other hospitals that closed had been bought or managed by individuals or companies that had promised to address their financial problems but failed to do so.8

Losses at Hospitals That Have Not Closed

Although the majority of rural hospitals receive enough revenues to cover their costs, more than one-third do not. Almost 700 rural hospitals lost money in 2024, and over 350 had losses greater than 5%. More than 350 rural hospitals had losses prior to the pandemic as well as in 2024.9

Large, persistent losses deplete a hospital’s financial reserves, making it more likely it will have unpaid bills and difficulties in making payroll. Rural hospitals with financial losses and low reserves are the most susceptible to closure.

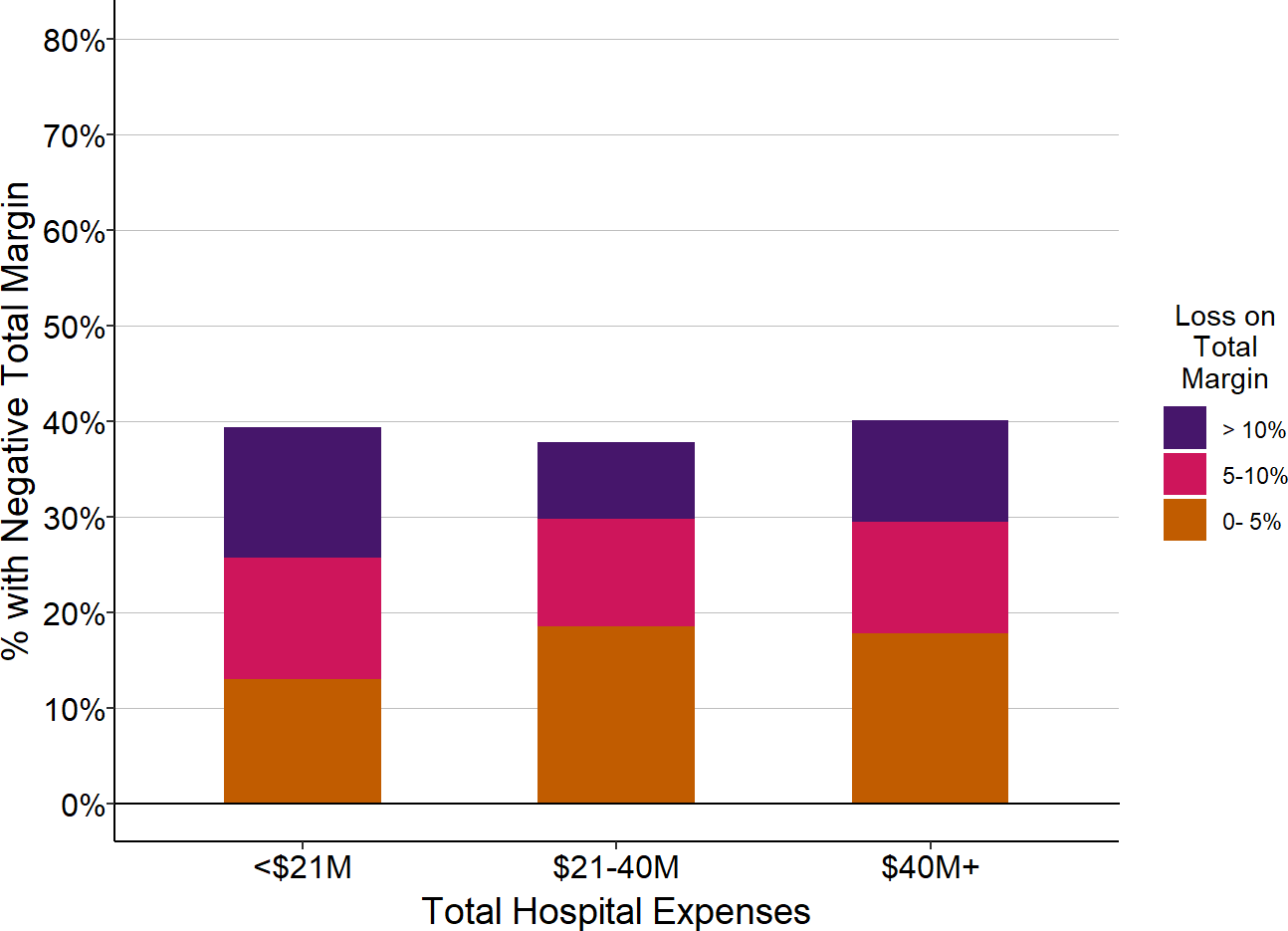

Although a significant proportion of rural hospitals of all sizes are losing money, the size of the losses are higher among the smallest rural hospitals, i.e., those in the lowest quartile of annual expenses ($24 million in 2024).10

Figure 3

Rural Hospitals Losing Money

| Total Hospital Expenses | Number of Rural Hospitals |

Percent with Total Margin < 0 |

Percent with Total Margin < -5% |

Percent with Total Margin < -10% |

|---|---|---|---|---|

| <$24M | 532 | 40.6% | 21.6% | 10.7% |

| $24-45M | 529 | 30.6% | 14.9% | 7.4% |

| $45M+ | 1,087 | 25.4% | 13.1% | 6.0% |

The chart shows the percentage of hospitals in each size category that had a median margin less than 0 in 2024, i.e., the hospital incurred a loss. If the median margin was lower than -5% or -10%, the hospital is included in the red or purple groups.

Hospitals that are losing money are at risk of closure, but even if a hospital does not close, large and persistent losses mean that the hospital will likely have to reduce the healthcare services it provides to the community. As a result, failure to address the significant financial problems facing the majority of these hospitals could lead to significant reductions in access to healthcare services for residents of many parts of the country.

Sources of Revenues in Rural Hospitals

Revenues at a hospital can be divided into four major categories:

- Health Insurance Plans: Since most patients have health insurance, the majority of revenues at every hospital comes from insurance plans. However, different insurance plans pay a hospital different amounts for the same service, and insurance plans pay different amounts for the same service at different hospitals. As a result, a hospital’s profitability will depend on the specific types of insurance its patients have and the amounts each of those plans pays the hospital for its services.

- Patients: Patients themselves are also an important source of revenue for hospitals. Obviously, if a patient has no insurance, the patient will be the primary payer for any services they receive. However, insured patients also serve as partial or even full payers for many of the services they receive because most health insurance plans require patients to pay copayments, co-insurance, and deductibles for services.11 In addition, if a service is not covered by the patient’s insurance plan, the patient will be responsible for the full charge. If patients cannot afford to pay some or all of the amounts they owe, this will reduce a hospital’s overall margin on services.

- Government Funding: Many rural hospitals receive government appropriations or tax revenues that are intended to support the hospital’s operations but are not directly tied to specific services for individual patients. For example, a number of rural hospitals are organized as public hospital districts and raise revenues from local tax levies. Some states provide special grants to rural hospitals to offset losses from the provision of care to uninsured patients.12

- Non-Patient Service Activities: Finally, most hospitals will receive some revenues for activities that are not directly associated with the hospital’s own healthcare services, e.g., operating a cafeteria, a gift shop, or a parking lot. Depending on the costs incurred for these activities, they may generate either a net profit or a loss for the hospital. In addition, a hospital will receive earnings on any investments it has made, and it may also have to pay interest on loans or bonds; the net revenue from these interest earnings and payments increases the total margin at some hospitals and reduces it at others.

The most detailed data available on the types of revenues received by hospitals come from the cost reports hospitals submit to the Centers for Medicare and Medicaid Services (CMS) each year. The cost reports do not allow revenues to be fully disaggregated into the categories above, but they do allow the following categories of revenues to be analyzed:

- Health Insurance Plans:

- Medicare Fee-For-Service: The most detailed information is available on payments associated with Medicare beneficiaries who are enrolled in “Original Medicare” (i.e., individuals who are enrolled in Medicare Part A and Part B and are not enrolled in a Medicare Advantage plan).13

- Medicaid: The cost reports include the total amount the hospital receives for services delivered to patients on Medicaid. This includes both payments hospitals receive directly from the state Medicaid agency as well as payments received from the Medicaid Managed Care Organizations (MCOs) that serve as payment intermediaries in many states.14

- CHIP and Indigent Care. Hospitals identify any payments for patients who are enrolled in Children’s Health Insurance Programs (CHIP) and state indigent care programs.

- Private/Other Payers: The remaining revenue from patient services – i.e., the total net revenue the hospital receives for all patient services15 minus the payments in the four categories above – represents the total amount of payments received from three types of payers: (1) private insurance plans (including Medicare Advantage plans16), (2) other governmental insurance programs17, and (3) self-pay patients.18 Since most of the revenue in this category typically comes from private insurance plans and patients, the analyses below will generally refer to this category of payers as “private payers” and the patients as “private-pay patients.”

- Patients:

- Patient Bad Debt: The cost reports do not distinguish how much of the revenue in the Private/Other Payers category comes directly from patients rather than insurance plans. However, the reports do include information on patient bad debt, i.e., what patients owe but fail to pay.19 This includes both unpaid amounts of cost-sharing for patients with insurance as well as unpaid amounts for uninsured patients who do not qualify for charity care. (Amounts that a health plan owes the hospital but does not pay are also considered bad debt on the hospital’s books, but these amounts are not included as “bad debt” on the Medicare cost reports.)

- Uninsured Charity Care Patients: Hospitals report the amount of revenues they would have received for services they delivered to patients who did not have insurance and who met the hospital’s standards for charity care.20

- Other. Revenues that are not directly associated with patient services are reported separately on the cost reports. This includes payments from governmental sources that are intended to offset losses on patient services, but are not tied directly to the number or types of services that individual patients receive, such as local tax levies and state grants. However, hospitals vary in how they classify these payments, and many hospitals report all or most other revenues simply as “other revenue,” so it is impossible to reliably separate government grants, tax levies, etc. from other sources for all hospitals.

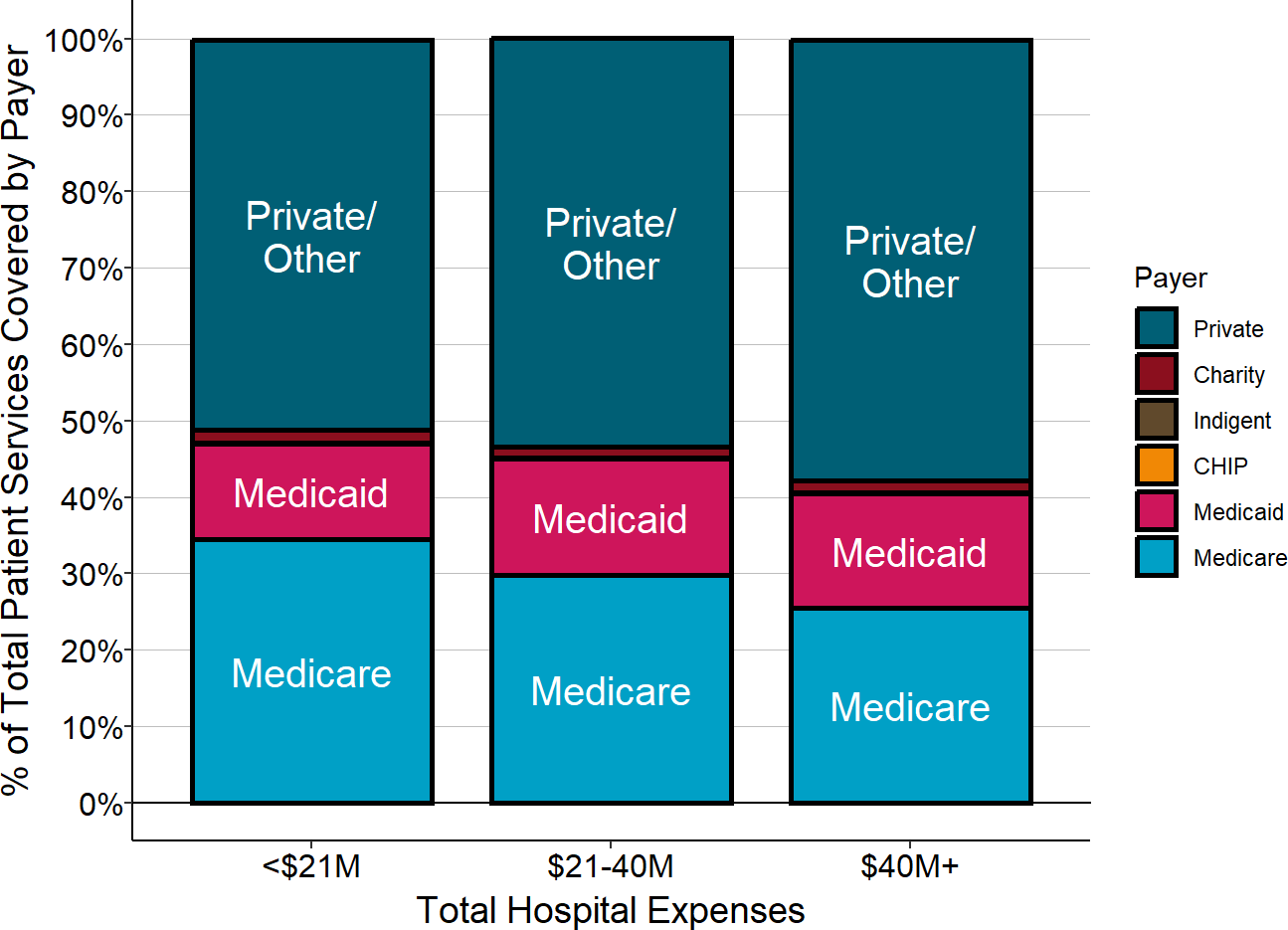

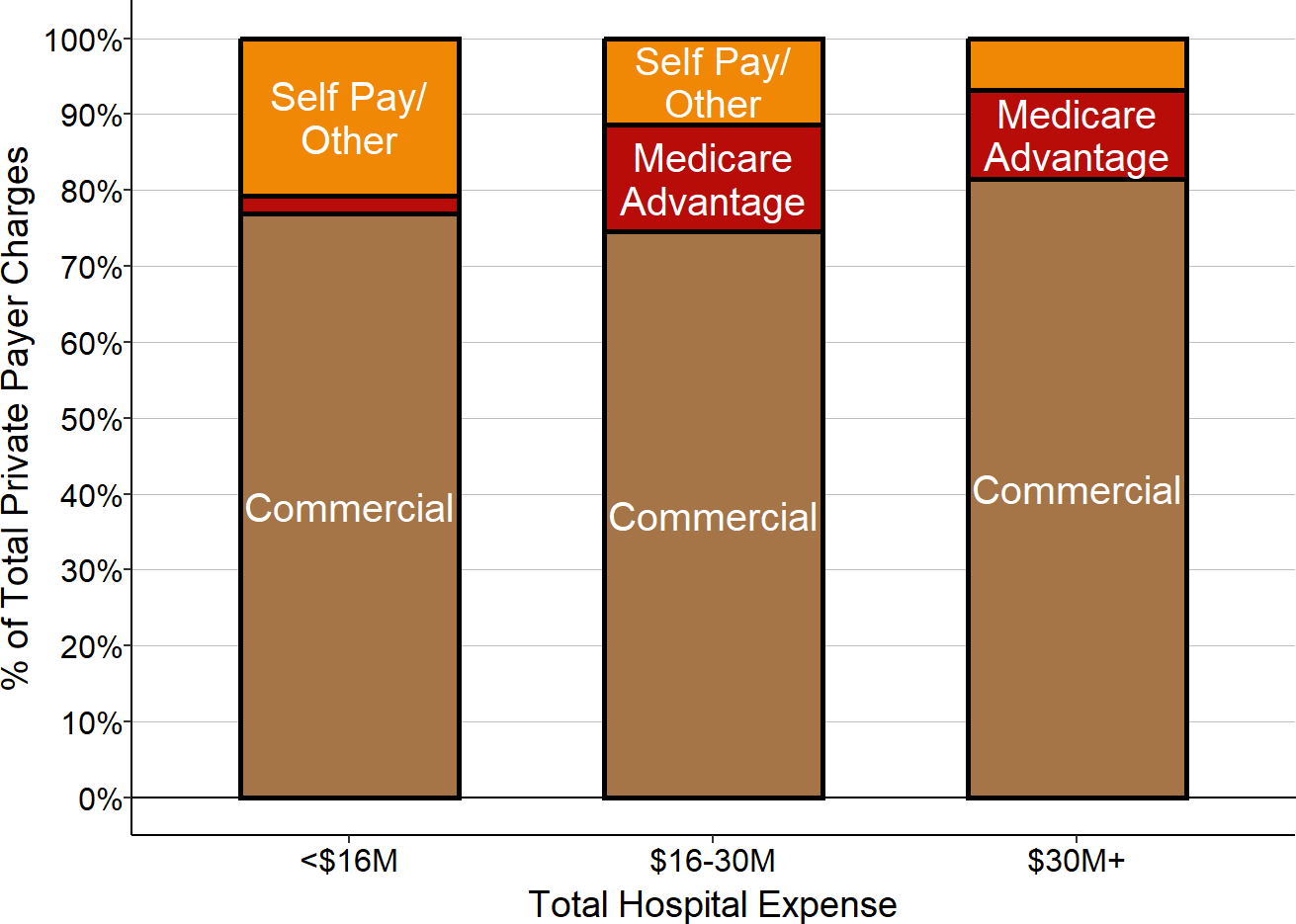

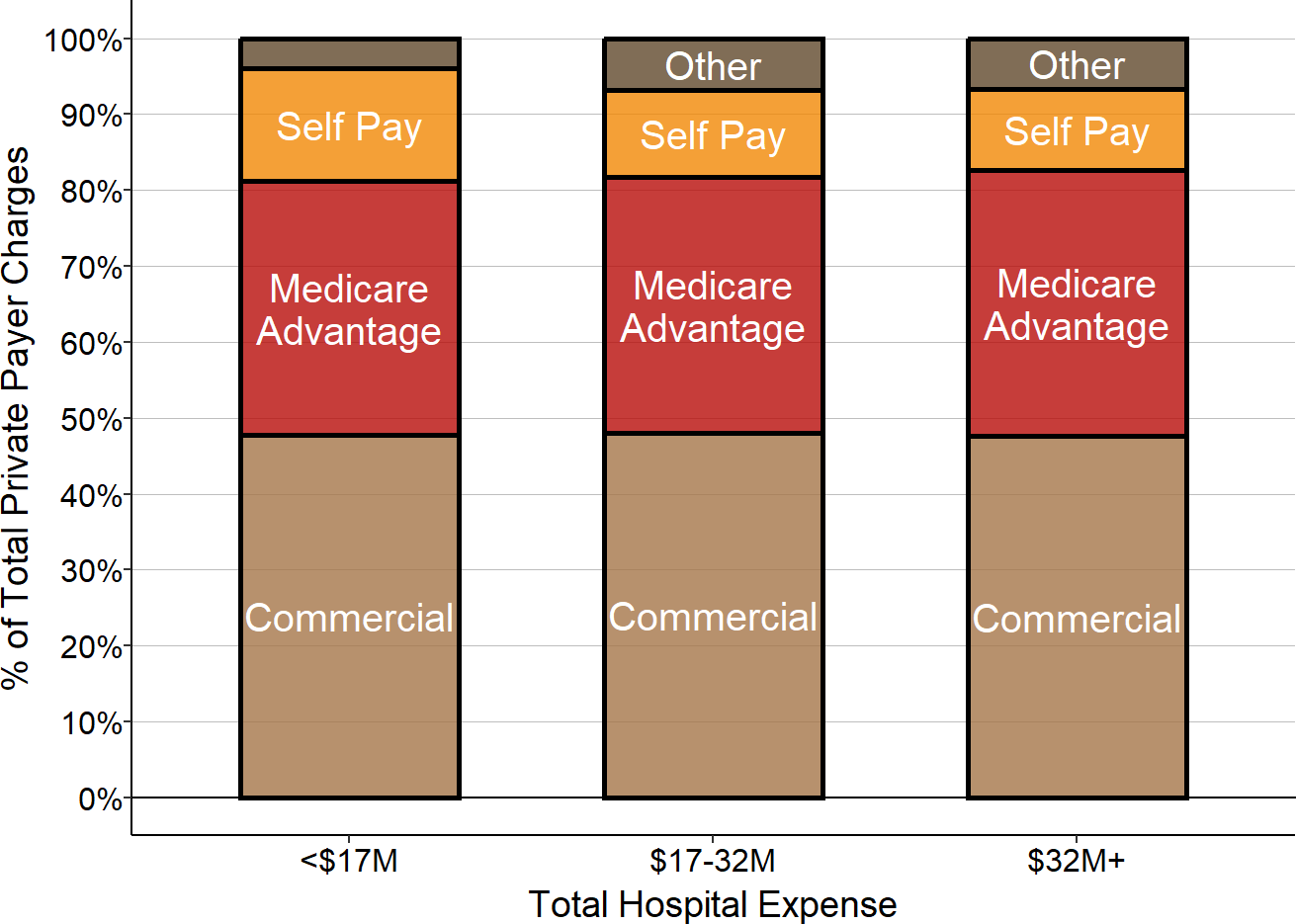

More than half (52%-59%) of patient services are associated with patients insured by private insurance companies and patients who pay for their care directly. Less than 1/3 (24%-33%) of services are associated with patients who have coverage under Original Medicare. Medicaid represents less than 15% of the patient services at rural hospitals, and charity care represents less than 2% of rural hospital services.

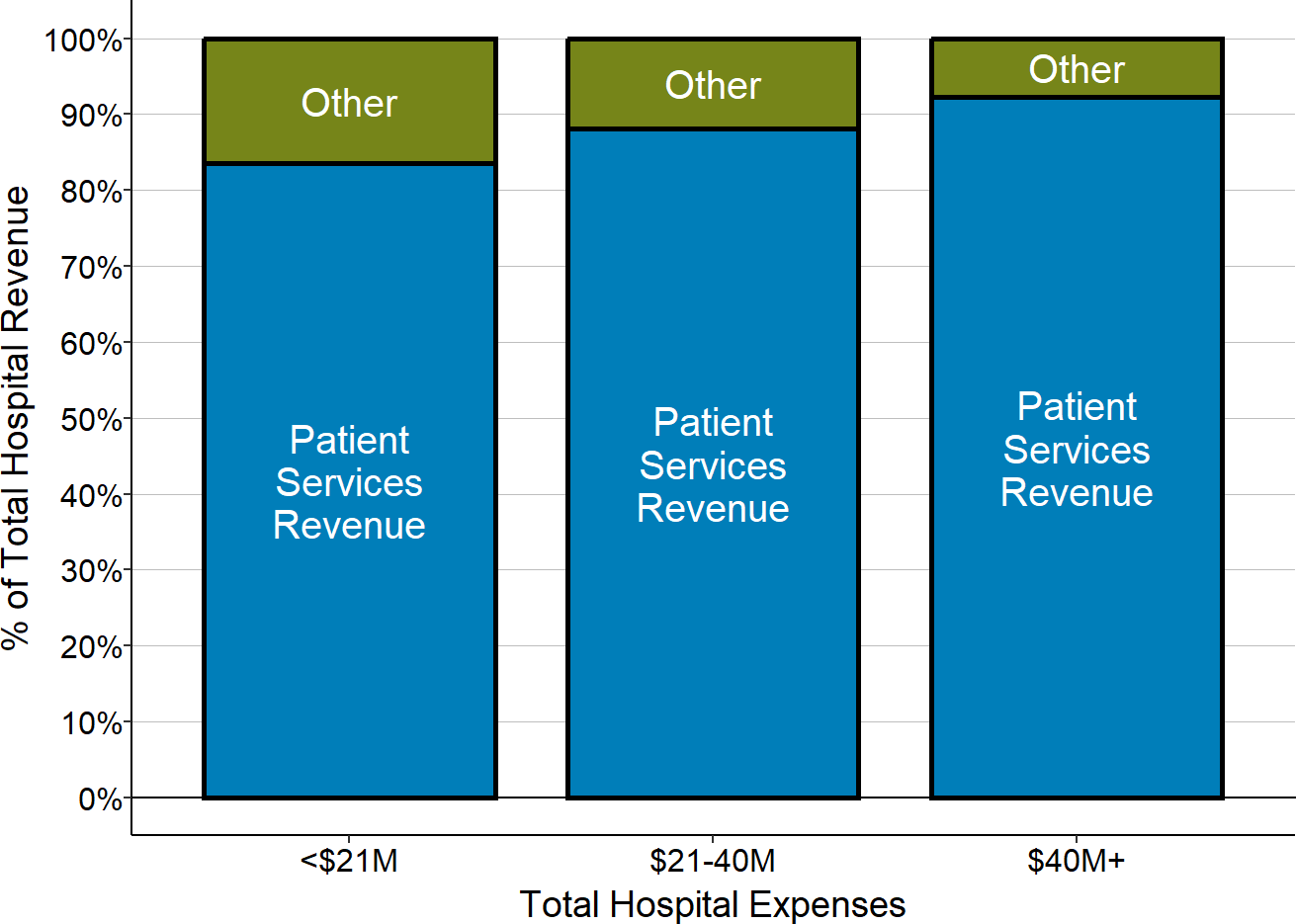

Figure 4

Payers for Patient Services at Rural Hospitals

The payer share is based on the estimated proportion of the hospital’s patient service costs for patients paid for by that payer. The value for each hospital is the median for the three most recent years available.

A portion of the patients with private insurance are Medicare beneficiaries who have a Medicare Advantage plan, so the proportion of services delivered to Medicare beneficiaries is higher than what is shown in the chart. However, Medicare Advantage plans are private companies and they are not required to pay the same amounts or use the same methods of payment that are used for patients in “Original Medicare,” so the figure accurately represents the different categories of payers that support the hospital’s services.21

It is important to recognize, however, that even though the differences in payer mix between smaller and larger hospitals are relatively small on average, individual hospitals can have very different mixes of payers. For example, some hospitals have much larger percentages of Medicaid patients and/or uninsured patients, and this can cause greater financial losses for these hospitals. The proportion of Medicare beneficiaries who have selected a Medicare Advantage plan rather than Original Medicare varies significantly from state to state and also from county to county within individual states, and that can cause the proportion of patient services paid for directly by the Medicare program to vary significantly for individual hospitals. As will be discussed further below, this can have a significant impact on a hospital’s financial condition.

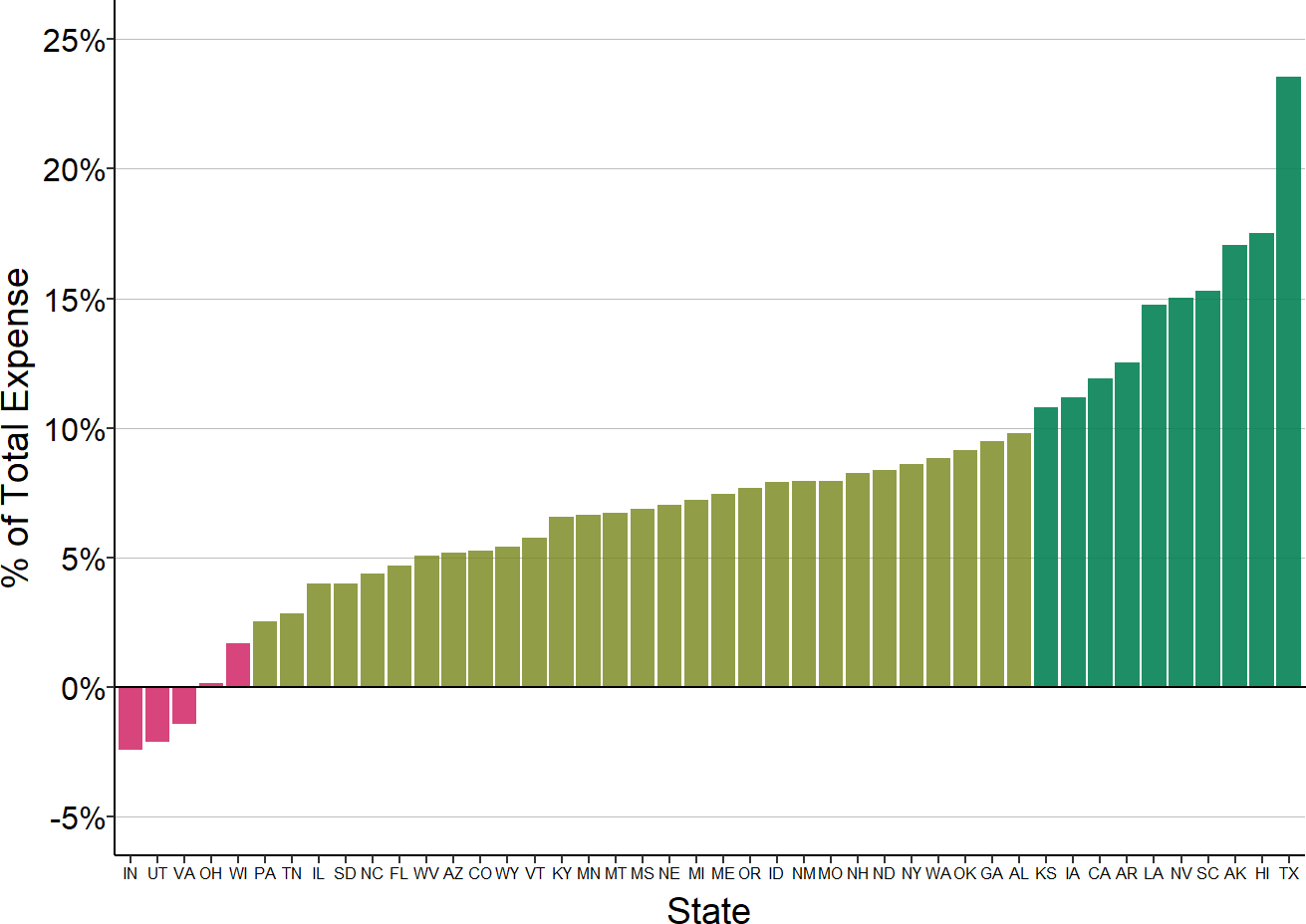

The vast majority of hospitals’ revenues and expenses are associated with services delivered to patients, so if a hospital is losing money overall, it is usually because the payments it receives for services are below the costs incurred in delivering services. However, many rural hospitals that are losing money on patient services receive a sufficient amount of money from taxes, grants, or profits on activities not directly related to patient services (e.g., a gift shop or parking lot) to offset those losses.

This “other revenue,” i.e., revenue that is not directly tied to patient services, represented 14% of the total revenues at the smallest rural hospitals (those with less than $24 million in annual expenses), and 12% of revenues at rural hospitals with annual expenses between $24 million and $45 million, compared to only 8% at larger rural hospitals.

Figure 5

Revenue from Patient Services vs. Other Sources

During the pandemic, the proportion of rural hospitals’ total revenue coming from “other revenue” increased dramatically because of the large grants rural hospitals received from federal pandemic assistance programs. For example, in 2020, at rural hospitals with less than $24 million in annual revenue, an average of 20% of their total revenue came from sources other than patient services. This is discussed in more detail below in The Impact of the Pandemic on Rural Hospitals.

Causes of Losses in Rural Hospitals

Understanding why some rural hospitals are losing money and why others are not requires determining not only how much each hospital receives from each category of payer, but how that revenue compares to the costs of the services the hospital delivered to the patients associated with that payer. Each category of payer described above can contribute either positively or negatively to the hospital’s overall profit or loss, depending on whether the amount paid was higher or lower than the cost of the associated services delivered by the hospital.

Measuring Payer-Specific Costs

Calculating payer-specific margins requires knowing not only the revenues the hospital receives from that payer but also the cost of the services received by the patients associated with that payer. These costs have to be estimated, and this is challenging to do accurately and fairly.

( on the challenges in determining payer-specific costs.)

Most of the costs incurred by a hospital are for facilities, equipment, and personnel that do not change when one more patient or one fewer patient receives a service, which means that the marginal (i.e., incremental) cost of delivering even a complex service to an individual patient is very small. For example, when a patient visits the Emergency Department, even with a serious condition, the hospital will not incur any significant additional expense in the ED to diagnose and treat the condition, because it will not need to hire additional physicians or purchase any additional equipment to do so.22

Although the incremental cost of each service is small, no patient could receive any service at all if the hospital does not have adequate staff and equipment available, and so some portion of that overall cost must be recovered from each patient. A way to measure this is to calculate the average cost per service, i.e., divide the total cost of the service line by the total number of services delivered. However, since some services require more time than others (e.g., a longer ED visit or a lab test that takes longer to perform), it would be misleading to assign the same average cost to every patient, regardless of the intensity of the service they received.

In order to adjust the average cost based on the intensity of individual services, the standard approach is to use the amount the hospital charges for a service as a measure of the relative intensity of the service. (This assumes that a hospital will charge more for delivering a higher-intensity service.) The amount the hospital charged for the service is used (i.e., the hospital’s “full price” for the service), not the amount that it was actually paid for the service, because the charge for a service is the same for every patient, whereas different payers pay very different amounts for services, and some patients cannot afford to pay anything at all.

The cost of an individual hospital service is generally estimated by first calculating the “cost-to-charge ratio” for the service line (e.g., the ED or the laboratory), and then multiplying the amount the hospital charged for the individual service (e.g., the ED visit or the specific laboratory test that was performed) by that ratio. For example, if the total cost of operating the hospital Emergency Department is $2 million, and the total amount that the hospital charged for all ED visits was $4 million, then the cost-to-charge ratio for the Emergency Department would be 0.5. If an individual patient made a visit to the ED and the hospital charged $200 for that visit, the cost of the visit would be estimated to be $100 ($200 x 0.5).

Using this service-line specific approach to determine cost of services delivered to patients insured by a specific payer or category of payers requires knowing how much the hospital billed those payers for services in each separate service line. Hospital cost reports are required to provide this level of detail for Medicare fee-for-service beneficiaries, but not for other payers. When only the total charges for a group of patients is known, but not the service-line specific charges, what is typically done is to calculate an overall cost-to-charge ratio for the entire hospital, and to use that for all service lines rather than service-line specific cost-to-charge ratios. For example, although Medicare requires hospitals to estimate the cost of services delivered to Medicare beneficiaries using service line cost-to-charge ratios, it only requires the hospital to estimate the cost of services to Medicaid patients using the aggregate (non-service specific) cost-to-charge ratio for the hospital because hospitals do not separately record the amounts charged for each category of services delivered to Medicaid patients.

Caution is needed when using a single cost-to-charge ratio for the entire hospital because it can be less accurate than a service-line specific approach for specific hospitals or specific payers. This is because the cost-to-charge ratio typically varies dramatically from service line to service line at most hospitals. For example, the cost-to-charge ratio for an ED visit might be 0.5, but the cost-to-charge ratio for a laboratory test might be only 0.25 (i.e., on average, the hospital charges four times as much for lab tests as it costs to deliver them) or even less. If some payers’ patients receive a different mix of services than the patients of other payers, the cost of services ascribed to some payers will be underestimated and the costs will be overestimated for others.23

The magnitude of the inaccuracy will depend on the extent to which different sets of patients use very different types of services at a hospital and the extent to which some hospitals set higher charges relative to costs in specific service lines more than other hospitals do. One study that examined the issue using data on California hospitals concluded that overall, the error was relatively small, but it is not clear whether similar conclusions would be drawn for other hospitals or more recent years.24 However, even the service line-specific approach will be inaccurate if hospitals set the charges for some services in a service line using a much higher mark-up than other services, and comparisons of costs and margins across hospitals will be inaccurate when different hospitals set their charges in different ways.25

The cost estimates used in the margin calculations shown below are calculated using the most detailed level of information about services and charges included in Medicare cost reports. The estimates are most accurate for Original Medicare patients because the charges for them are reported separately for each individual service line. Costs for Medicaid and private-pay patients can generally only be estimated at a service line level for inpatient care, not for any other service line.

Measuring Payer-Specific Margins

The amount that each payer contributes to the hospital’s overall profit or loss can be measured in two ways:

- The margin (profit or loss) on the services delivered to the patients with a specific type of payer. The dollar amount of margin is determined by subtracting the estimated cost of the services delivered from the amount of revenue received from the payer.26 The percentage margin is then determined by dividing that dollar margin by the cost of the services.27 For example, if the margin on Original Medicare patients is -10% at a particular hospital, it means that Medicare paid 10% less than the cost of delivering the services patients with Original Medicare received at that hospital.

- The payer’s percentage contribution to the hospital’s total profit or loss. A large percentage profit or loss on a particular payer’s patients will only have a large impact on the hospital’s overall profitability if that payer insures a large percentage of the hospital’s patients. The contribution made by a particular payer to the hospital’s overall profitability is determined by comparing the dollar amount of profits and losses from that payer to the profits and losses from all of the other payers. To measure this, the dollar amount of margin associated with a payer is divided by the hospital’s total expenses, rather than just the cost associated with that payer’s patients.28 For example, if services to Medicare patients represent 40% of the hospital’s total costs, then a -10% margin on the Medicare patients reduces the hospital’s overall margin by -4% (-10% times 40%).

Each of these two measures conveys different and important information:

- The first measure (margin on the payer’s patients) conveys the extent to which an individual payer is covering the costs of delivering services to its patients.

- The second measure (payer contribution to the hospital’s total margin) conveys the amount by which that payer is increasing or decreasing the hospital’s overall profitability.

Because of the large differences in the relative sizes of different categories of payers and the variations in payer mix across hospitals, the payers that generate the highest profits or losses on the first measure can turn out to be less important to the hospital’s overall profitability than the payers who insure the largest numbers of patients.29

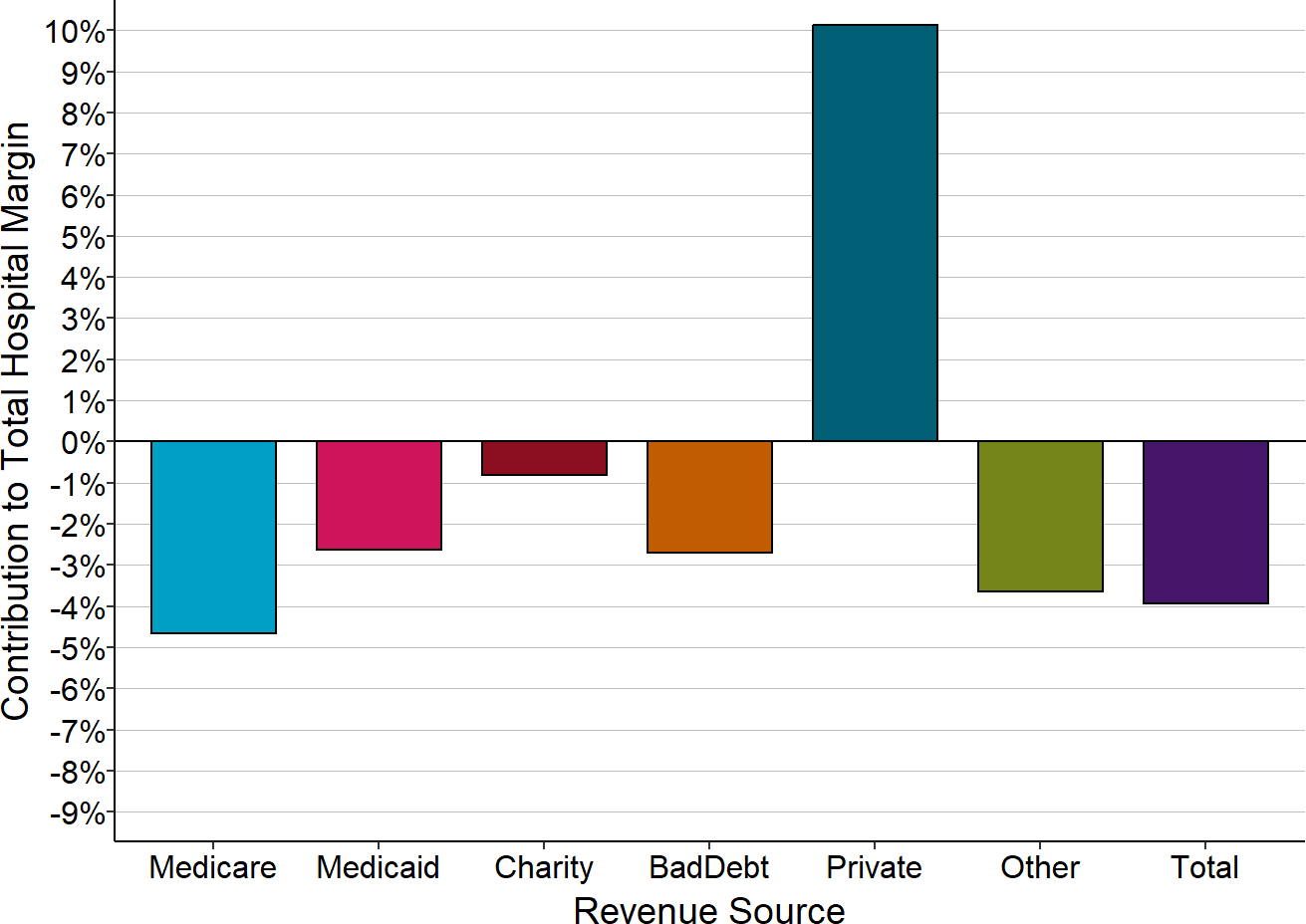

Causes of Losses at Hospitals That Closed

The causes of financial losses differ significantly between the small rural hospitals that have closed and larger rural hospitals. As shown below, the majority of larger rural hospitals (i.e., those with total expenses above the median for rural hospitals) made significant profits on patients with private insurance, but those profits were not sufficient to offset the losses on Medicare, Medicaid, and bad debt. In contrast, the majority of small rural hospitals had losses on patients with private insurance, so the hospital had no way to offset losses from uninsured patients and low Medicaid payments. Although the small hospitals received more revenue from sources other than patient services than larger hospitals, it was not sufficient in most cases to offset the losses on patient services.

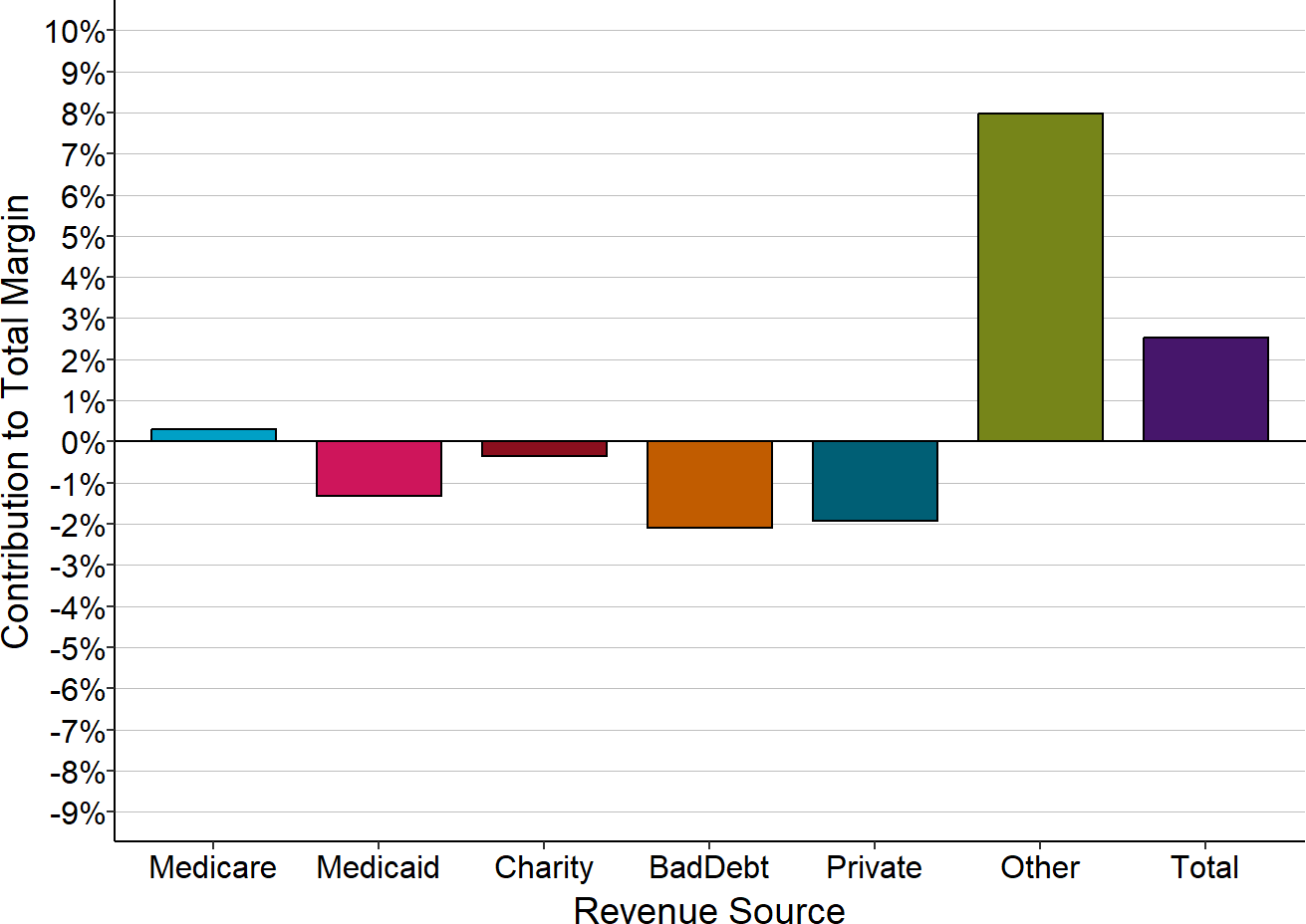

Figure 6

Components of Total Margin

Small Rural Hospitals That Closed

The Contribution to Total Hospital Margin for a specific payer is the dollar margin (i.e., the amount of profit or loss) earned on services delivered to patients insured by that payer, divided by the hospital’s total expenses for all patients. The amounts shown are the medians for the 3 years prior to the hospital’s closure. “Small” rural hospitals are those with total annual expenses less than the median expenses for rural hospitals in the year prior to closure.

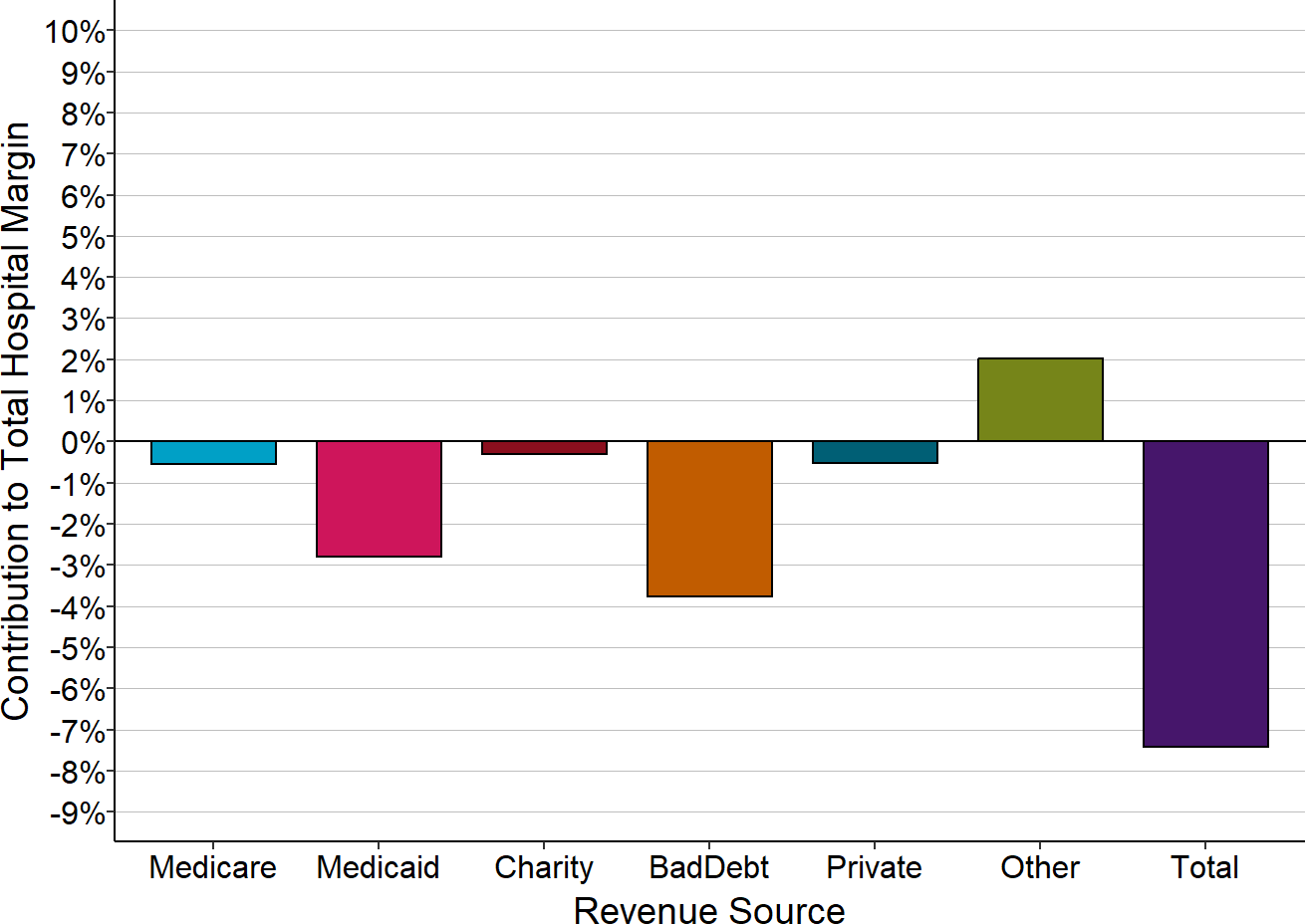

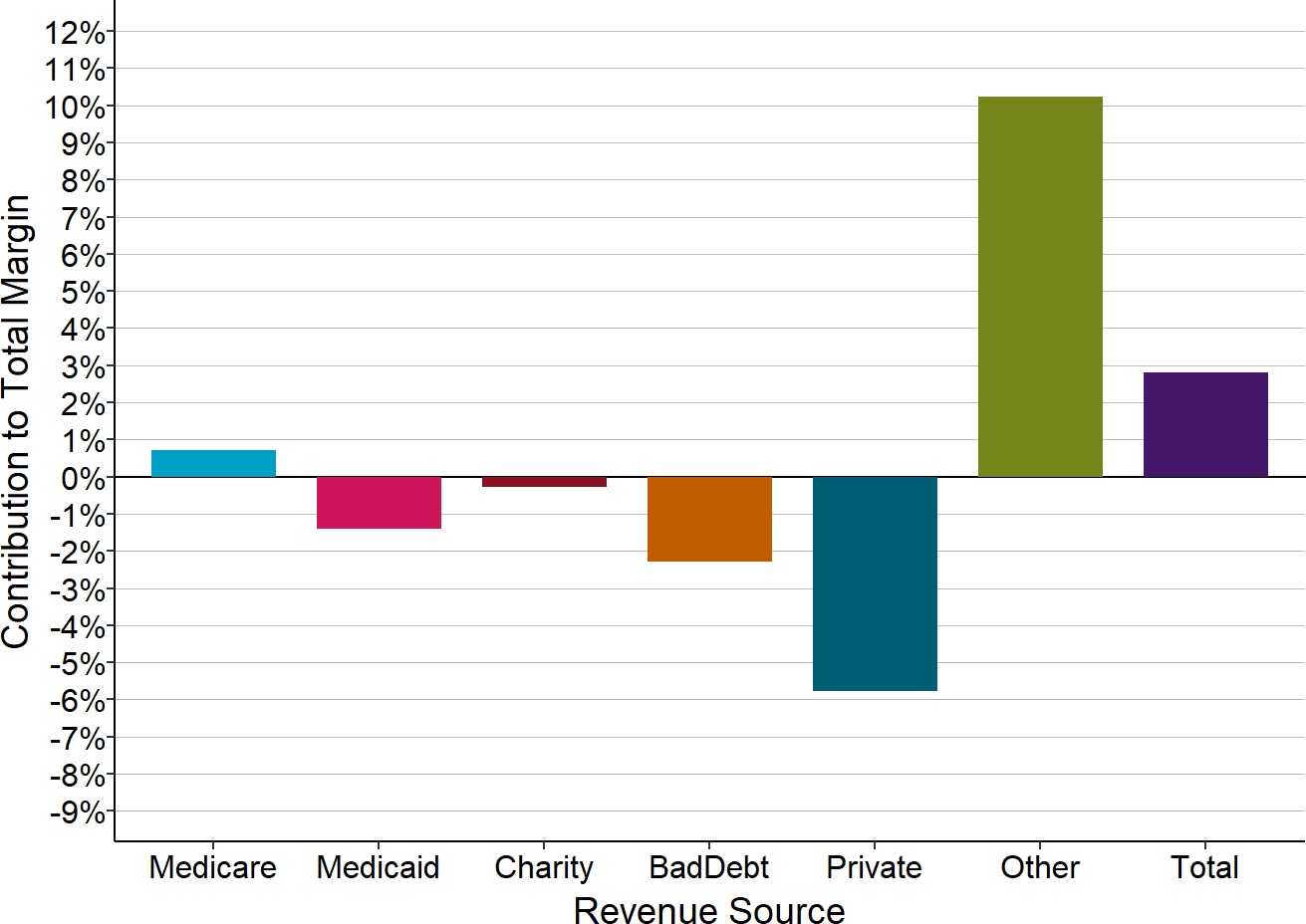

Figure 7

Components of Total Margin

Larger Rural Hospitals That Closed

The Contribution to Total Hospital Margin for a specific payer is the dollar margin (i.e., the amount of profit or loss) earned on services delivered to patients insured by that payer, divided by the hospital’s total expenses for all patients. The amounts shown are the medians for the 3 years prior to the hospital’s closure. “Larger” rural hospitals are those with total annual expenses greater than or equal to the median expenses for rural hospitals in the year prior to closure.

The small rural hospitals that did not close had smaller losses on Medicaid and bad debt, but the biggest reason most of the hospitals have remained open is that they have received other types of revenue, such as local tax revenues, that are sufficient to offset the losses on both insured and uninsured patients.

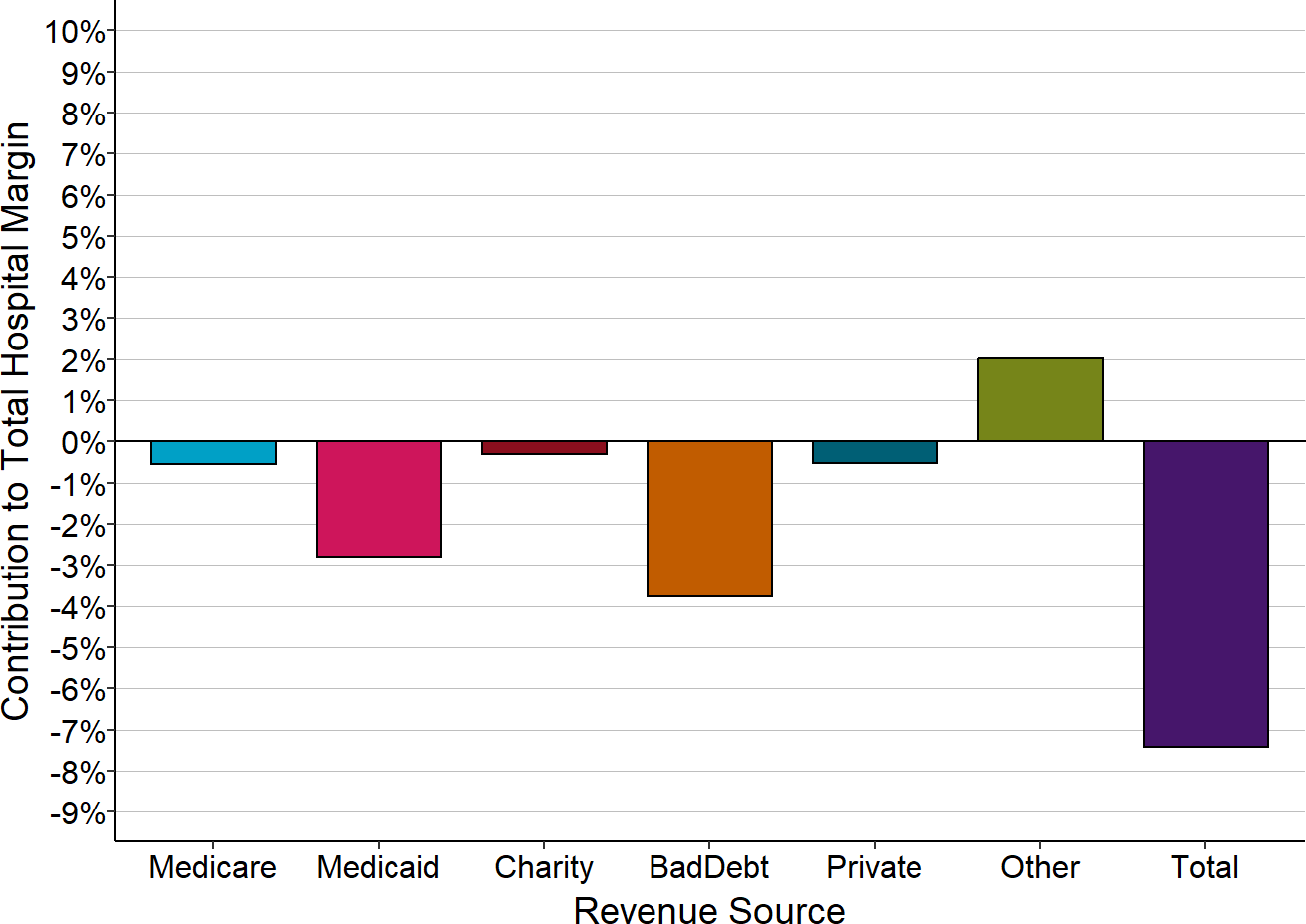

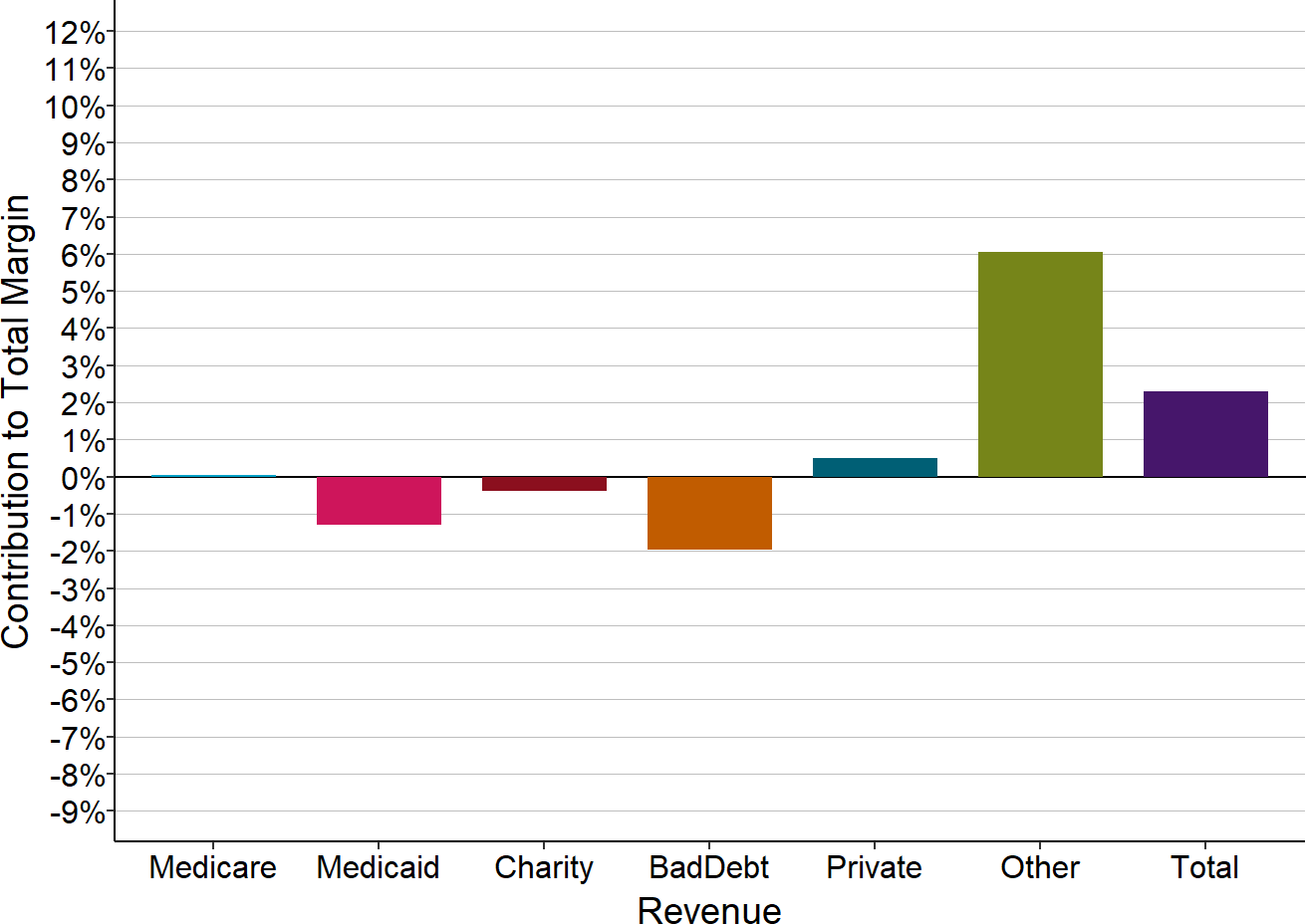

Figure 8

Components of Total Margin

Small Rural Hospitals That Closed

The Contribution to Total Hospital Margin for a specific payer is the dollar margin (i.e., the amount of profit or loss) earned on services delivered to patients insured by that payer, divided by the hospital’s total expenses for all patients. The amounts shown are the medians for the 3 years prior to the hospital’s closure. “Small” rural hospitals are those with total annual expenses less than the median expenses for rural hospitals in the year prior to closure.

Figure 9

Components of Total Margin

Small Rural Hospitals That Have Not Closed

The Contribution to Total Hospital Margin for a specific payer is the dollar margin (i.e., the amount of profit or loss) earned in the most recent year available on services delivered to patients insured by that payer, divided by the hospital’s total expenses for all patients. “Small” rural hospitals are those that were open in 2025 and had annual expenses in 2024 less than the median expenses for rural hospitals ($45 million).

Causes of Losses in the Smallest Rural Hospitals

Figure 9 masks significant differences between the smallest rural hospitals – those with less than $24 million in total annual expenses – and the small rural hospitals that are somewhat larger.

The charts below show how the different revenue categories contribute to the total margins at the hospitals with less than $24 million in annual expenses, and at the hospitals with $24-45 million in annual expenses.

Figure 10

Components of Total Margin

Rural Hospitals <$24M Total Expenses

The Contribution to Total Hospital Margin for a specific payer is the dollar margin (i.e., the amount of profit or loss) earned on services delivered to patients insured by that payer, divided by the hospital’s total expenses for all patients. The amounts shown are the medians for all rural hospitals with less than $24 million in annual expenses that were open in 2025.

Figure 11

Components of Total Margin

Rural Hospitals $24-45M Total Expenses

The Contribution to Total Hospital Margin for a specific payer is the dollar margin (i.e., the amount of profit or loss) earned on services delivered to patients insured by that payer, divided by the hospital’s total expenses for all patients. The amounts shown are the medians for all rural hospitals with more than $24 million but less than $45 million in annual expenses that were open in 2024.

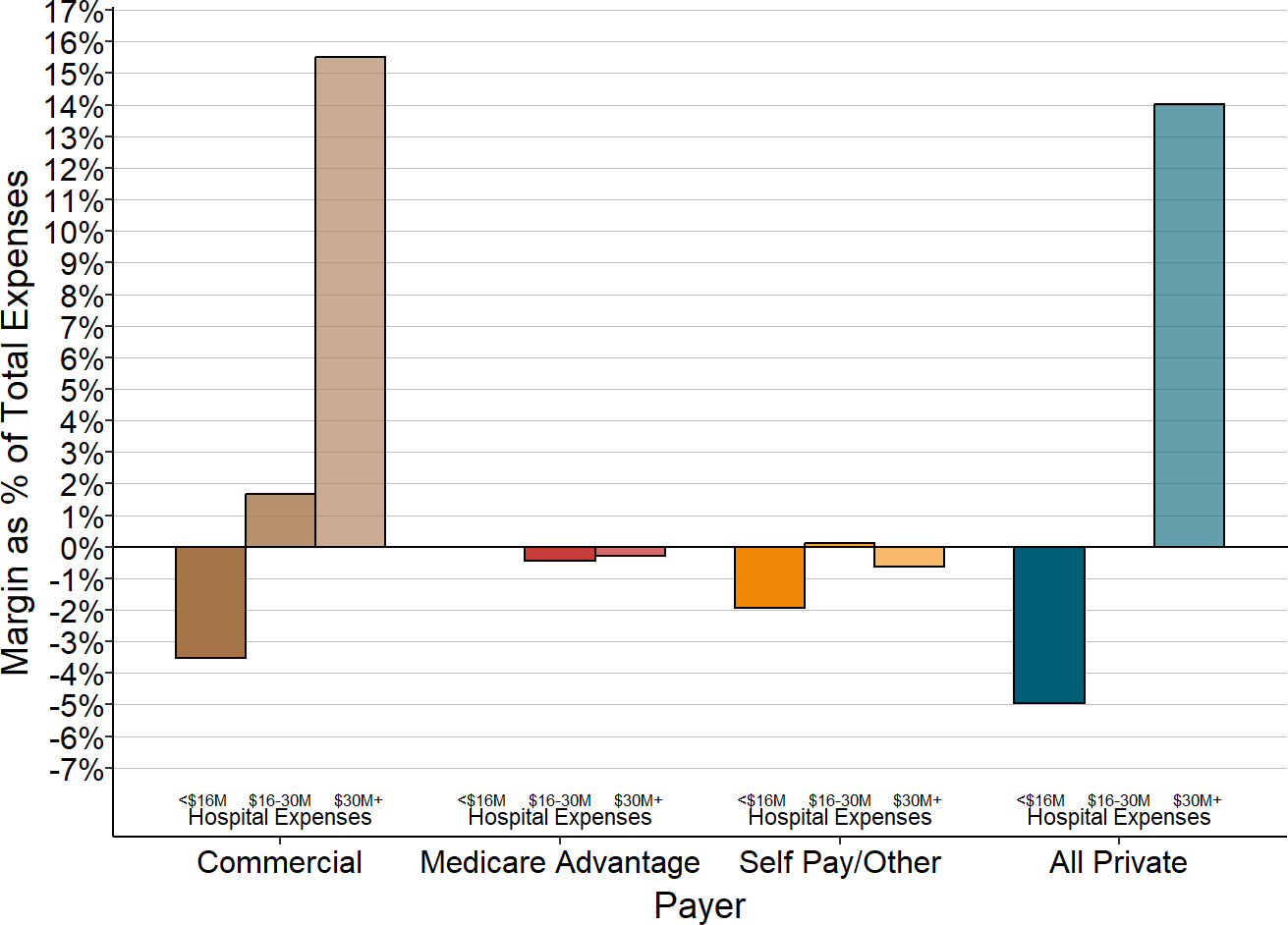

Only two categories have differences that are both statistically significant and large in size:

- Patients with Private Insurance: The majority of the smallest hospitals lose money on patients with private insurance, whereas the majority of the larger hospitals make small profits on these patients. At the larger hospitals, the profits on private-pay patients are too small to offset the losses from bad debt much less losses on Medicaid and charity care, whereas the smallest hospitals lose large amounts on private-pay patients through a combination of payments below costs and patient bad debt.

- Other Revenues: Other revenues are much larger relative to total expenses and revenues at the smallest hospitals than at larger ones. Many of the smallest hospitals would have lost money overall had it not been for the revenues they received that were not tied directly to patient services.

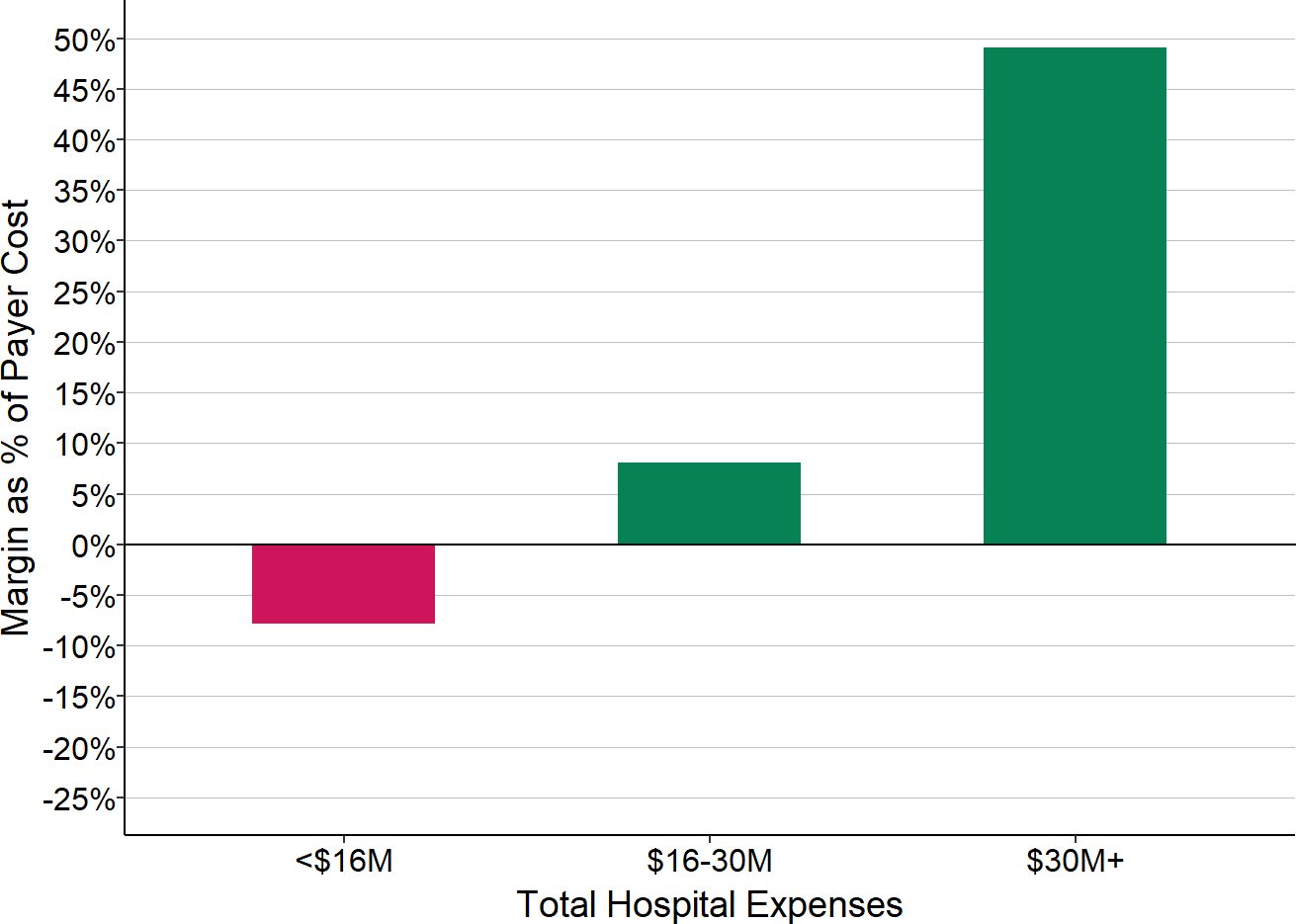

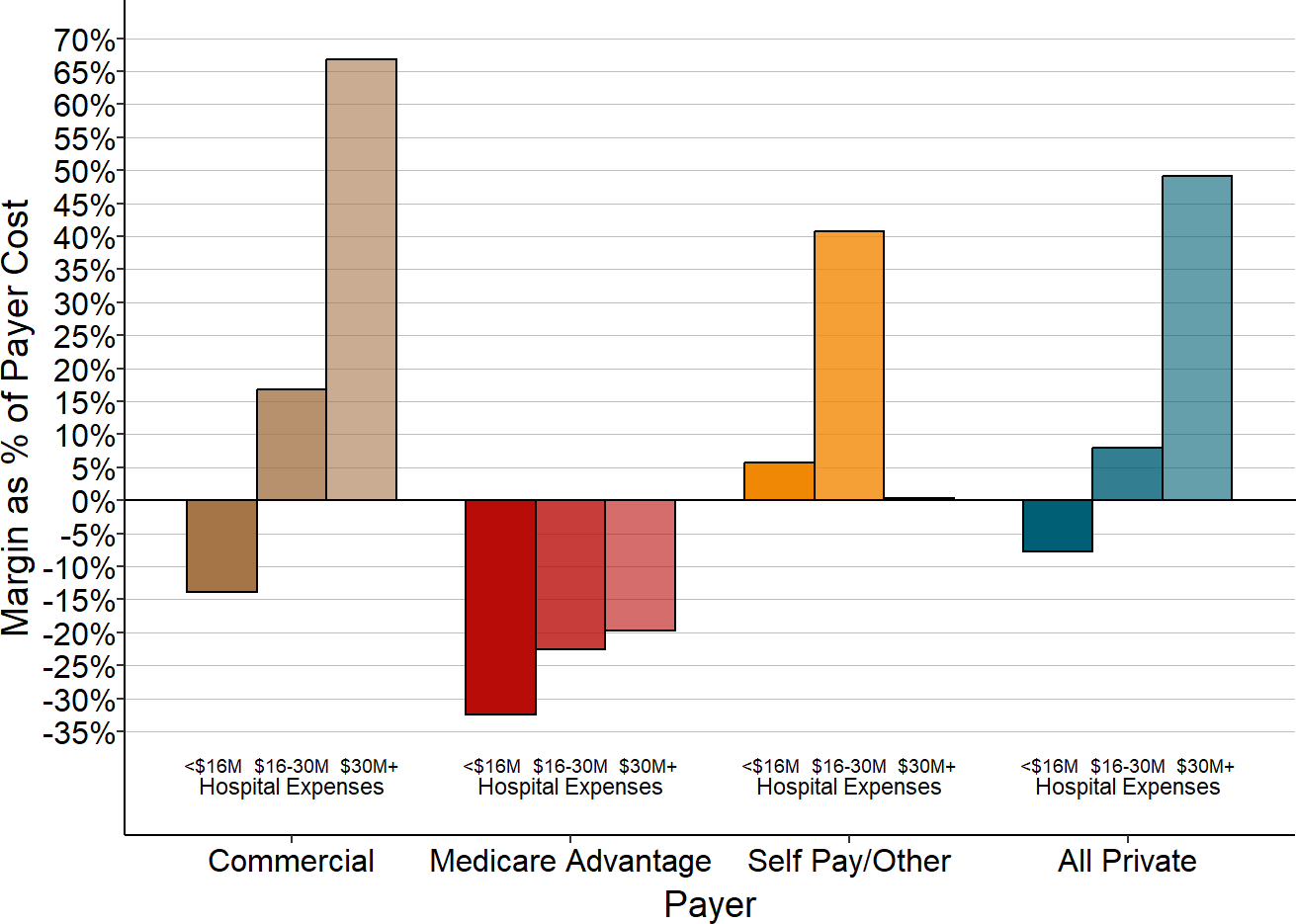

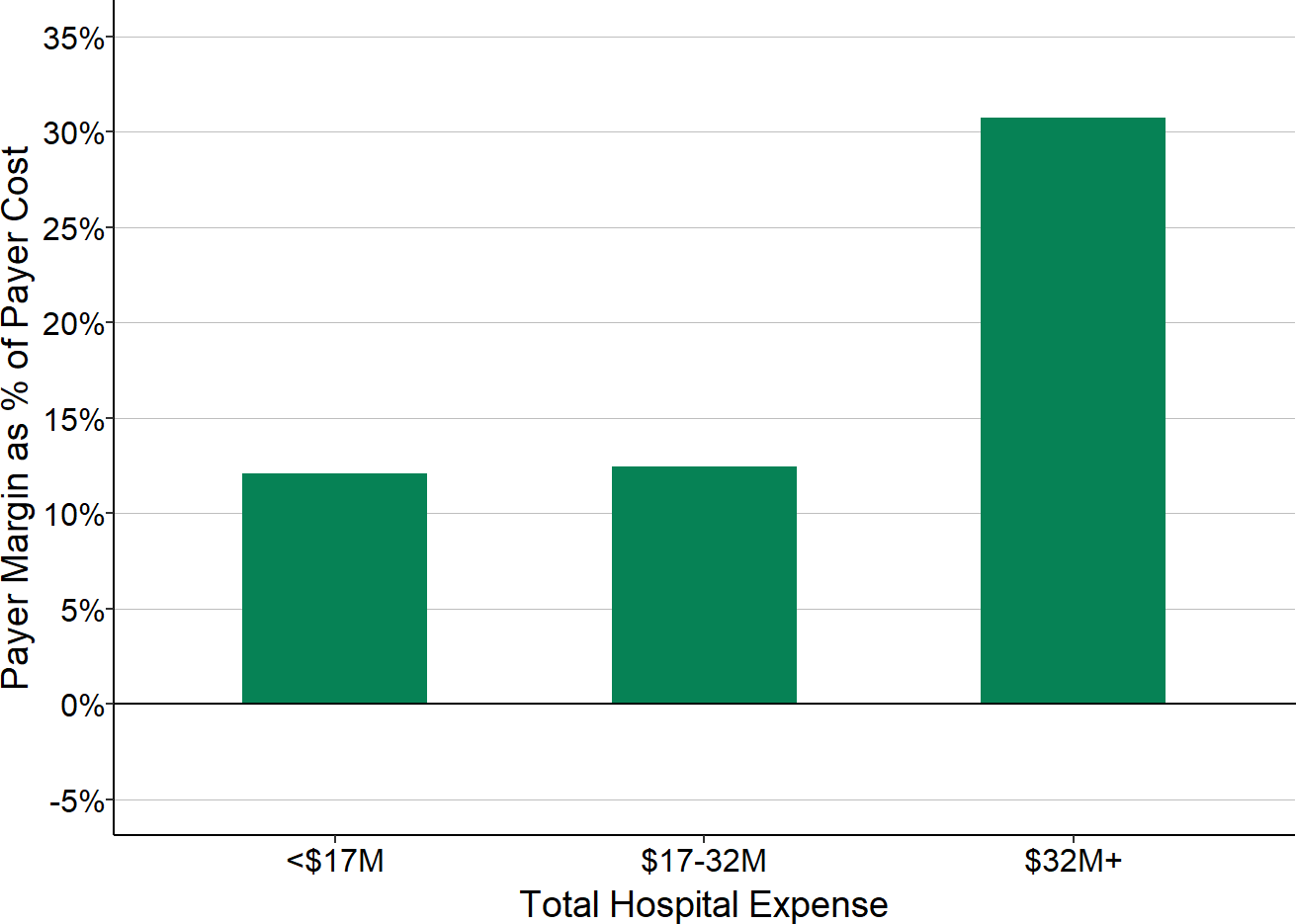

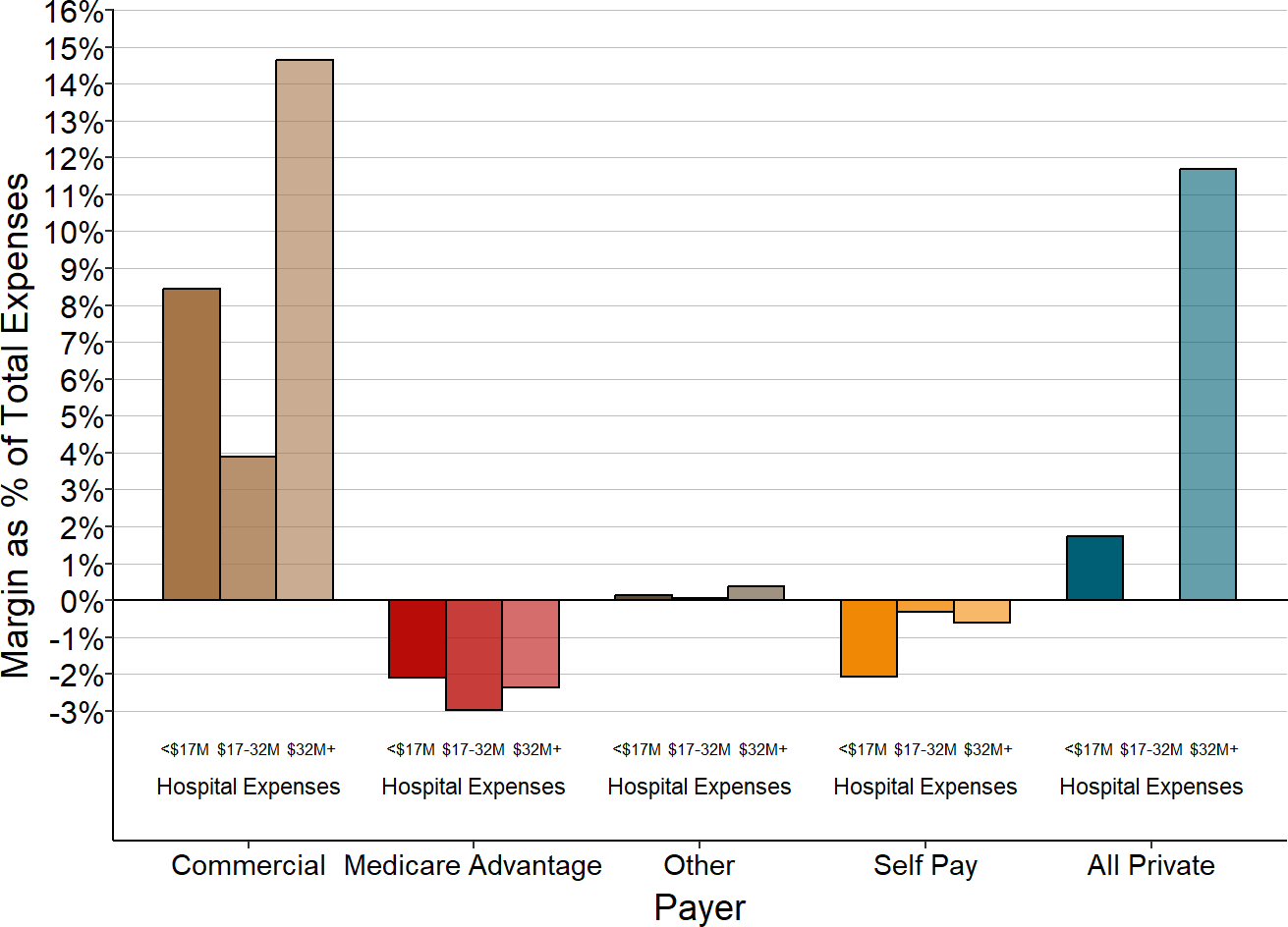

The Role of Private Payers in Rural Hospital Losses

The smaller the hospital, the less likely it is that the hospital will make profits on private-pay patients and the more likely it will have losses. Moreover, the smaller the hospital, the larger the losses will be on private-pay patients. Because rural hospitals deliver about half of their services to private-pay patients, losses on those patients have a large impact on the hospital’s total margin.

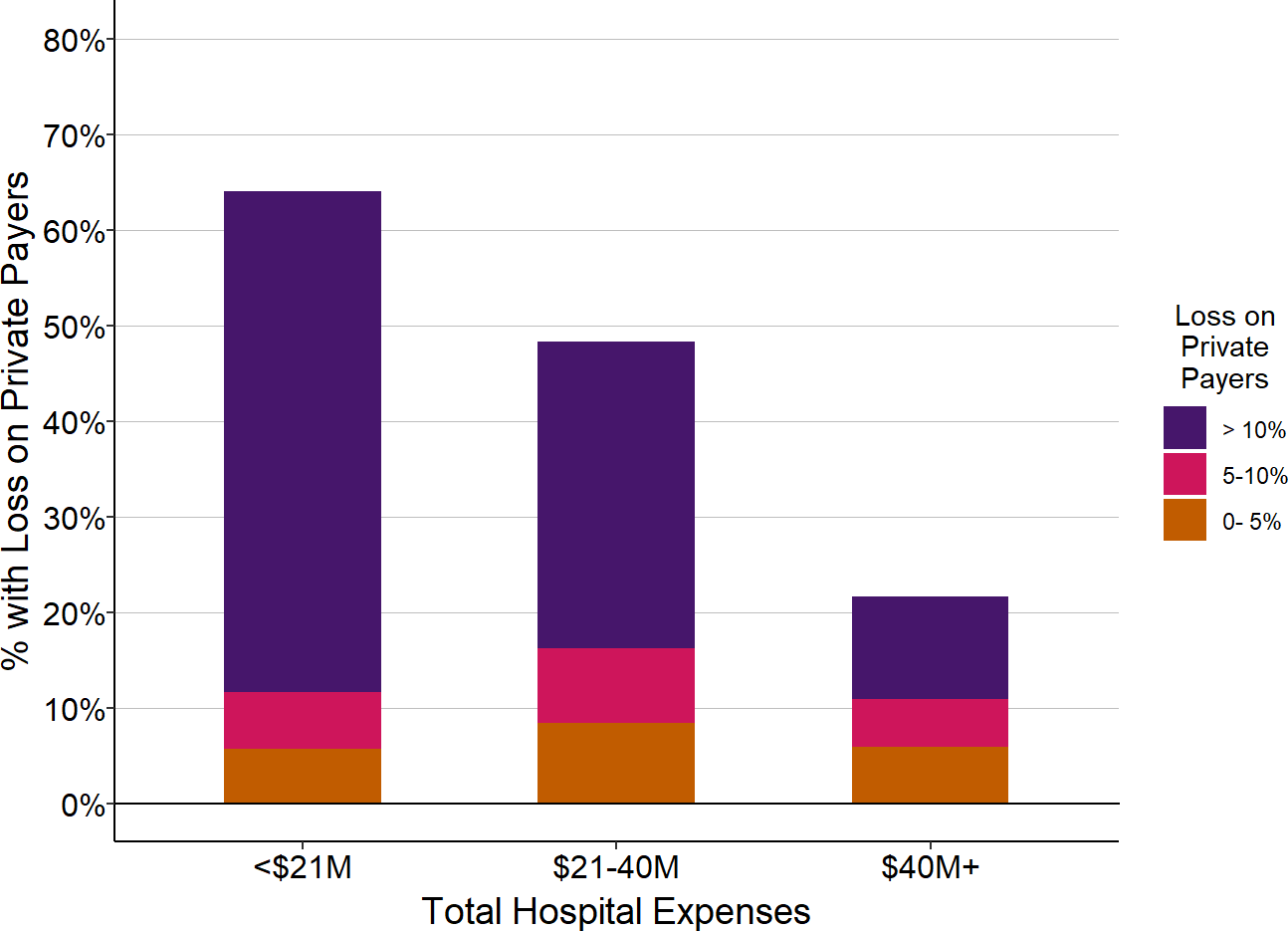

Figure 12

Percentage of Rural Hospitals

With Losses on Patients with Private Insurance

| Total Hospital Expenses | Number of Rural Hospitals |

Percent with Loss on Privately Insured Patients |

Percent with Private Payer Loss 5-10% |

Percent with Private Payer Loss > 10% |

|---|---|---|---|---|

| <$24M | 507 | 61.1% | 54.2% | 47.3% |

| $24-45M | 515 | 41.6% | 32.8% | 24.1% |

| $45M+ | 1,067 | 19.6% | 14.4% | 10.0% |

The chart shows the percentage of rural hospitals in each size category that lost money on services to patients with private/other insurance during the most recent year. The purple bars represent the proportion of hospitals that lost 10% or more on services to patients with private insurance, and the red bars represent the proportion that lost 5-10% on services to patients insured by private insurance companies.

Low payments from private payers also help explain why, in every size category, some hospitals have bigger financial losses or smaller profits than others. Although rural hospitals deliver about half of their services to private-pay patients on average, the mix of patients varies significantly from hospital to hospital. If hospitals are paid less for patients with private insurance than patients with public insurance, then hospitals will do worse financially if they have more privately-insured patients, and vice versa.

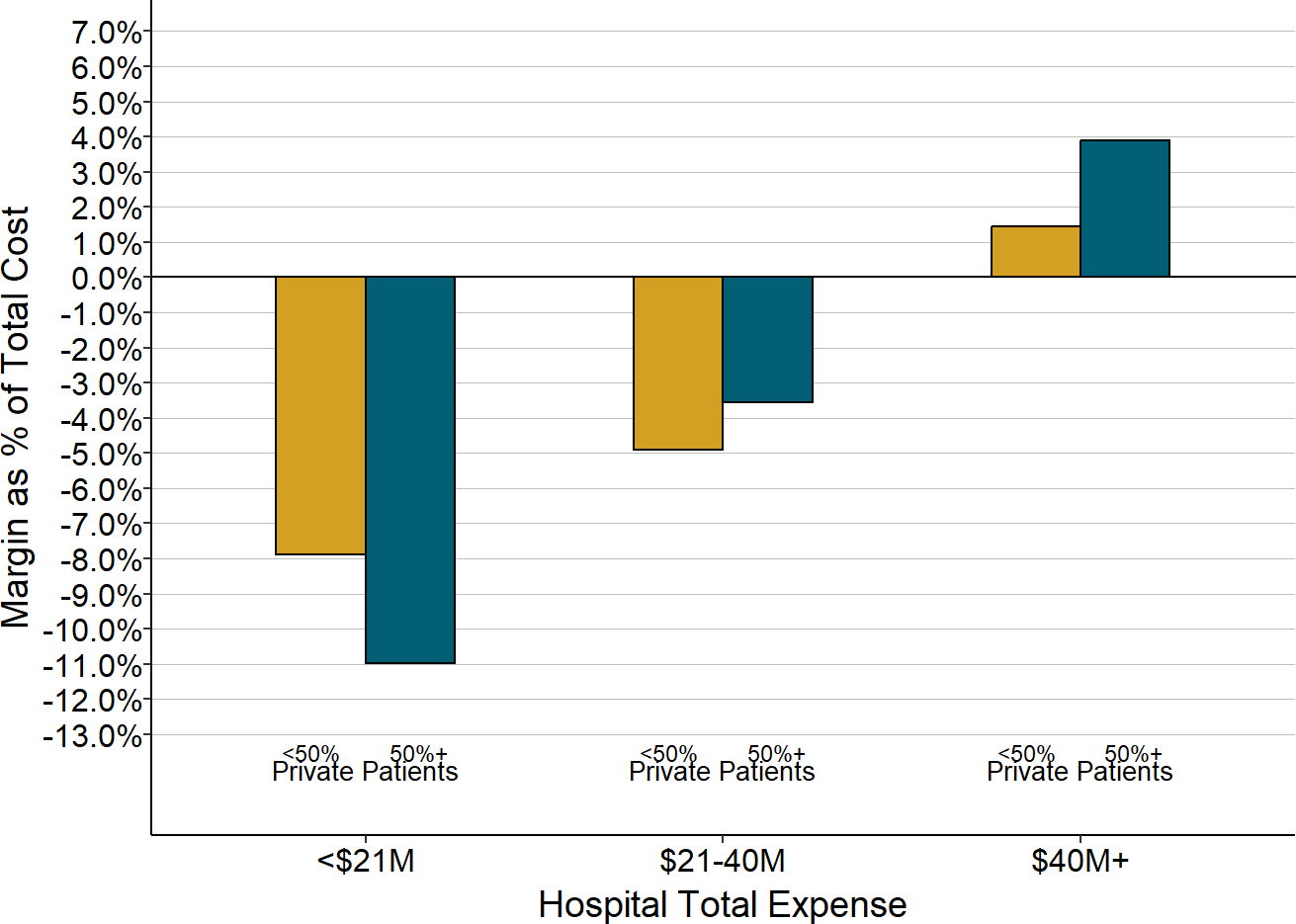

Small rural hospitals lose slightly less on patient services if more than half of the services are paid for by private payers, but most small rural hospitals lose money overall regardless of whether they have higher or lower percentages of patients insured by private insurance companies. In contrast, larger hospitals make higher profits on patient services if they have a higher share of privately-insured patients, because at larger hospitals, payments for patients with private insurance are higher than the cost of services and offset losses on uninsured patients and patients insured by Medicaid.

Figure 13

Impact of Privately Insured Patients on Patient Service Margin

The value for each hospital is the median of the total annual margins (across all payers) at the hospital during the most recent year available. The chart shows the median amounts for all of the rural hospitals with total expenses in each category based on the percentage of the hospital’s patients with private insurance. “<50% Private Patients” means that less than 50% of the cost of all patient services at the hospital were associated with patients who had private insurance.

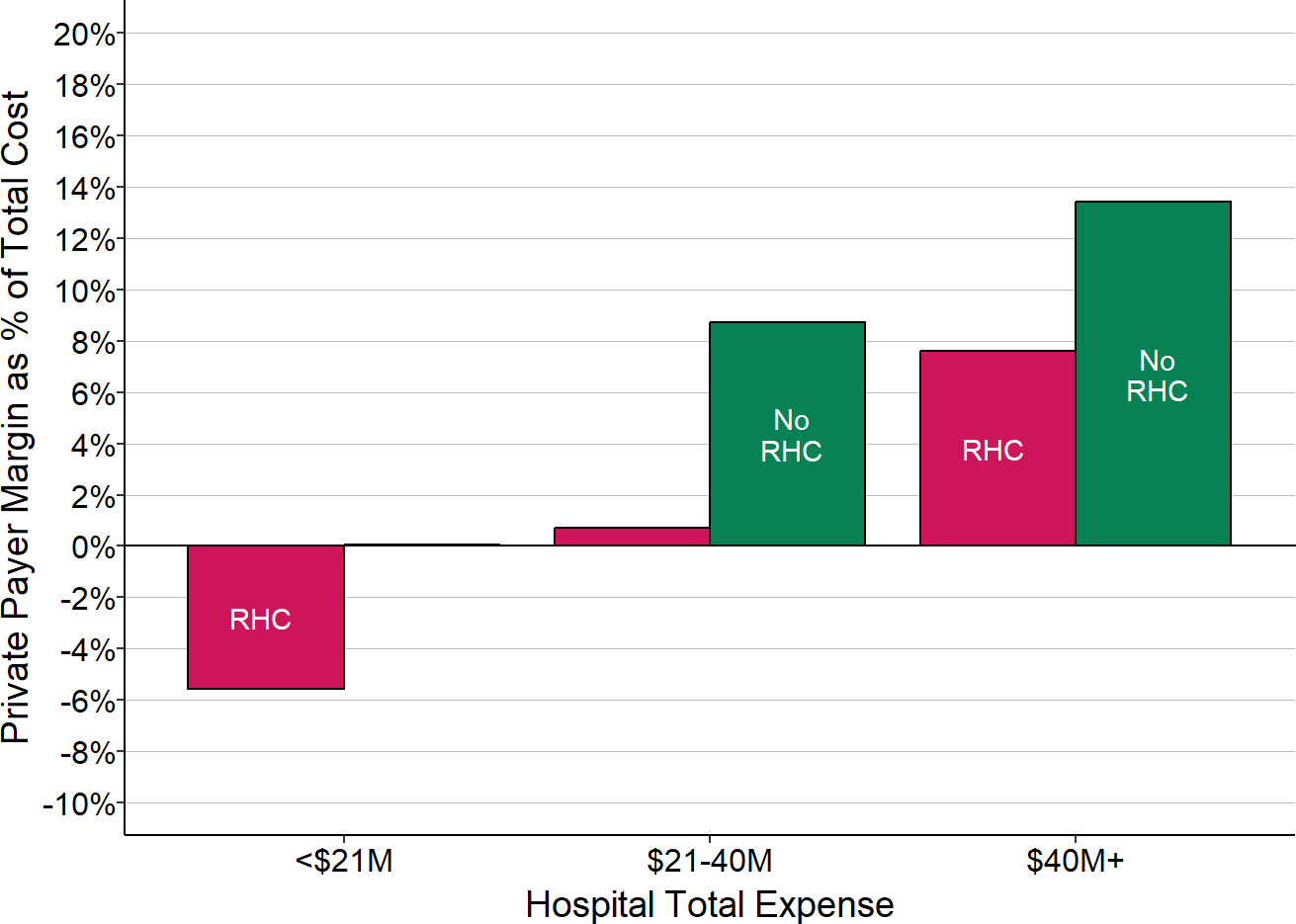

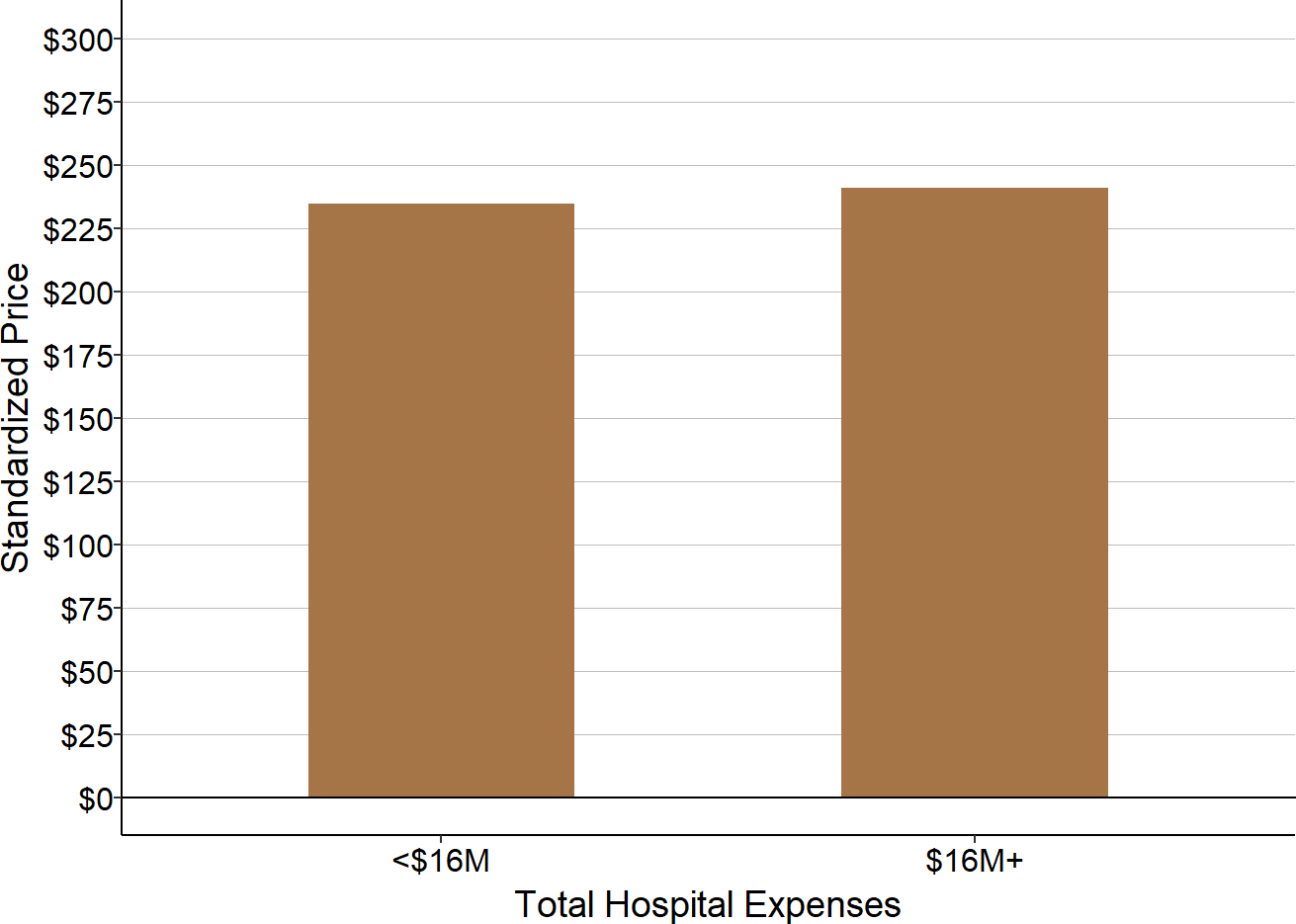

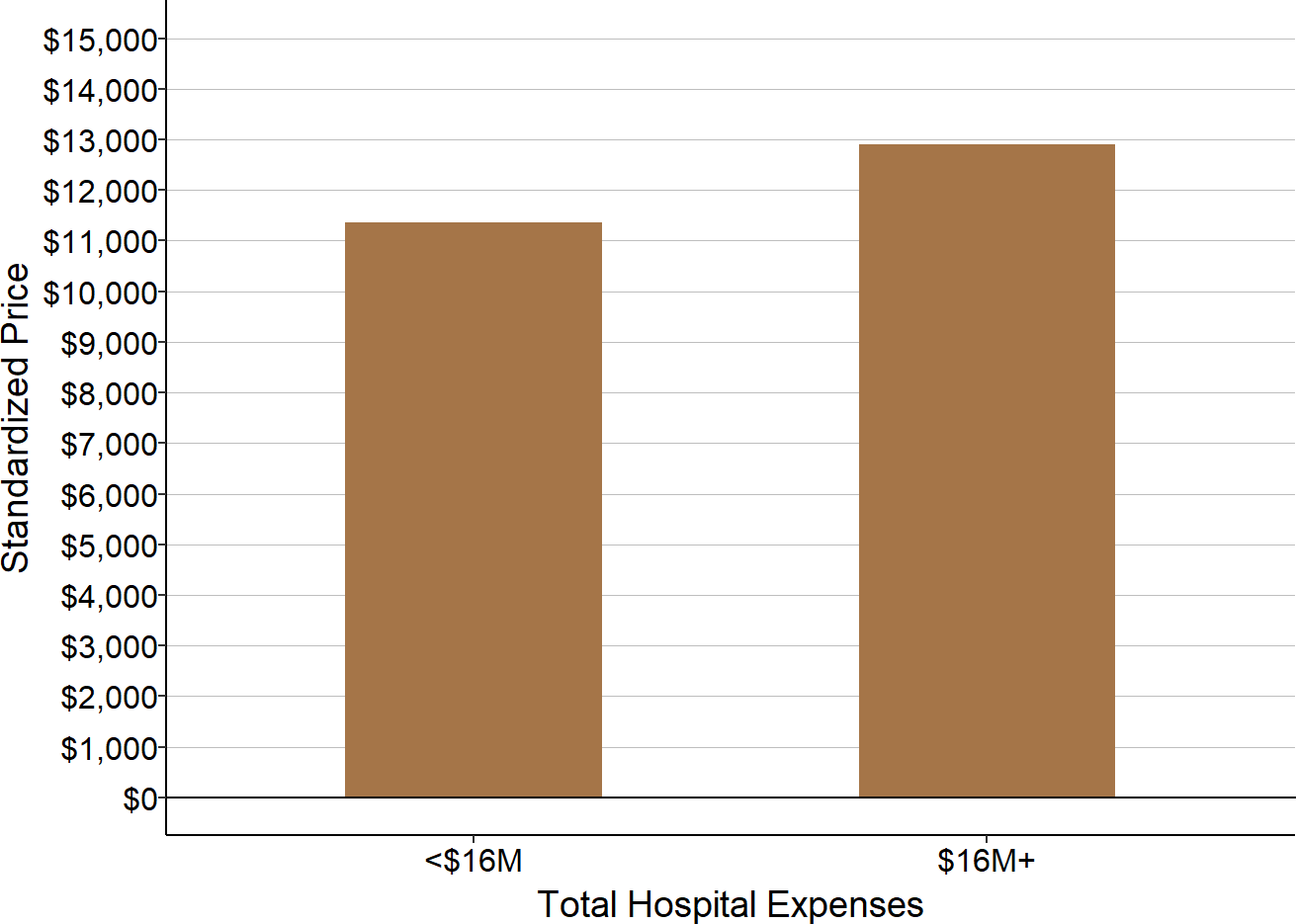

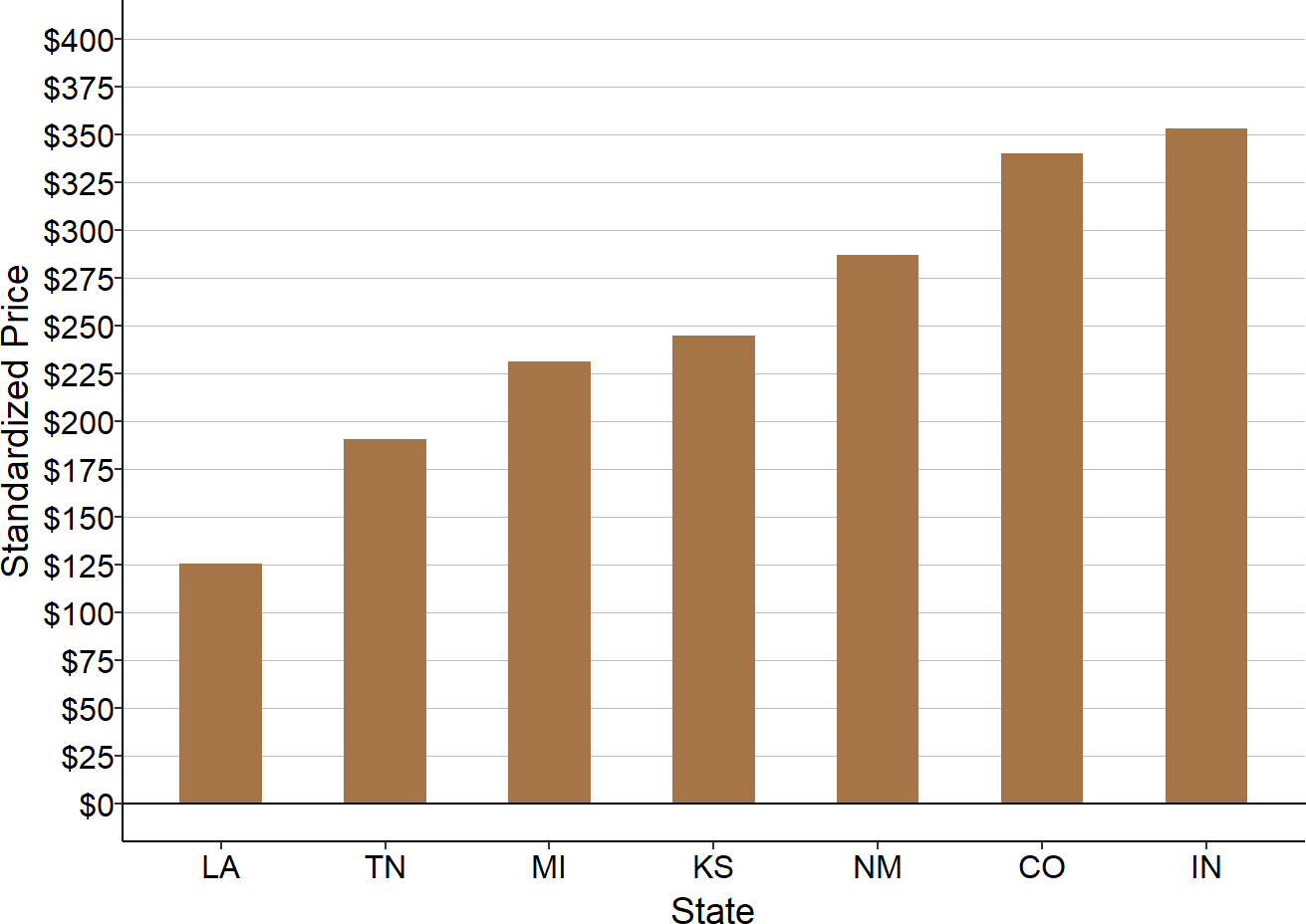

The amount that small hospitals lose on private-payer patients also depends on the kinds of services the hospital delivers. The majority of rural hospitals operate one or more Rural Health Clinics (RHCs) in order to ensure that the residents of their community have access to primary care services. On average, the RHCs represent about 1/6 of the hospitals’ patient service costs, so profits or losses on the clinics can have a large impact on the hospitals’ overall profitability.

Primary care is difficult to sustain financially everywhere, and it is particularly hard to sustain in small rural communities because of the significantly higher costs associated with delivering care to smaller patient populations. To support the higher costs of primary care in rural areas, Medicare pays for RHC services based on their actual costs when the RHC is operated by a rural hospital with less than 50 beds. The average cost per visit in 2025 at rural hospital-based RHCs was $293, and Medicare paid an average of $218 per visit at those RHCs, twice as much as what Medicare pays for visits at primary care practices and non-hospital-based RHCs.30

Private health plans, however, typically pay the same amounts for primary care services at hospital-based RHCs as they pay other primary care practices. Even if a plan pays more for primary care visits than the standard Medicare fees, those payments will still be less than the cost per visit at most RHCs. As shown below, small rural hospitals that operate a Rural Health Clinic lose significantly more on private payments than hospitals without an RHC, and larger hospitals that operate an RHC make smaller profits than hospitals that do not.

Figure 14

Private Payer Contribution

to Total Hospital Margin

By Presence of Rural Health Clinic (RHC)

The value for each hospital is the median during the most recent three years available (excluding 2020) of the margin earned on services for patients with private insurance divided by the hospital’s total expenses; this represents the amount that privately-insured patients contributed to the hospital’s total margin. The chart shows the median of these amounts for all of the rural hospitals with total expenses in each category based on whether the hospital operated a Rural Health Clinic (RHC) or not.

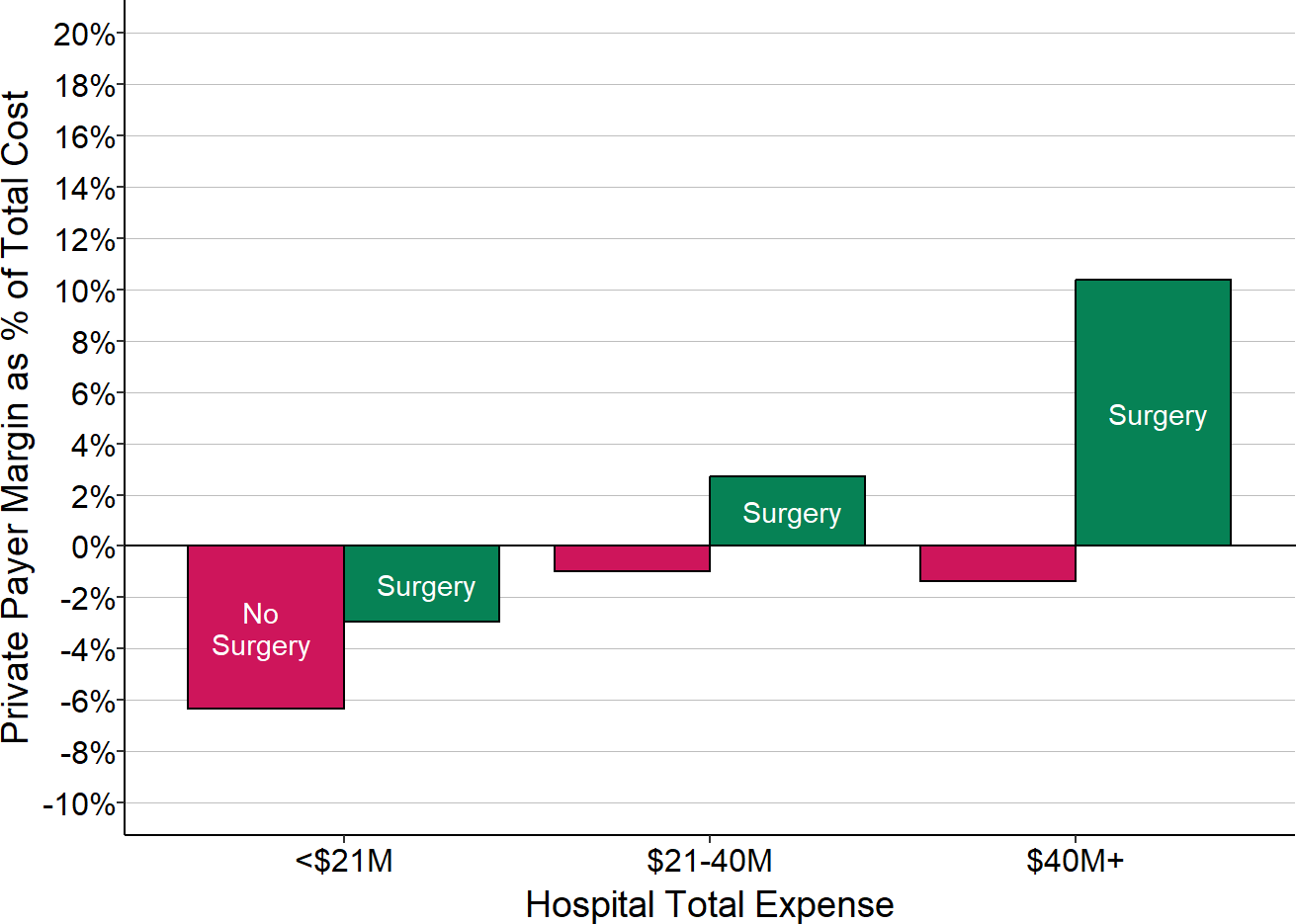

Figure 15

Private Payer Contribution

to Total Hospital Margin

By Whether Surgery is Performed

The value for each hospital is the median during the most recent three years available (excluding 2020) of the margin earned on services for patients with private insurance divided by the hospital’s total expenses; this represents the amount that privately-insured patients contributed to the hospital’s total margin. The chart shows the median of these amounts for all of the rural hospitals with total expenses in each category based on whether the hospital performed surgery or not.

Whereas primary care is one of the lowest-paid services in healthcare, surgery is one of the highest paid procedures. The cost report data show that small rural hospitals that were able to perform surgery had smaller losses or higher profits on patients with private insurance than hospitals that did not.

Although the majority of small rural hospitals perform at least some surgical procedures, one-third of the smallest hospitals (those with less than $24 million in total expenses) do not, and these hospitals have bigger financial losses than those that do offer surgery.

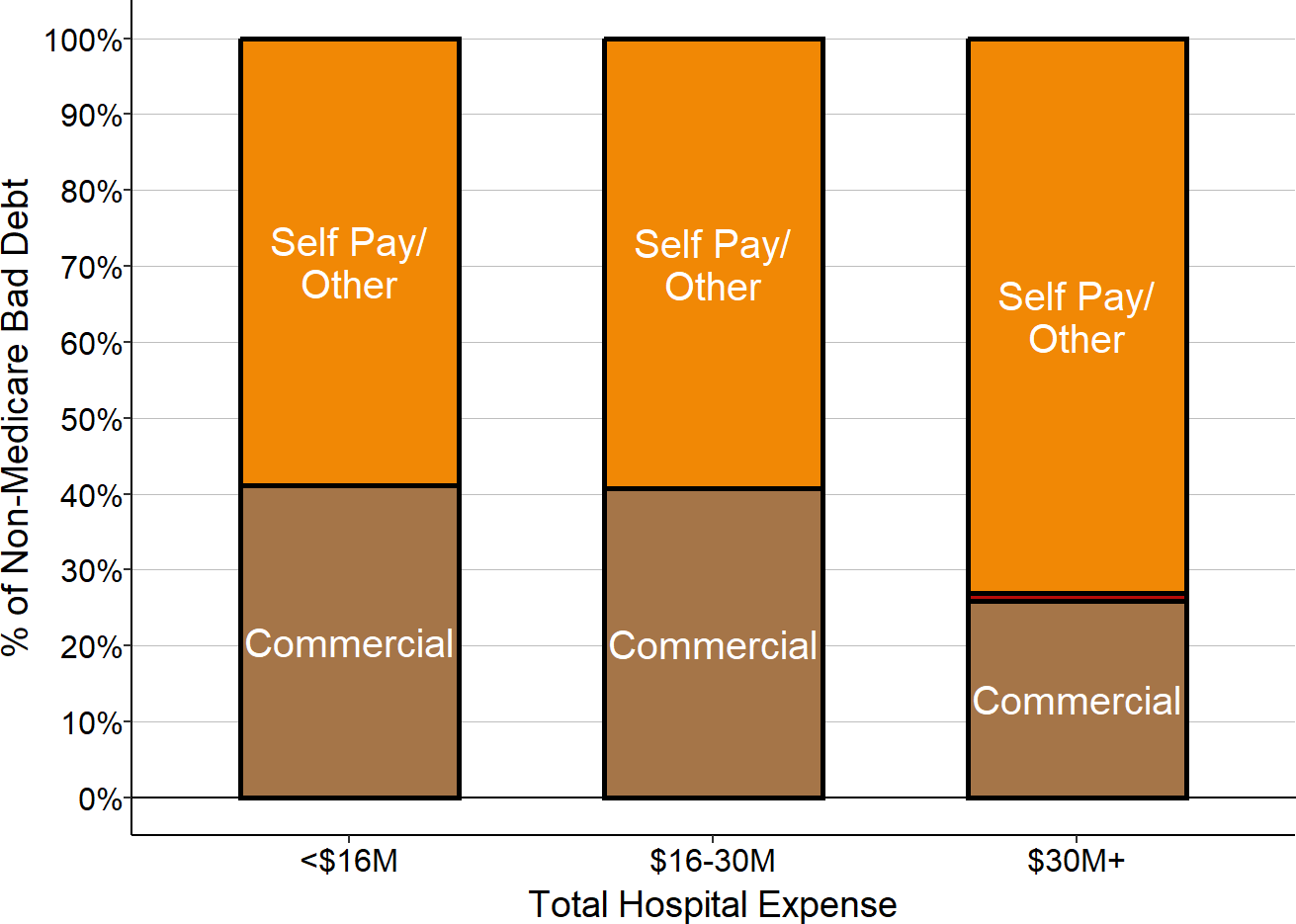

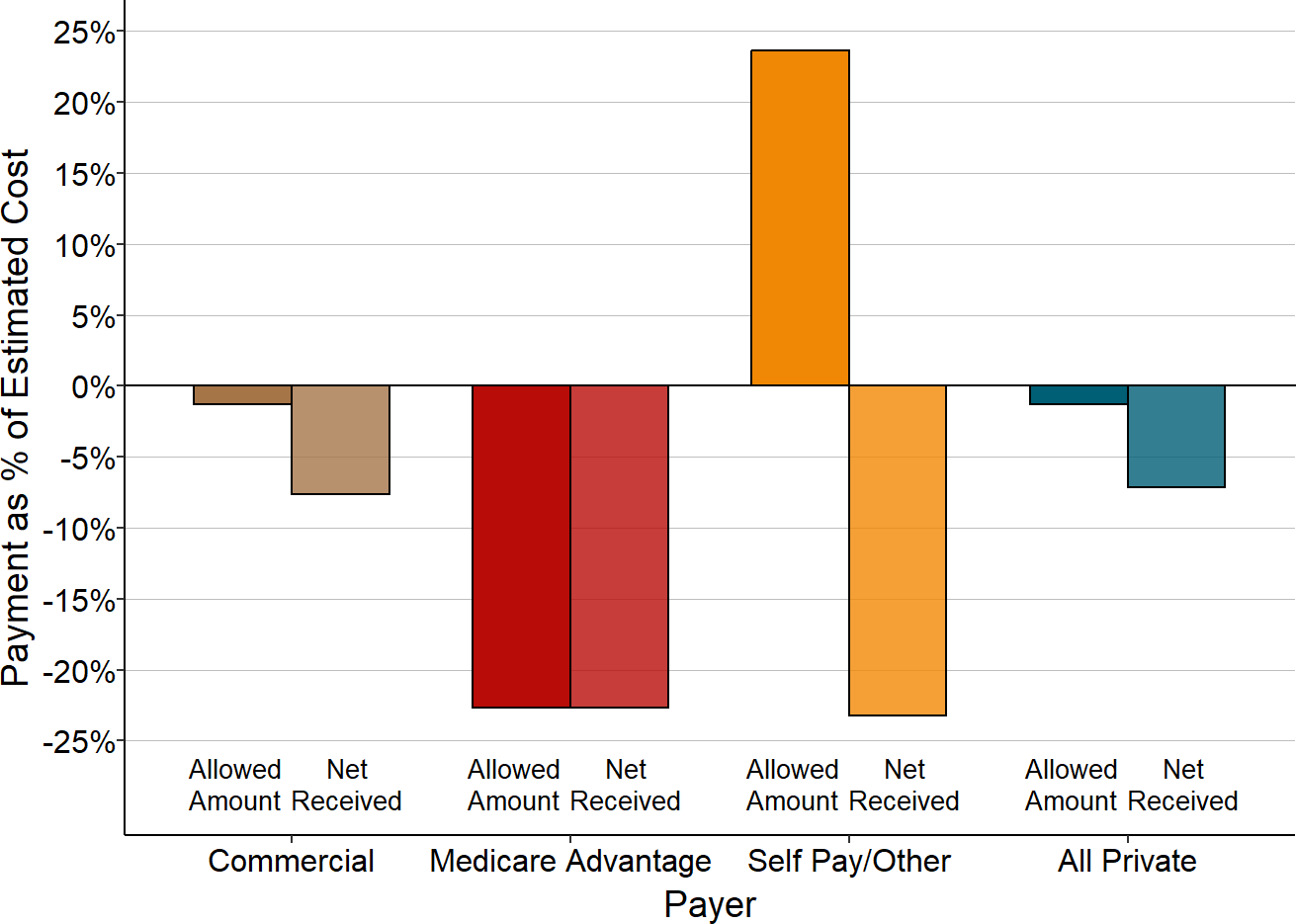

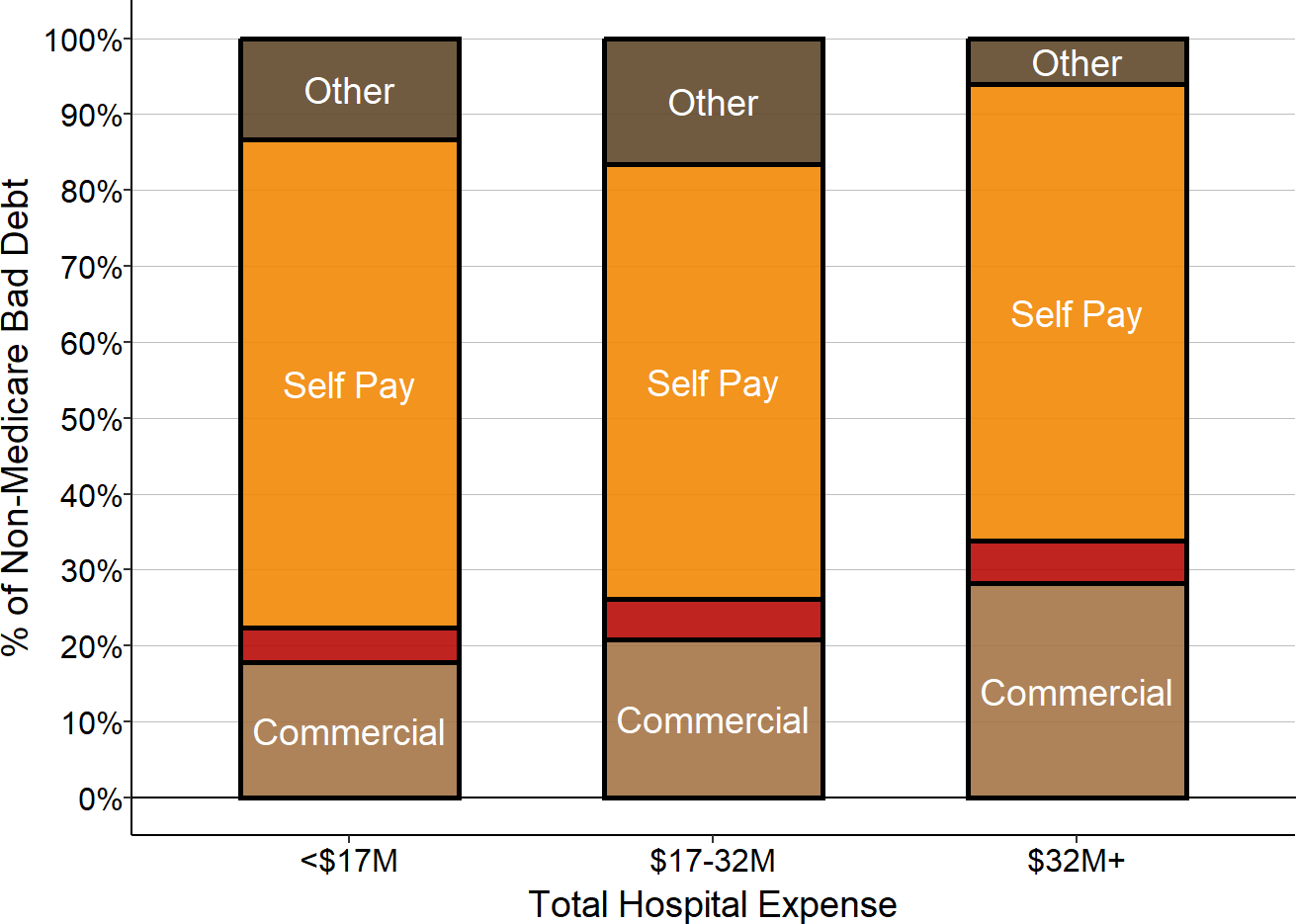

Impact of Patient Bad Debt

For services delivered to patients with private insurance, the insurance company determines the total amount the hospital is eligible to be paid (what is commonly referred to as the “allowed amount”), but the insurance company rarely pays that full amount itself. Patients are generally required to pay all or part of the allowed amount based on the cost-sharing requirements in their insurance – i.e., deductibles, copayments, and co-insurance. The private insurance payments shown in the previous section represent the allowed amounts determined by the health insurance plan, including both the portion paid directly by the health plan and the portion patients are expected to pay.

Cost-sharing requirements in private insurance plans have increased significantly over time, and a growing number of patients cannot afford to pay them. As a result, hospitals receive less actual revenue for privately-insured patients than their insurance company has “allowed” the hospital to receive. If a patient with private insurance does not pay all or part of the portion of charges for which they are responsible, this is classified on hospital cost reports as either “charity care for insured patients” (for patients who meet the hospital’s charity care standards) or as “bad debt” (for the remaining patients who do not qualify for charity care). Patients who do not have insurance but who do not qualify for charity care (typically described as “self-pay” patients) are responsible for the hospital’s full charge for their services or any discounted amount the hospital offers them; any portion of this amount that they fail to pay is also classified as bad debt.31 (Patients who do not have insurance and who meet the hospital’s standards for charity care are shown as “charity” in the earlier figures.)

The cost of services associated with these unpaid charges represents a significant loss for most hospitals and it is shown as “Bad Debt” in the figures.32 For most hospitals, the cost associated with bad debt33 is much larger than the cost of charity care for insured patients.34

As shown in Figure 9, bad debt for private-pay patients represents more than 2% of the total cost of services at small rural hospitals, i.e., it causes total margins at most rural hospitals to be more than 2% lower than what they would otherwise be. Bad debt losses are somewhat larger at the smallest rural hospitals than at larger hospitals, which is likely due to a combination of lower incomes in small rural communities and higher cost-sharing requirements in the health insurance plans available in these communities. Out-of-pocket medical costs for people with employer-sponsored insurance are significantly higher than average in a number of states that have large rural populations. In many of these states, more than one-fifth of the people with employer-sponsored insurance had out-of-pocket medical expenses greater than 10% of their household income.35

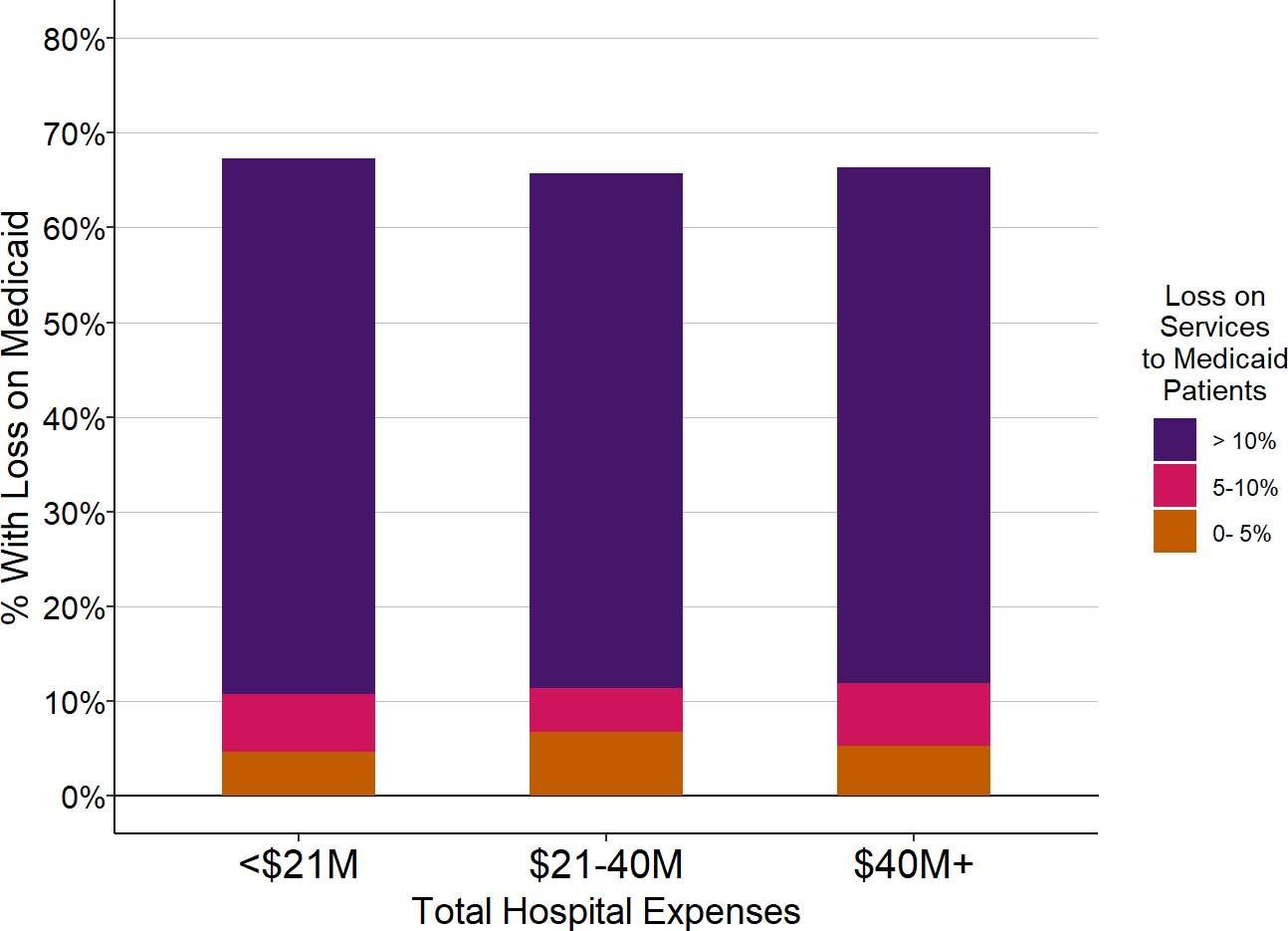

Impact of Medicaid on Hospital Finances

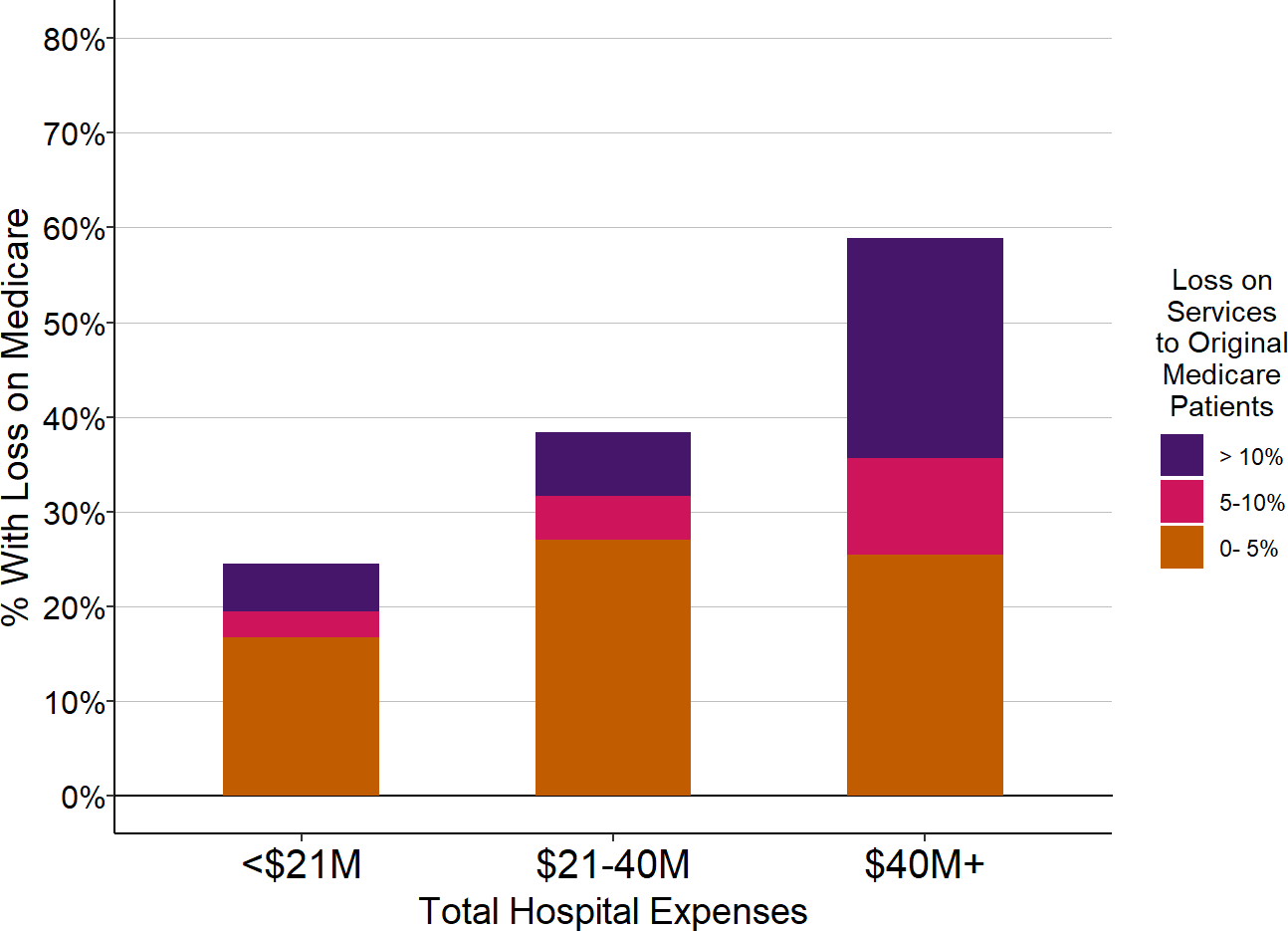

The majority of small rural hospitals, regardless of the hospital’s size, lose money on Medicaid patients. Moreover, the majority of hospitals have large losses – greater than 10% – on Medicaid patients.

Figure 16

Percentage of Rural Hospitals

With Losses on Medicaid Patients

| Total Hospital Expenses | Number of Hospitals |

Percent with Loss on Medicaid Patients |

Percent with Medicaid Loss 5-10% |

Percent with Medicaid Loss > 10% |

|---|---|---|---|---|

| <$24M | 532 | 58.8% | 51.3% | 46.2% |

| $24-45M | 515 | 58.8% | 54.8% | 49.7% |

| $45M+ | 996 | 60.0% | 53.5% | 47.2% |

The chart shows the percentage of rural hospitals in each size category that lost money on services to patients insured by Medicaid during the most recent three years available (excluding 2020). The purple bars represent the proportion of hospitals that lost 10% or more on services to Medicaid patients, and the red bars represent the proportion that lost 5-10% on services to patients insured by Medicaid.

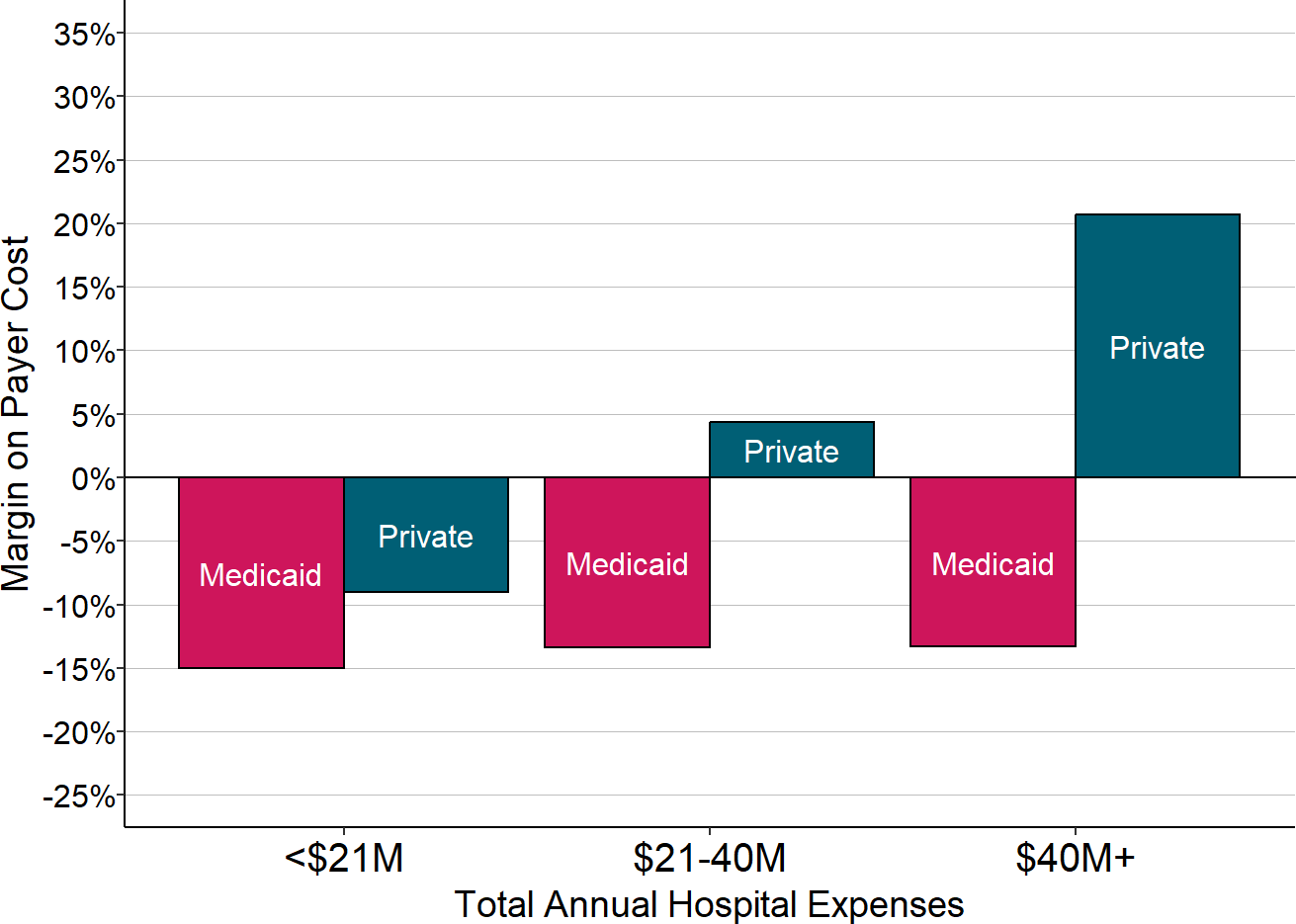

On average, rural hospitals are paid less for services by Medicaid than by private payers. The smallest rural hospitals lose money on both Medicaid and private-pay patients, but the losses are larger on Medicaid patients.

Figure 17

Margins on Medicaid vs. Private Payers at Rural Hospitals

Each bar represents the median value for all rural hospitals that had total expenses in the category shown. The value for each hospital is the median during the most recent three years available (excluding 2020) of the margin (profit or loss) earned on services delivered to patients with private insurance or patients with Medicaid.

However, as shown earlier in Figure 4, a much smaller portion of hospitals’ services are delivered to Medicaid patients than to private-pay patients. This means that a loss on services to patients with private insurance will have a bigger impact on the hospital’s overall margin than a similar loss on Medicaid patients. The amount that a particular type of payer contributes to a hospital’s total profit or loss is determined by two separate factors: (1) the difference between what the payer pays for each service and how much it costs the hospital to deliver the service, and (2) what proportion of the hospital’s total patients and services are paid for by that payer. A small profit or loss for a large number of patients can have a bigger impact on the hospital’s overall profitability than a larger profit or loss for a small group of patients.

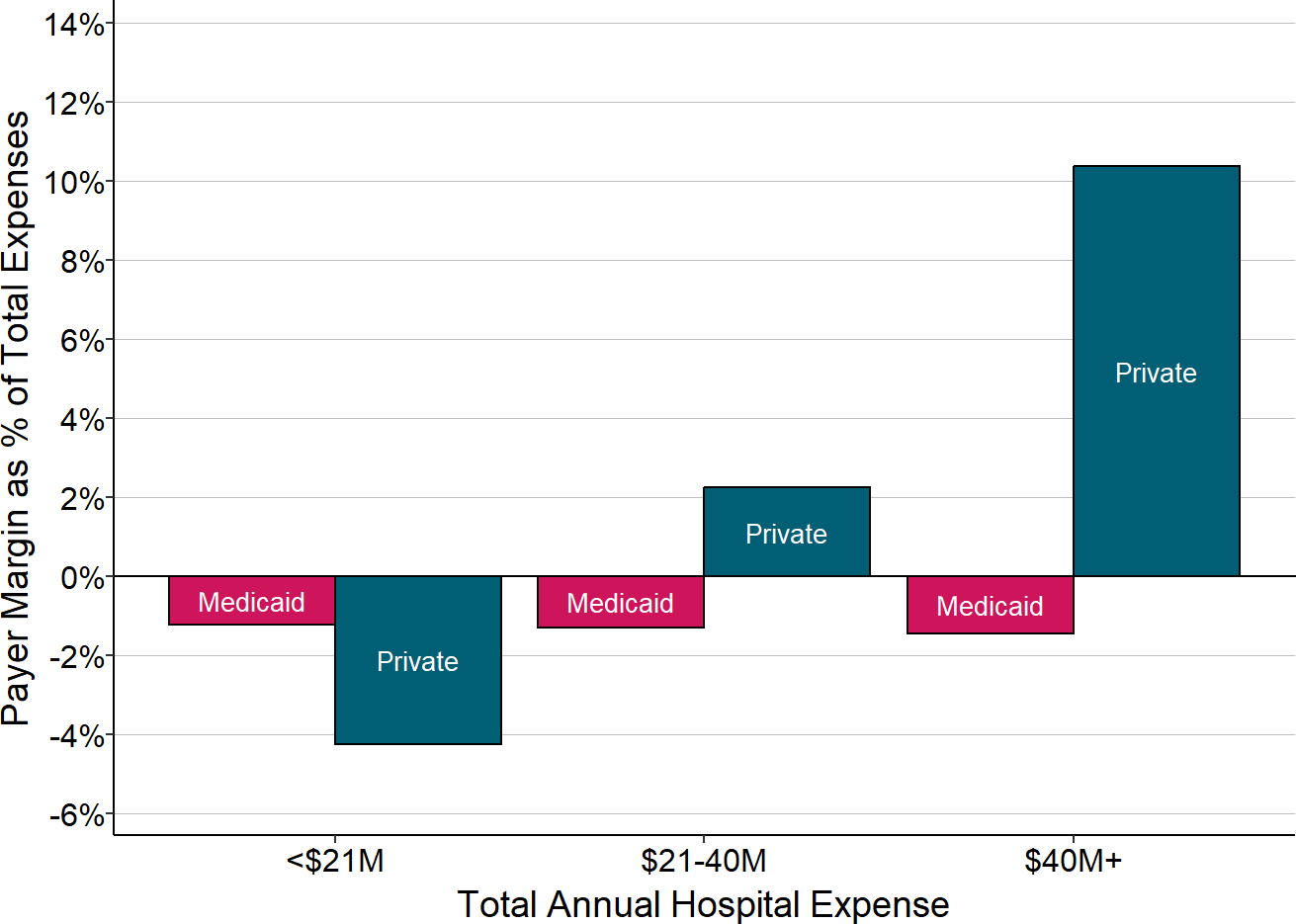

Figure 18

Contributions of Medicaid and Private Payers

to Total Margins at Rural Hospitals

Each bar represents the median value for all rural hospitals that had total expenses in the category shown. The value for each hospital is the median during the three most recent years available of the dollar margin (i.e., profit or loss) earned on services for patients with private insurance or patients with Medicaid, divided by the hospital’s total expenses. This represents the amount that privately-insured patients or Medicaid patients contributed to the hospital’s total margin.

In fact, as shown in Figure 18, at the smallest rural hospitals, the losses on patients with private insurance have a bigger negative impact on the hospital’s overall margin than the losses on patients with Medicaid.36 In contrast, at the larger hospitals, the profits on the private-pay patients more than offset the large losses on Medicaid patients because there are many more private-pay patients than Medicaid patients.37

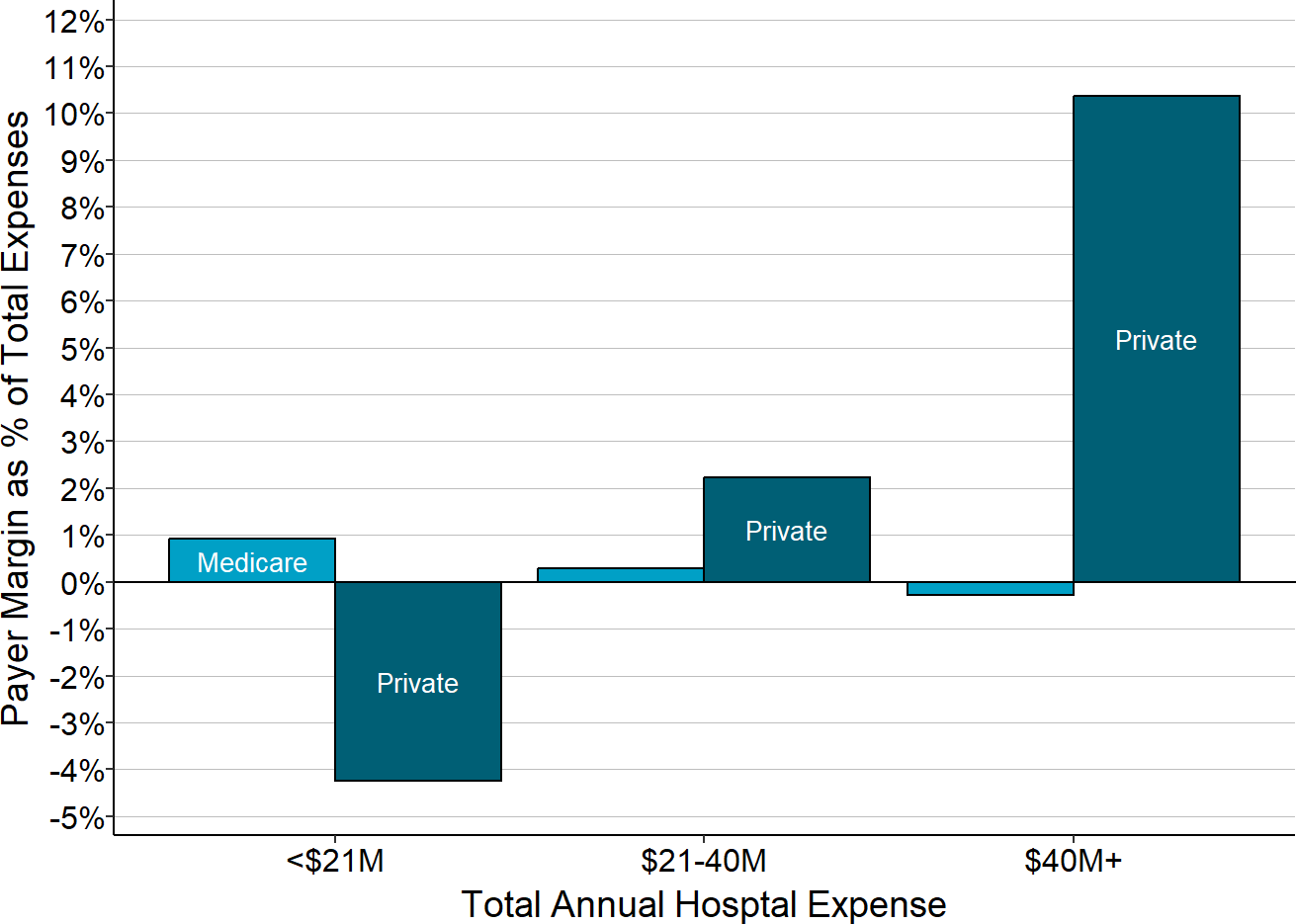

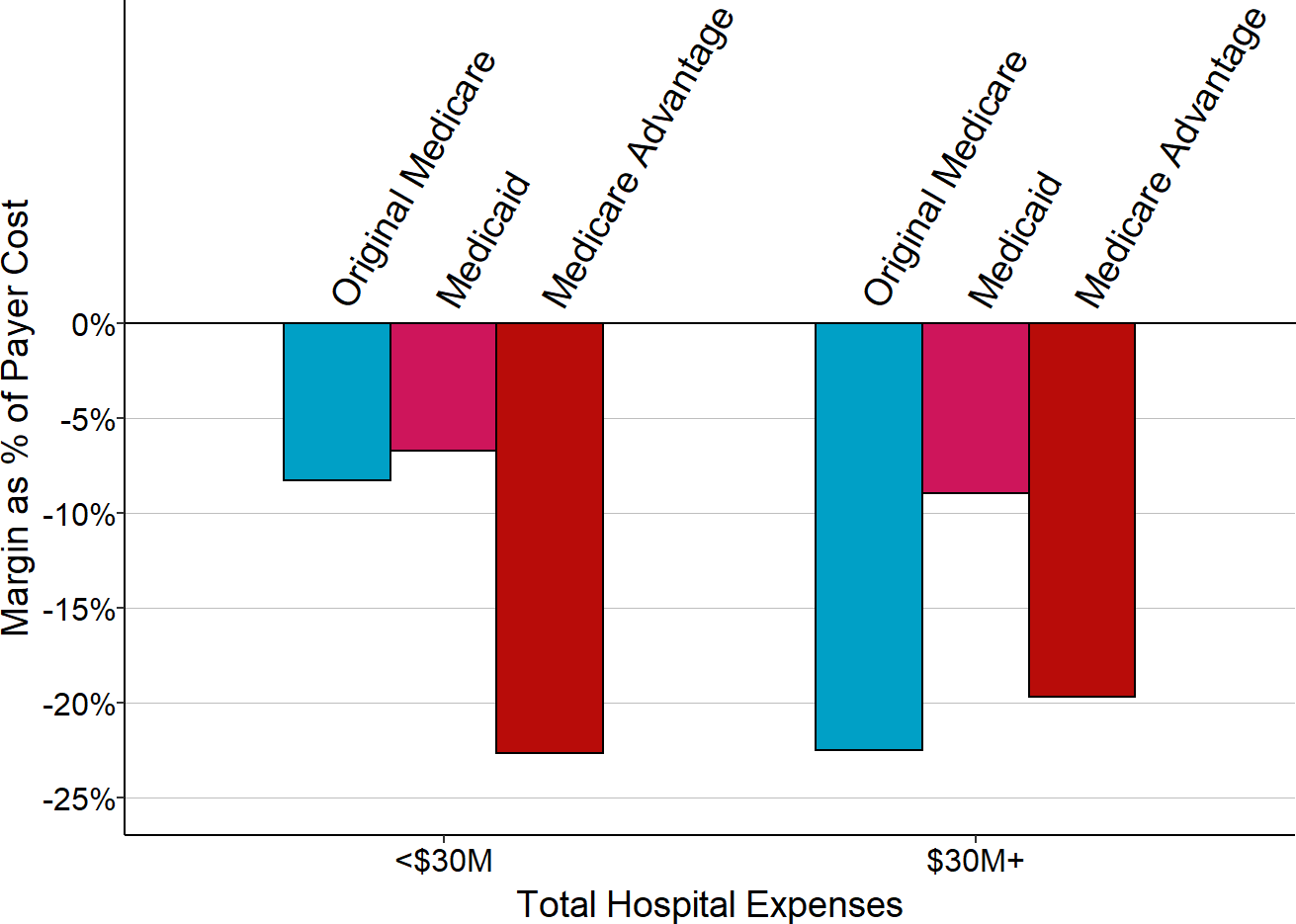

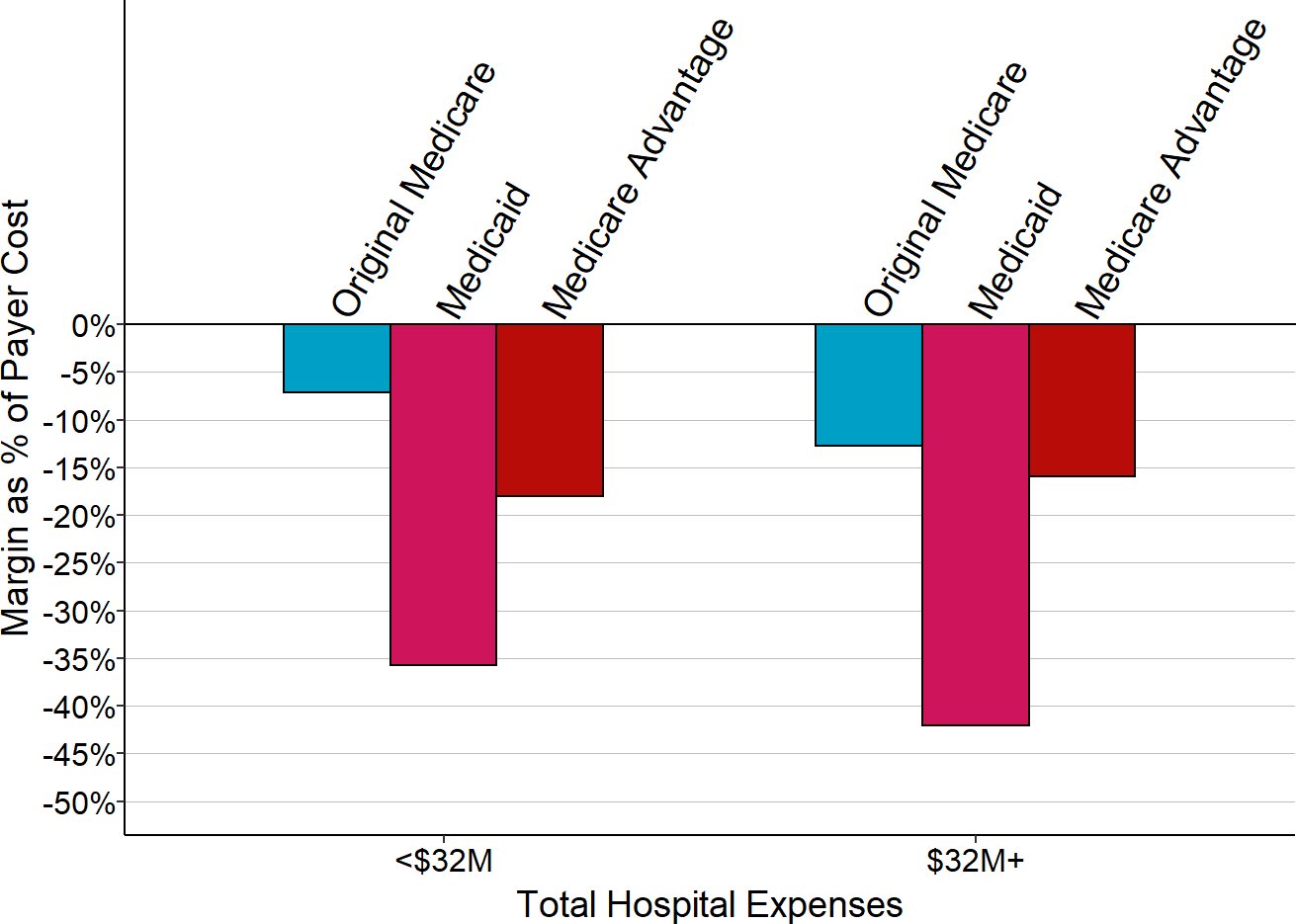

The Impact of Medicare Payments

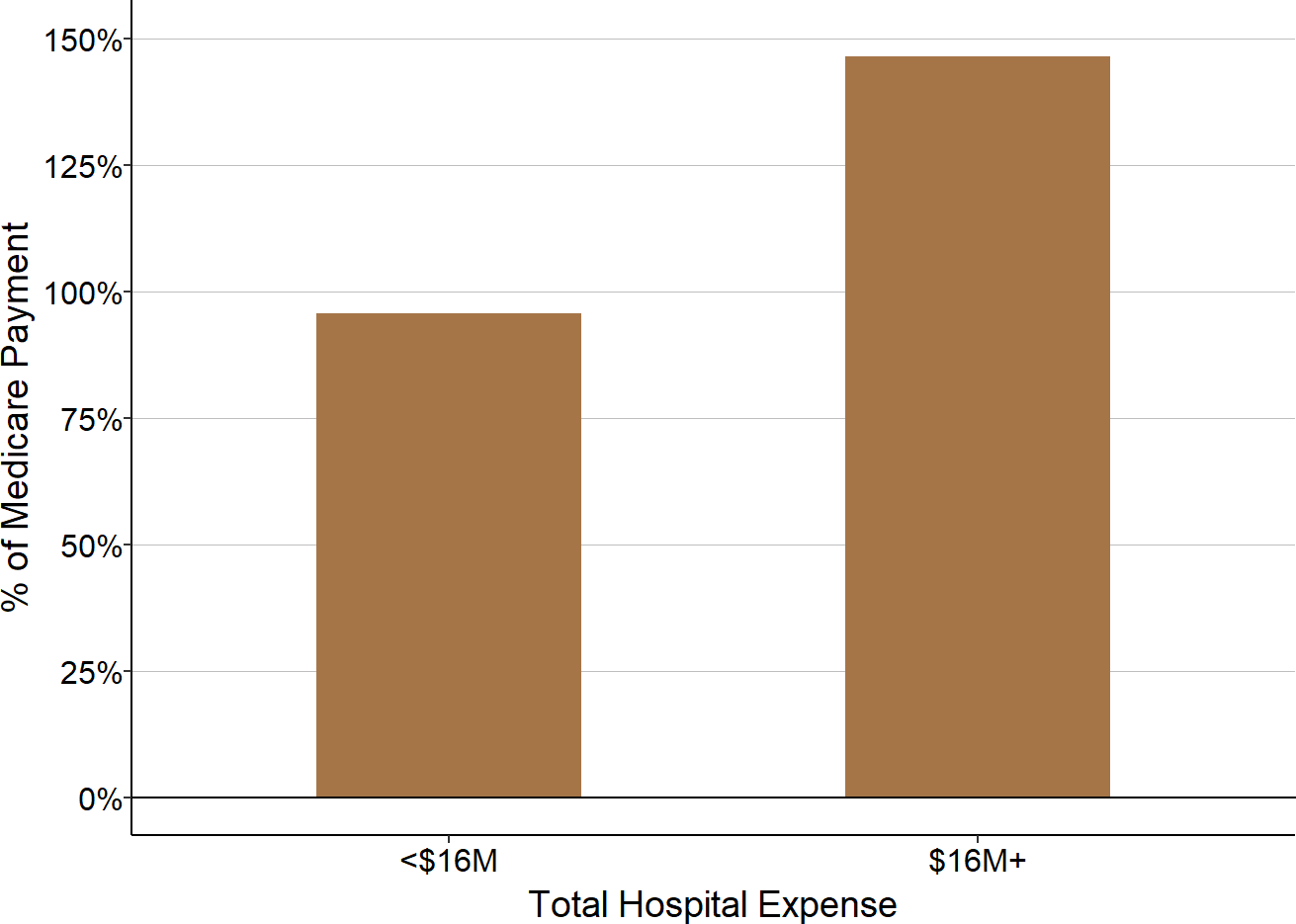

In contrast to private payers and Medicaid, Original Medicare (i.e., traditional Medicare insurance, not a Medicare Advantage plan) provides better financial support to small rural hospitals than it does to larger hospitals. The majority of very small rural hospitals receive payments for Original Medicare beneficiaries that are slightly higher than the costs of services to those beneficiaries, whereas at larger hospitals, most hospitals lose money on Original Medicare patients.

Figure 19

% of Small Rural Hospitals

With Losses on Original Medicare Patients

| Total Hospital Expenses | Number of Hospitals |

Percent with Loss on Original Medicare |

Percent with Medicare Loss 5-10% |

Percent with Medicare Loss > 10% |

|---|---|---|---|---|

| <$24M | 532 | 30.6% | 9.2% | 4.7% |

| $24-45M | 515 | 47.4% | 15.3% | 9.5% |

| $45M+ | 996 | 67.2% | 37.2% | 25.2% |

The chart shows the percentage of rural hospitals in each size category that lost money on services to patients with Original Medicare insurance during the three most recent years available. The purple bars represent the proportion of hospitals that lost 10% or more on services to Original Medicare beneficiaries, and the red bars represent the proportion that lost 5-10% on services to patients insured by Original Medicare.

Although patients with Original Medicare represent a much larger percentage of rural hospitals’ patients than patients with Medicaid do, there are generally fewer Medicare patients than there are privately-insured patients at most hospitals. Moreover, the losses on patients with Original Medicare are much smaller than the losses on Medicaid patients or private-pay patients. As a result, the losses on privately-insured patients at the smallest rural hospitals have a much bigger impact on the hospitals’ total margins than do profits or losses on Medicare patients. In contrast, the positive margins on private-pay patients at many larger hospitals more than offset their losses on Medicare patients as well as the losses on Medicaid patients.

Figure 20

Contributions of Original Medicare and Private Payers

to the Total Margin at Rural Hospitals

Each bar represents the median value for all rural hospitals that had total expenses in the category shown. The value for each hospital is the median during the three most recent years available of the dollar margin (i.e., profit or loss) earned on services for patients with private insurance or patients with Original Medicare, divided by the hospital’s total expenses. This represents the amount that privately-insured patients or Original Medicare patients contributed to the hospital’s total margin.

Payments for the smallest hospitals under Original Medicare are higher because smaller hospitals are more likely to be classified as Critical Access Hospitals and qualify for cost-based payment.38 Except for Critical Access Hospitals, the majority of rural hospitals lose money on Medicare patients. The strengths and weaknesses of the Critical Access Hospital payment system is discussed in more detail in the section on Cost-Based Payment.

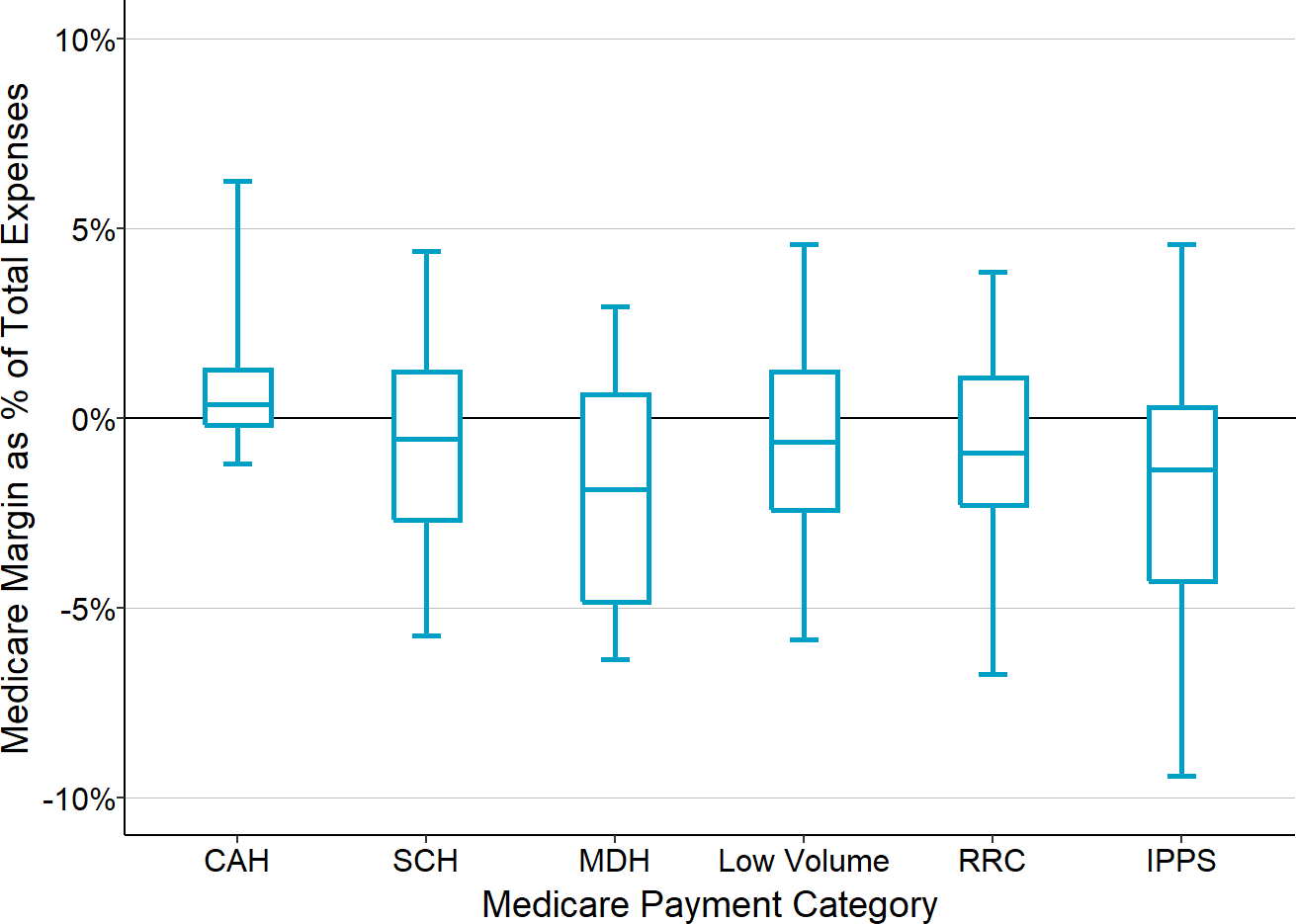

Figure 21

Medicare Contribution to Total Hospital Margin

The chart shows the amounts Original Medicare contributes to the hospital’s total margin for rural hospitals in each Medicare payment category. The value for each hospital is the median for the three most recent years available of the margins on Original Medicare patients divided by the hospital’s total expenses. CAH = Critical Access Hospital, SCH = Sole Community Hospital, MDH = Medicare Dependent Hospital, Low Volume = Eligible for Low Volume Adjustment in Payment, RCH = Participant in Rural Community Hospital Demonstration, IPPS = Standard Inpatient Prospective Payment System Payment.

The bottom of each box shows the 1st quartile (i.e., 25% of the hospitals have a value lower than this amount), the top of the box shows the 3rd quartile, and the center line represents the median value for the category (i.e., 50% of the hospitals are above or below this amount). The ends of the “whiskers” above and below each box represent the 5th and 95th percentiles, i.e., the values for 90% of the hospitals in the category are between these amounts. The center line is below 0 for all categories other than Critical Access Hospitals (CAHs), which means the majority of other rural hospitals lose money on their Medicare patients.

The Key Role of Other Sources of Revenue

As a result of the large losses on patients with private insurance, over 70% of the smallest rural hospitals (those with total expenses below $24 million) have been losing money overall on the delivery of patient services in recent years. The majority have had losses of 6% or more, and over one-fourth have had losses of 15% or more. Most rural hospitals with expenses between $24 million and $45 million have also been losing money on patient services, and over 10% have had losses greater than 15%.

In contrast, two-thirds of rural hospitals with expenses greater than $45 million have been making profits delivering patient services.

If a hospital is losing significant amounts of money on patient services, the only way it can continue to operate is if it has sources of revenue other than payments for patient services. Most of the smallest rural hospitals receive a significant amount of other revenues that offset the losses they incur on patient services, whereas the majority of the largest rural hospitals do not need other sources of revenue in order to be profitable.

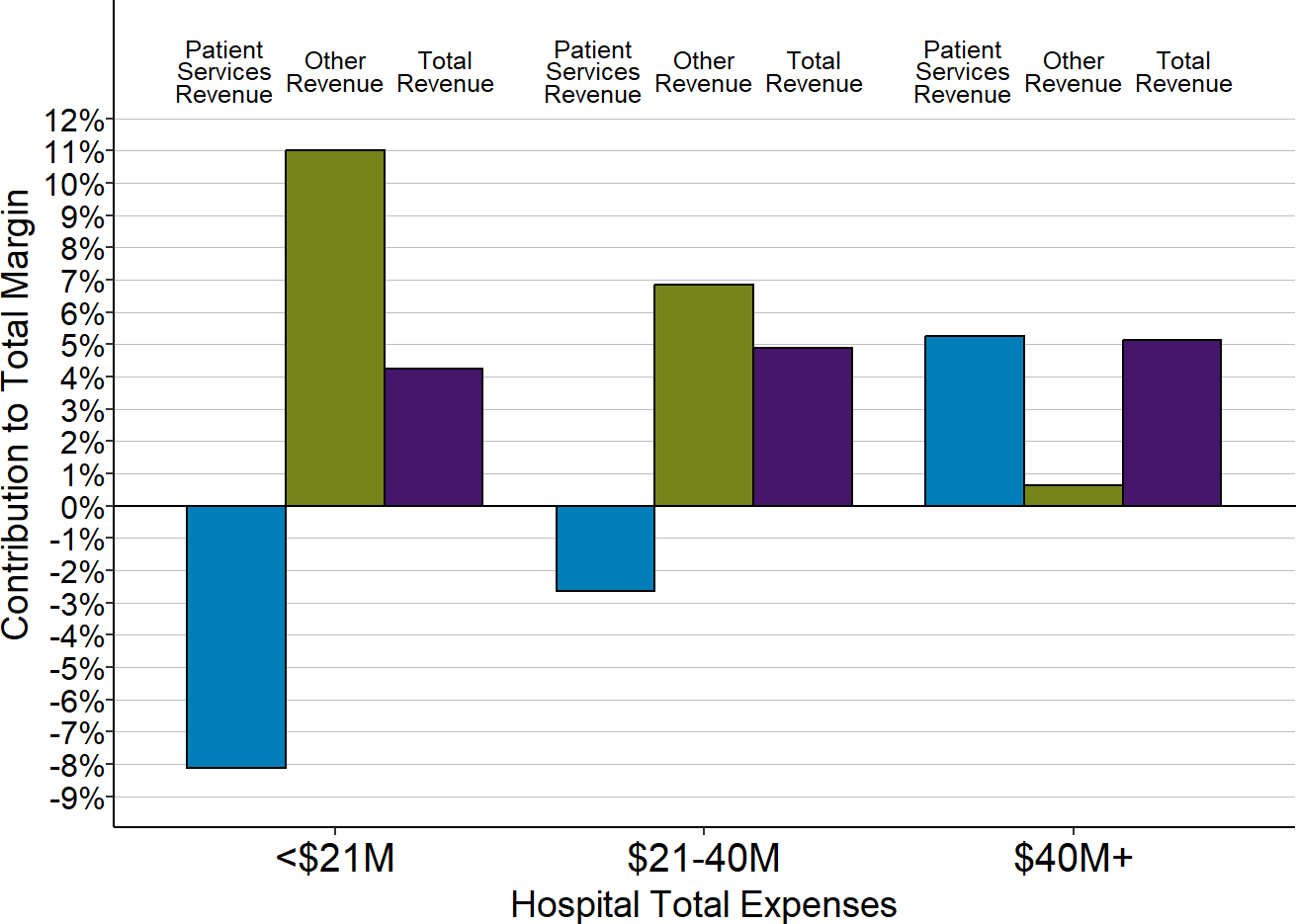

Figure 22

Contributions of Patient Services Revenue and

Other Revenues to Total Hospital Margins

at Rural Hospitals

Each bar represents the median value for all rural hospitals that had total expenses in the category shown. The value for each hospital is the median during the most recent three years (except for 2020) of (a) the dollar margin (i.e., profit or loss) earned on services to patients, (b) the amount of revenue received from sources other than patient serivces, or (c) the total hospital revenue, divided by the hospital’s total expenses. This shows how much revenue from patient services and other sources of revenue contributed to the hospital’s total margin.

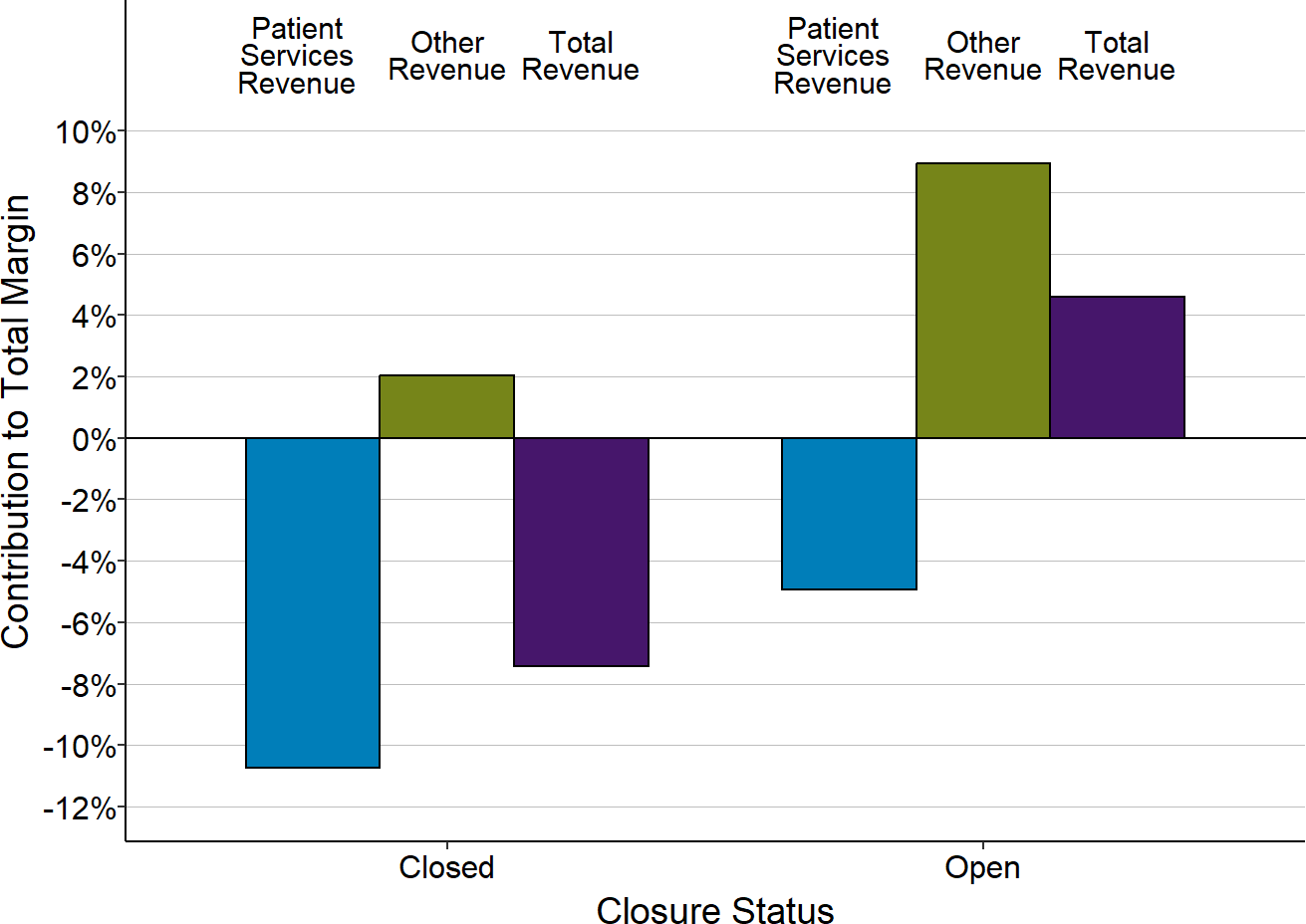

Of course, if the losses on patient services are too large or the other sources of revenue are too small, a small rural hospital will end up with overall losses and it could be forced to close as a result. The small rural hospitals that have closed since 2015 had losses on patient services that were much higher than what other small rural hospitals experienced, and they received less in other revenues as a percentage of their total expenses that could help offset these losses. As a result, they incurred significant overall losses, which likely led to their closure.

Figure 23

Contributions of Patient Services and Other Revenues

to Total Margins at Closed and Open Small Rural Hospitals

Each bar represents the median value for (1) all rural hospitals that have closed since 2015 or (2) remained open in 2024. Only rural hospitals with less than $45 million in expenses are included. The value for each hospital is the median for the three years prior to closure (for hospitals that had closed) or the most recent year available (for hospitals that were open in 2024) of (a) the dollar margin (i.e., profit or loss) earned on services to patients, (b) the amount of revenue received from sources other than patient serivces, or (c) the total hospital revenue, divided by the hospital’s total expenses. This shows how much revenue from patient services and other sources of revenue contributed to the hospital’s total margin.

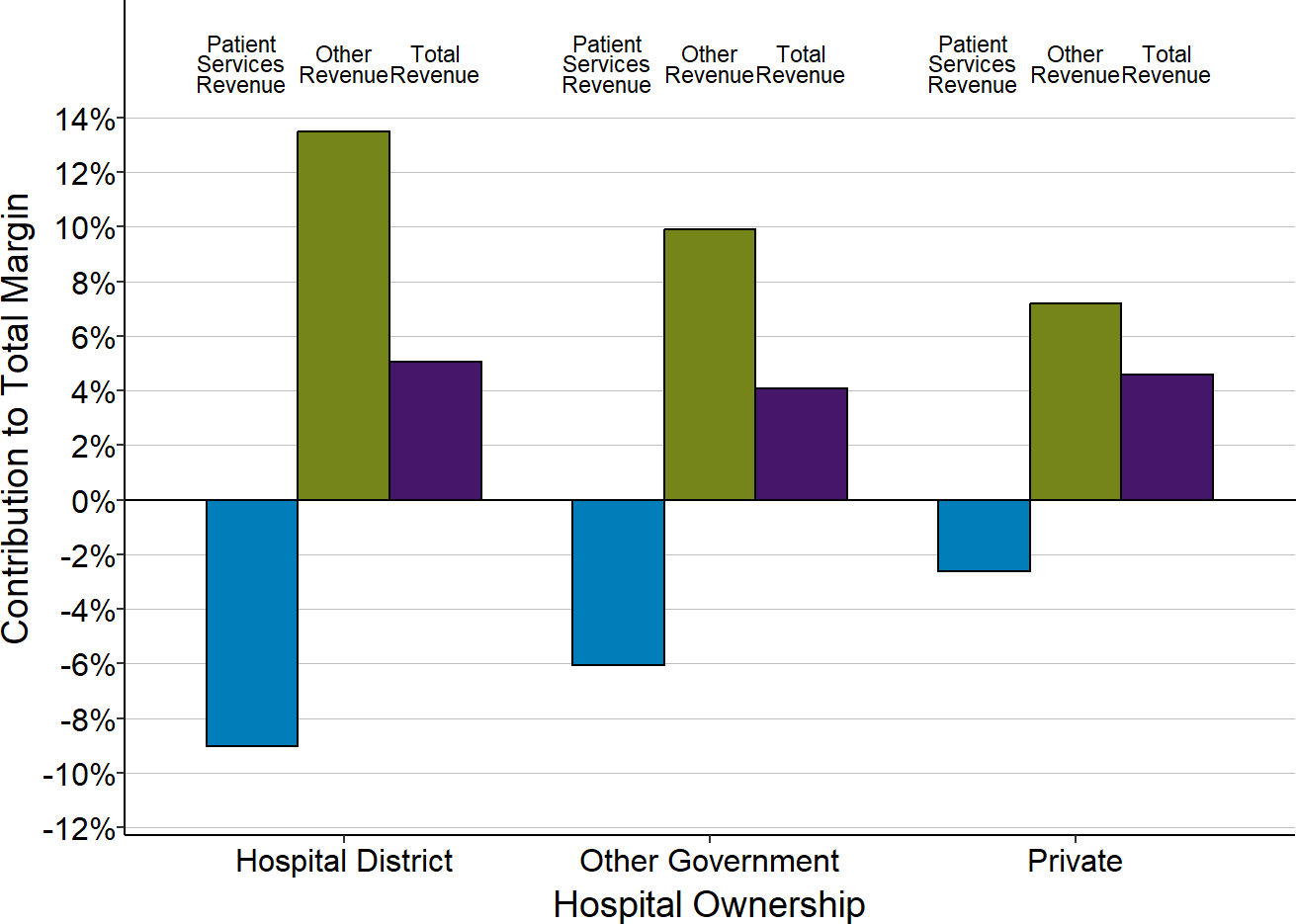

Rural hospitals vary significantly in their ability to obtain “other revenues” to offset losses on patient services. Hospitals that are organized as public hospital districts or owned by a governmental entity (e.g., a county or municipality) often have access to public funding sources that are not available to other hospitals, such as the ability to impose tax levies on local residents. The more than 200 small rural hospitals operated by hospital districts have significantly higher losses on patient services than other similarly-sized hospitals, but they also have more revenue from taxes and other sources that has enabled a majority to balance their budgets and continue operating.

Figure 24

Contributions of Patient Services and Other Revenues

to Total Margins by Hospital Ownership Status

Each bar represents the median value for small rural hospitals with the type of ownership shown. Only rural hospitals with less than $45 million in expenses are included. The value for each hospital is the median during the three most recent years available of (a) the dollar margin (i.e., profit or loss) earned on services to patients, (b) the amount of revenue received from sources other than patient serivces, or (c) the total hospital revenue, divided by the hospital’s total expenses. This shows how much revenue from patient services and other sources of revenue contributed to the hospital’s total margin.

The Impact of the Pandemic on Small Rural Hospitals

The nationwide coronavirus pandemic had a number of significant impacts on small rural hospitals. Patient service margins at most hospitals decreased during the pandemic, but large amounts of special federal assistance caused total margins to temporarily improve.

Pandemic Impact on Patient Services

The First Year of the Pandemic (2020)

Most rural hospitals experienced lower margins on patient services during their 2020 fiscal year than during the previous year.39 This was most problematic for small rural hospitals (those with less than $45 million in total annual expenses). The majority of small rural hospitals were losing money on patient services prior to the pandemic, so the lower margins during the initial year of the pandemic pushed them even further into the red. In contrast, even though larger rural hospitals and urban hospitals also experienced lower margins, most of them continued to generate profits on patient services overall.

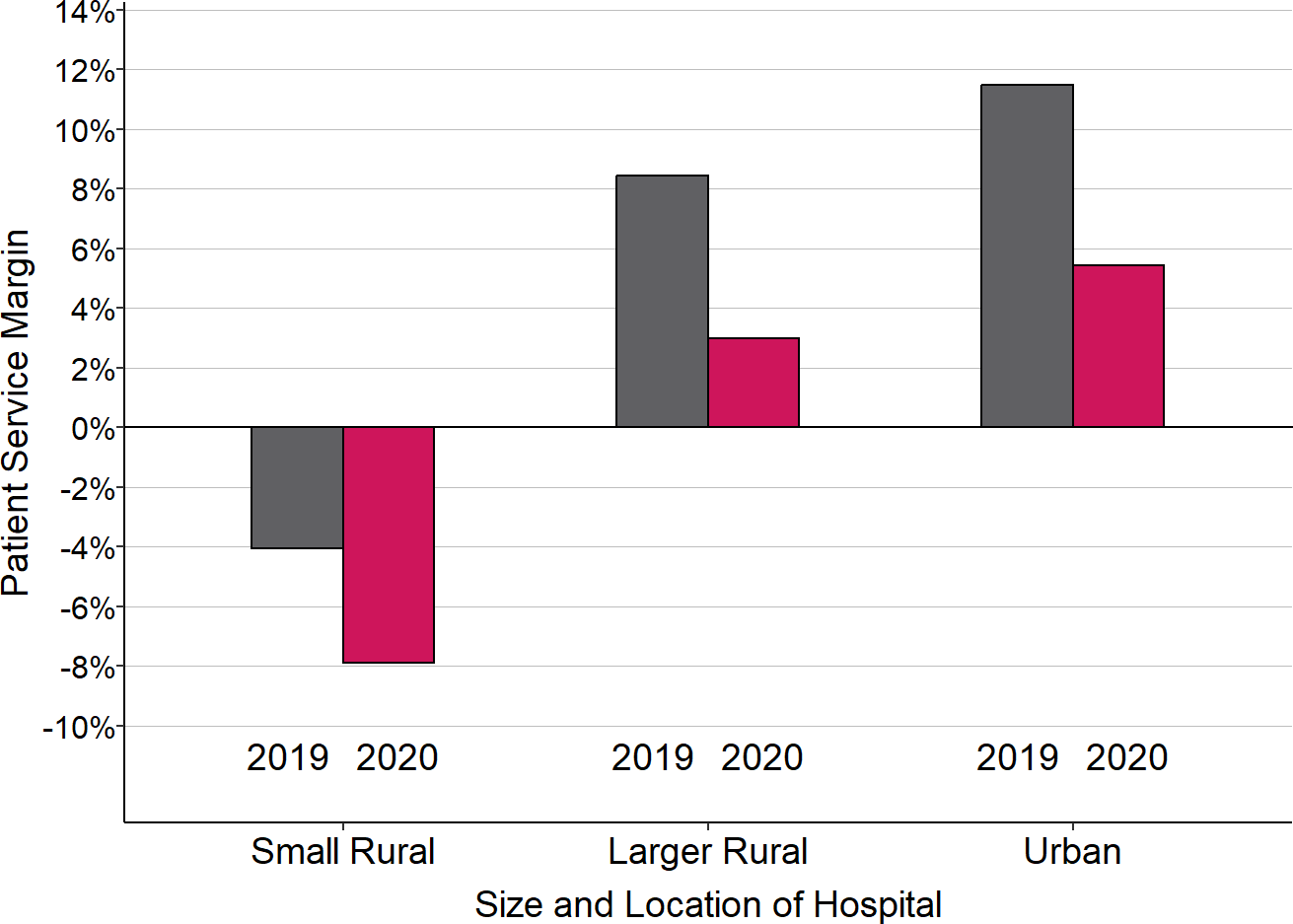

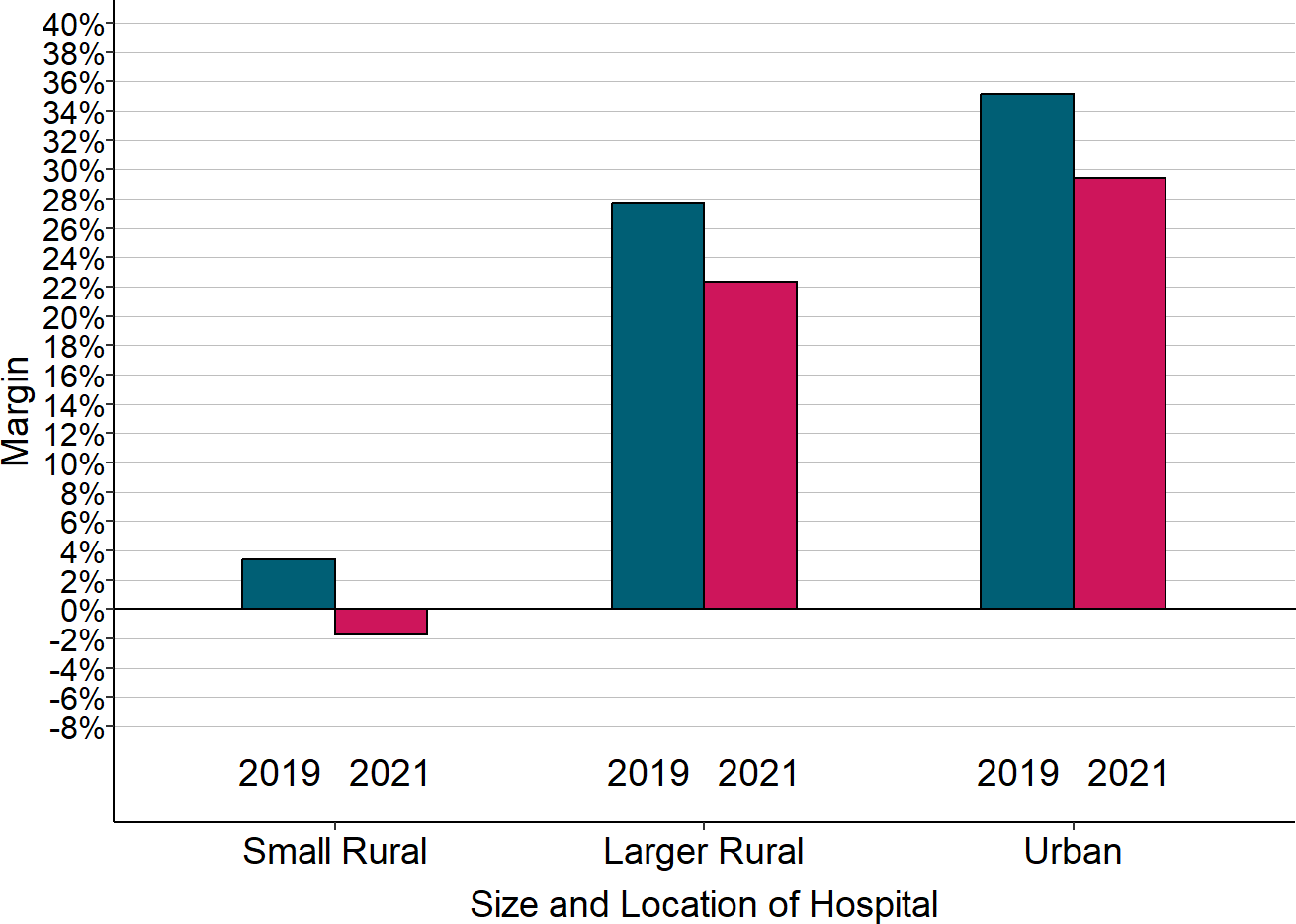

Figure 25

Change in Median Margins on Patient Services

“Small Rural” hospitals are rural hospitals with less than $45 million in total annual expenses. 2020 is the hospital’s fiscal year that included the March-June 2020 period, and 2019 is the preceding year.

The reductions in margins on patient services during the initial months of the pandemic were due to three different factors:

Higher Costs of Delivering Services. The costs of delivering patient services increased due to the high costs of acquiring personal protective equipment and other COVID-related expenses on top of the normal annual growth in the costs of supplies and personnel. Patient service costs increased by a median of 3.5% at small rural hospitals in 2020, but the increase was over 8% for one-fourth of the hospitals.

Fewer Services Delivered. At most rural hospitals, the volume of patient services decreased. This was caused by a combination of patients delaying care and reduced ability of hospitals to deliver services due to pandemic restrictions and shortages of staff and supplies. Total charges for services delivered (the best measure of overall service volume available) decreased by a median of 2% at small rural hospitals, which suggests that the number of services at most of the hospitals decreased by 2% or more.40 For one-fourth of small rural hospitals, charges decreased by more than 8%.

Inadequate Payments for Services by Private Payers. Private health insurance plans paid a smaller percentage of rural hospitals’ charges and costs during the initial year of the pandemic. In contrast, Medicare payments to rural hospitals increased during the pandemic because of the suspension of federal sequestration reductions during the portion of the year in which the Public Health Emergency was in effect. Also, since Medicare pays Critical Access Hospitals based on their actual costs, they received an additional increase in Medicare payments if they experienced an increase in costs. The majority of rural hospitals also received higher Medicaid payments as a percentage of their charges during the initial year of the pandemic, although this varied significantly by state and by hospital.

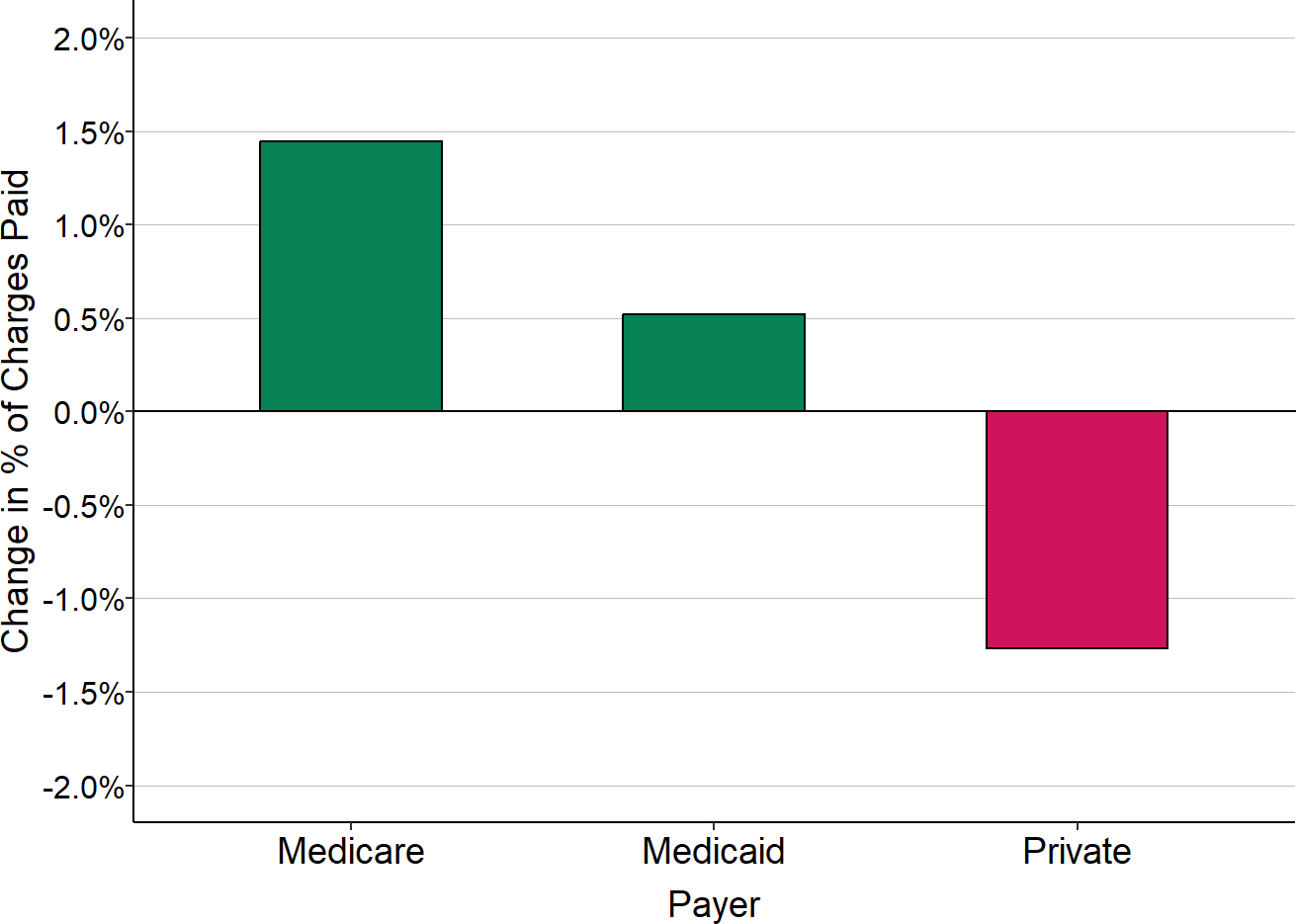

Figure 26

Change in Percentage of Charges Paid, 2019-2020

“Medicare” includes only Original Medicare. Medicare Advantage plans are included with “Private” payers. The change shown is the difference between the fiscal year that included the March-June 2020 period and the preceding fiscal year for all rural hospitals.

The primary reason overall patient service margins at rural hospitals decreased during the pandemic was higher losses on patients insured by private health plans (including Medicare Advantage plans). The losses on patients insured by private health plans hurt the smallest rural hospitals the most because they were already receiving low payments from private payers prior to the pandemic. Although hospitals of all sizes experienced lower margins on patients with insurance from private companies during the pandemic, for most small rural hospitals, the reductions meant they lost money providing services to these patients.

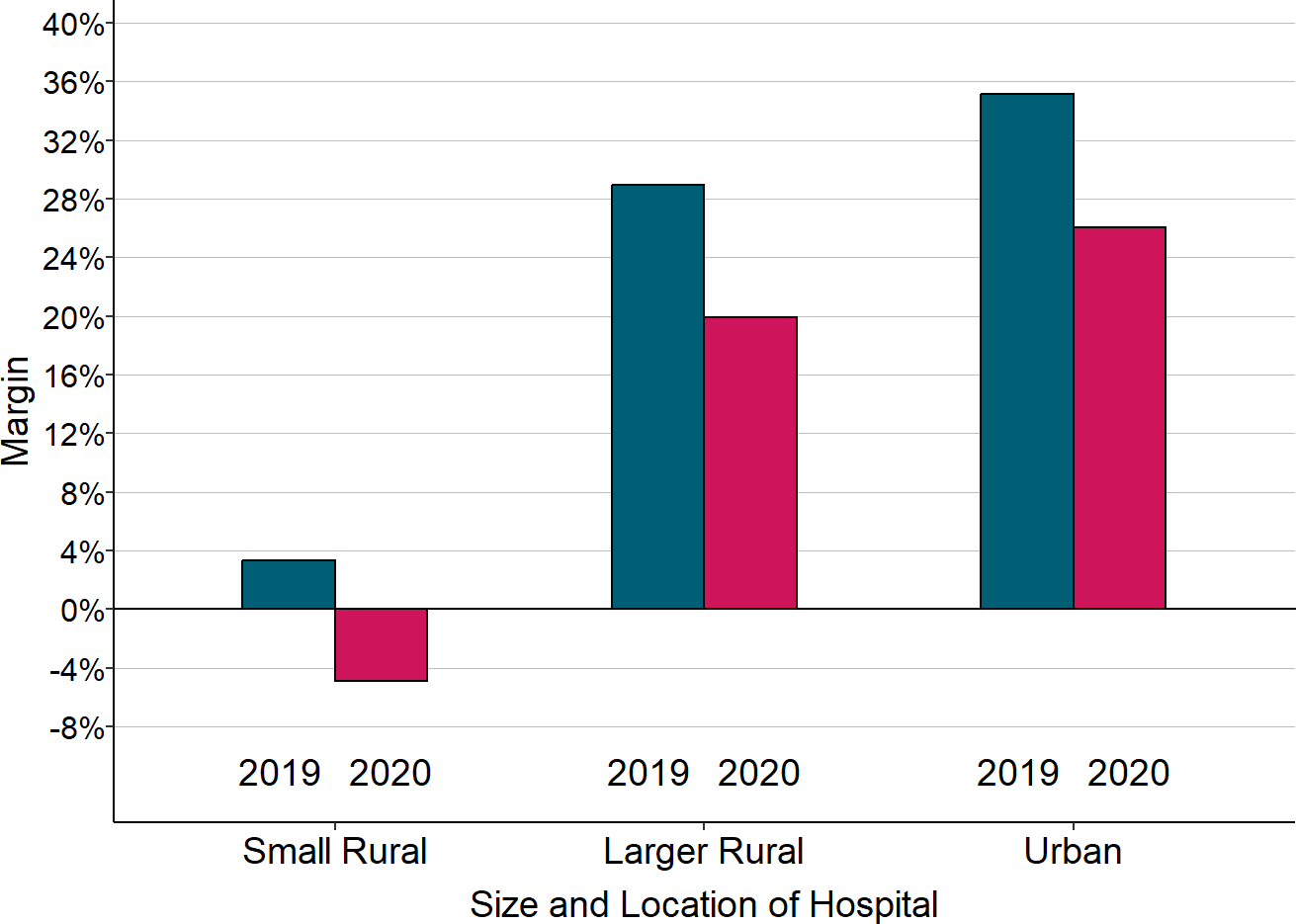

Figure 27

Median Margin on Patients With Private Insurance

“Small Rural” hospitals are rural hospitals with less than $45 million in total annual expenses. 2020 is the hospital’s fiscal year that included the March-June 2020 period, and 2019 is the preceding year. The margin shown is the difference between the revenues received from private insurance plans (including Medicare Advantage plans) and the cost of the services delivered to the patients insured by those plans, divided by the cost.

The Second Year of the Pandemic (2021)

In the second year after the pandemic began, total charges at the majority of hospitals increased above pre-pandemic levels, reflecting a combination of a higher volume of services and higher amounts charged per service to cover higher costs. However, costs increased significantly compared to pre-pandemic levels, and at most small rural hospitals, revenues increased less than the increase in costs. As a result, patient service margins at small rural hospitals remained lower than they were prior to the pandemic.

Payments from private payers continued to be the primary cause of the reduction in margins for small rural hospitals. The reductions were much higher in some states than others, reflecting both differences in payments by different insurance plans and differences in the payers providing insurance in each state.

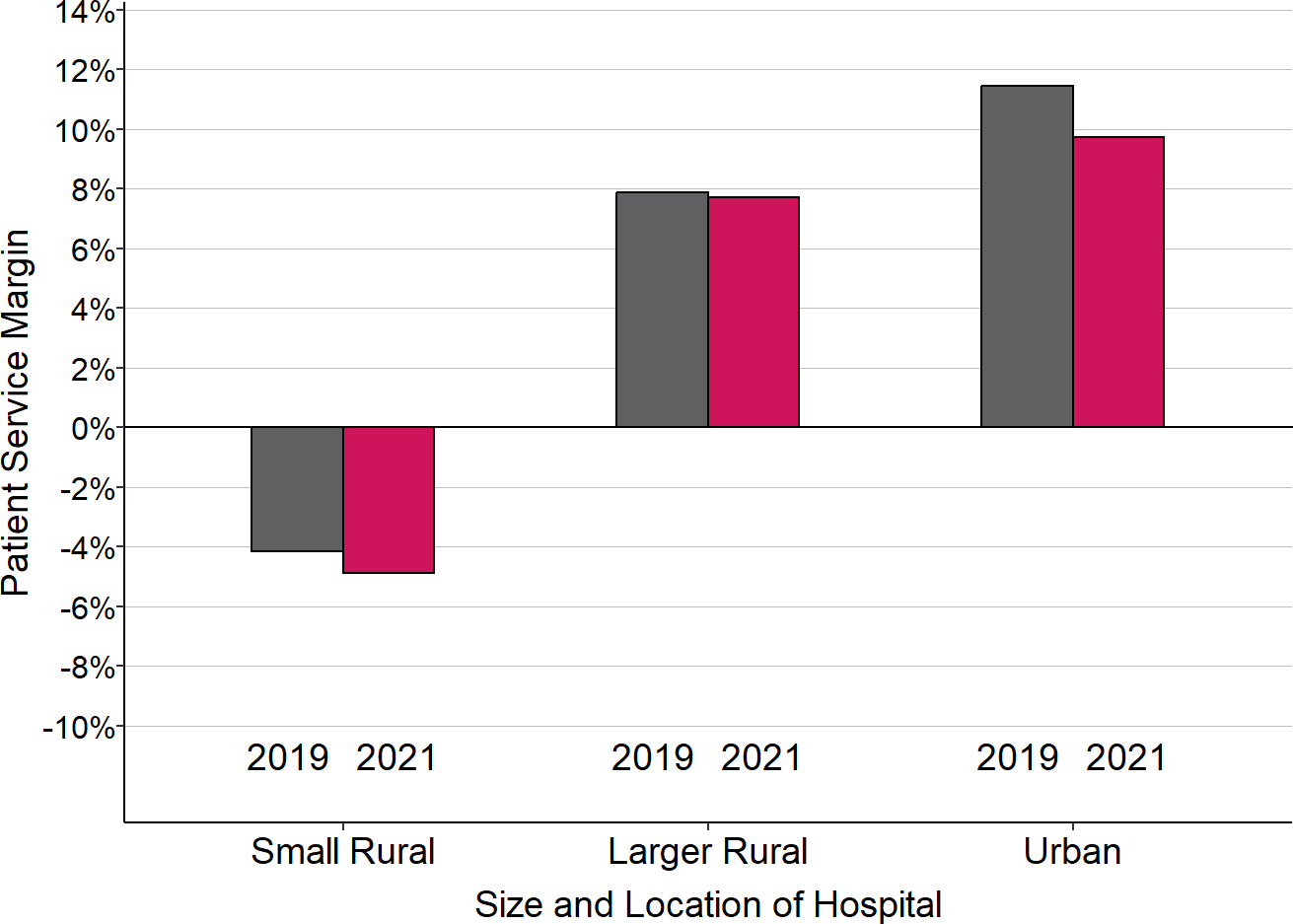

Figure 28

Change in Median Margins on Patient Services

“Small Rural” hospitals are rural hospitals with less than $45 million in total annual expenses. The hospital’s fiscal year that included the March-June 2020 period is considered to be 2020 for the purposes of this analysis. 2021 is the hospital’s fiscal year that followed that, and 2019 is the year that preceded it.

Figure 29

Median Margin on Patients With Private Insurance

“Small Rural” hospitals are rural hospitals with less than $45 million in total annual expenses. 2020 is the hospital’s fiscal year that included the March-June 2020 period, and 2019 is the preceding year. The margin shown is the difference between the revenues received from private insurance plans (including Medicare Advantage plans) and the cost of the services delivered to the patients insured by those plans, divided by the cost.

The Third Year of the Pandemic (2022)

Inflation and supply chain problems made everything more expensive in 2022 than 2021, and the national staff shortages in healthcare forced rural hospitals to pay much higher amounts to hire and retain staff and to pay high rates for temporary workers to fill vacancies. On top of higher costs, the 2% sequestration reduction in Medicare payments resumed in the second half of 2022. Both of these factors pushed hospitals’ margins on patient services lower in 2022.

Pandemic Impact on Total Profit Margins

One might have expected that the higher losses on patient services in 2020 would have caused more rural hospitals to close in 2021. That didn’t happen because rural hospitals’ total margins improved. In fact, the largest improvements occurred at the smallest rural hospitals, despite the greater losses on patient services.

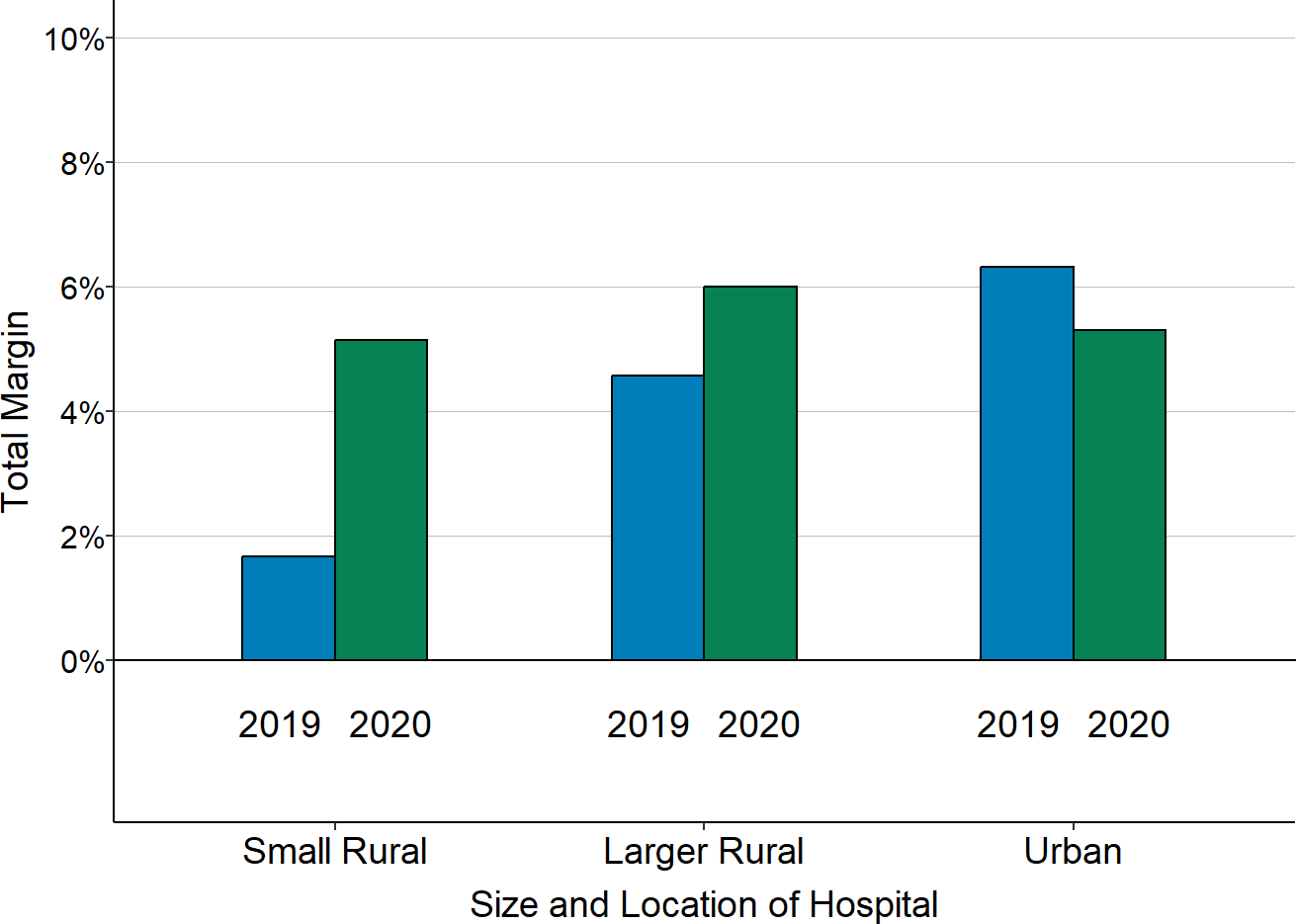

Figure 30

Change in Median Total Margin 2019-2020

“Small Rural” hospitals are rural hospitals with less than $45 million in total annual expenses. 2020 is the hospital’s fiscal year that included the March-June 2020 period, and 2019 is the preceding year. The margin shown is the difference between the total revenues received from all sources (including grants and revenues from activities other than patient services) and the total expenses incurred by the hospital, divided by the total expenses.

Hospitals had higher total margins even with lower margins on patient services because of the large amounts of government aid they received during the pandemic. The federal government provided several different types of financial assistance to hospitals in an effort to offset the negative impacts of the pandemic:

- Provider Relief Fund (PRF). Congress authorized $178 billion in Provider Relief (PRF) funding to cover financial losses and unexpected costs incurred by hospitals and other healthcare providers during the pandemic. The initial funds received by hospitals were equivalent to at least 2% of their 2018 patient revenue. Additional amounts were then provided for hospitals that serve a large number of low-income patients, hospitals that treated a large number of COVID-19 patients, and hospitals that had losses or higher costs between July 2020 and March 2021. The median award for rural hospitals was about $5 million, but large rural hospitals received much larger awards.

- American Rescue Plan (ARP) Rural Funds. Congress also authorized $8.5 billion in ARP funds specifically for hospitals and other providers that serve patients in rural areas to help cover lost revenue and costs associated with COVID-19. The median award for rural hospitals was about $1 million.

- Paycheck Protection Program (PPP). Congress authorized $659 billion for PPP loans to businesses and nonprofit organizations, including hospitals, if they had 500 or fewer employees. These loans were forgiven (i.e., converted into a grant) if the hospital maintained payroll and compensation levels during the initial months of the pandemic. The median amount received by rural hospitals that were eligible and applied was about $2 million.

- Advance Payments from Medicare. If a hospital requested it, the Centers for Medicare and Medicaid Services (CMS) provided an advance on the Medicare payments the hospital would expect to receive for services it delivered in future months. Not every hospital requested an advance, but most of those that did received millions of dollars in advance payments. These payments were not grants, but loans intended to help improve cash flow for the hospital during the pandemic. Hospitals have to repay these funds to CMS by the end of 2022.

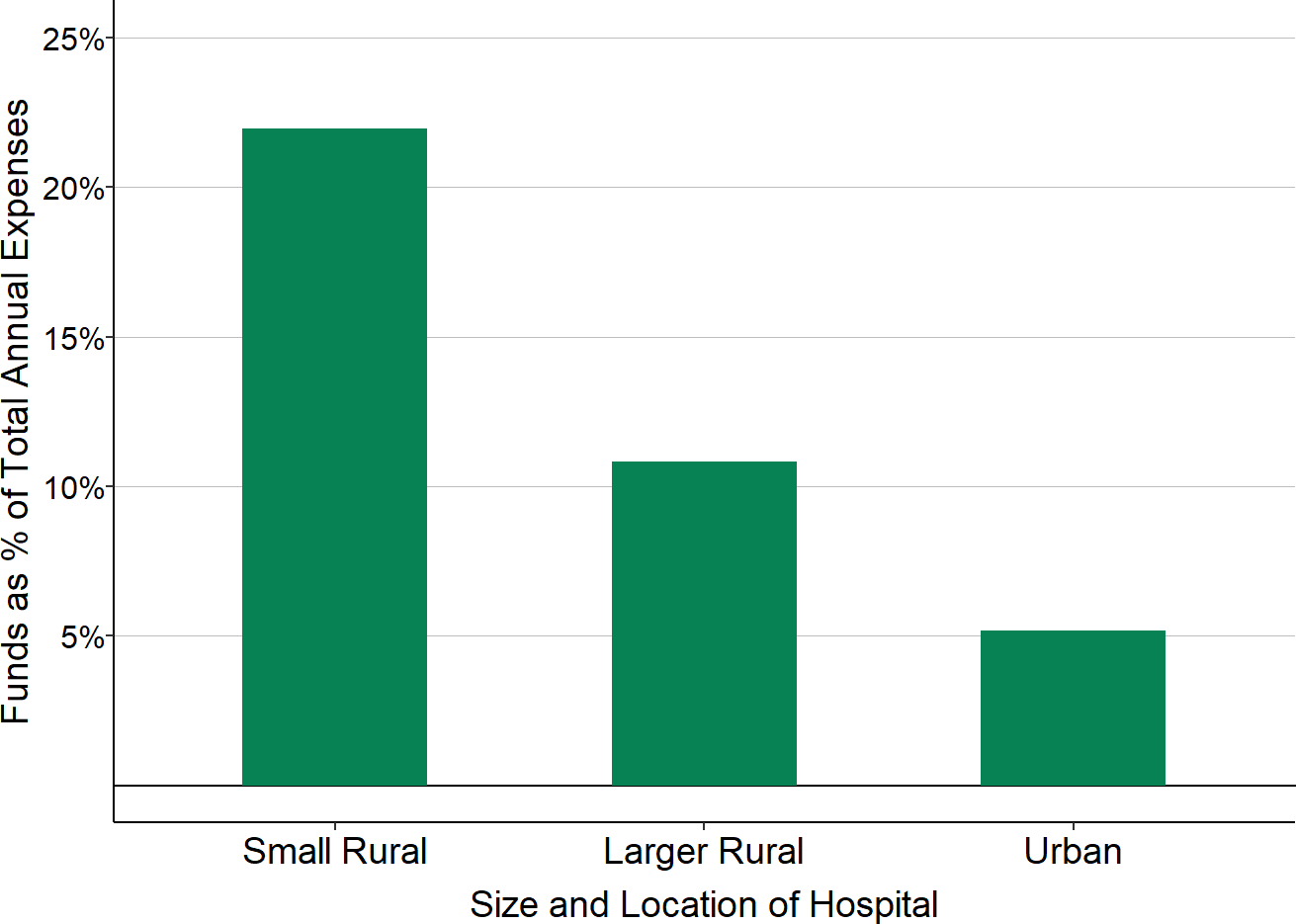

All of this funding helped rural hospitals stay afloat during the pandemic, particularly the small rural hospitals that needed help the most. Although bigger hospitals received larger amounts of funds in absolute terms, small rural hospitals received more funds in relative terms. For example, Federal Provider Relief Fund awards were equivalent to more than 20% of total expenses at small rural hospitals, but less than 15% for larger rural hospitals and less than 5% for most urban hospitals.

Figure 31

Provider Relief Fund Awards as % of Total Hospital Expenses

“Small Rural” hospitals are rural hospitals with less than $45 million in total annual expenses. The percentage shown is the median of the estimated total amount each hospital received in Provider Relief Funds divided by the hospital’s total expenses. The amount of Provider Relief Funds a hospital received could not be determined in cases where the funds went to parent corporations or entities with different names than the hospital.

However, hospitals can only keep the funds from the Provider Relief Fund and the American Rescue Plan if they are used “for health care related expenses or lost revenues that are attributable to coronavirus.” The Provider Relief Fund awards were so large that most small hospitals were only able to use a portion of the funds in 2020. Since the pandemic continued into 2022, hospitals were able to recognize additional portions of the funds in 2021 and 2022, but it is possible that some hospitals will have to return a portion of the funds they received.

Pandemic Aid Made Rural Hospitals Appear Healthier Than They Really Are

A disadvantage of the large, one-time funding awards and advance payments is that they make small rural hospitals appear stronger financially than they really are. For example:

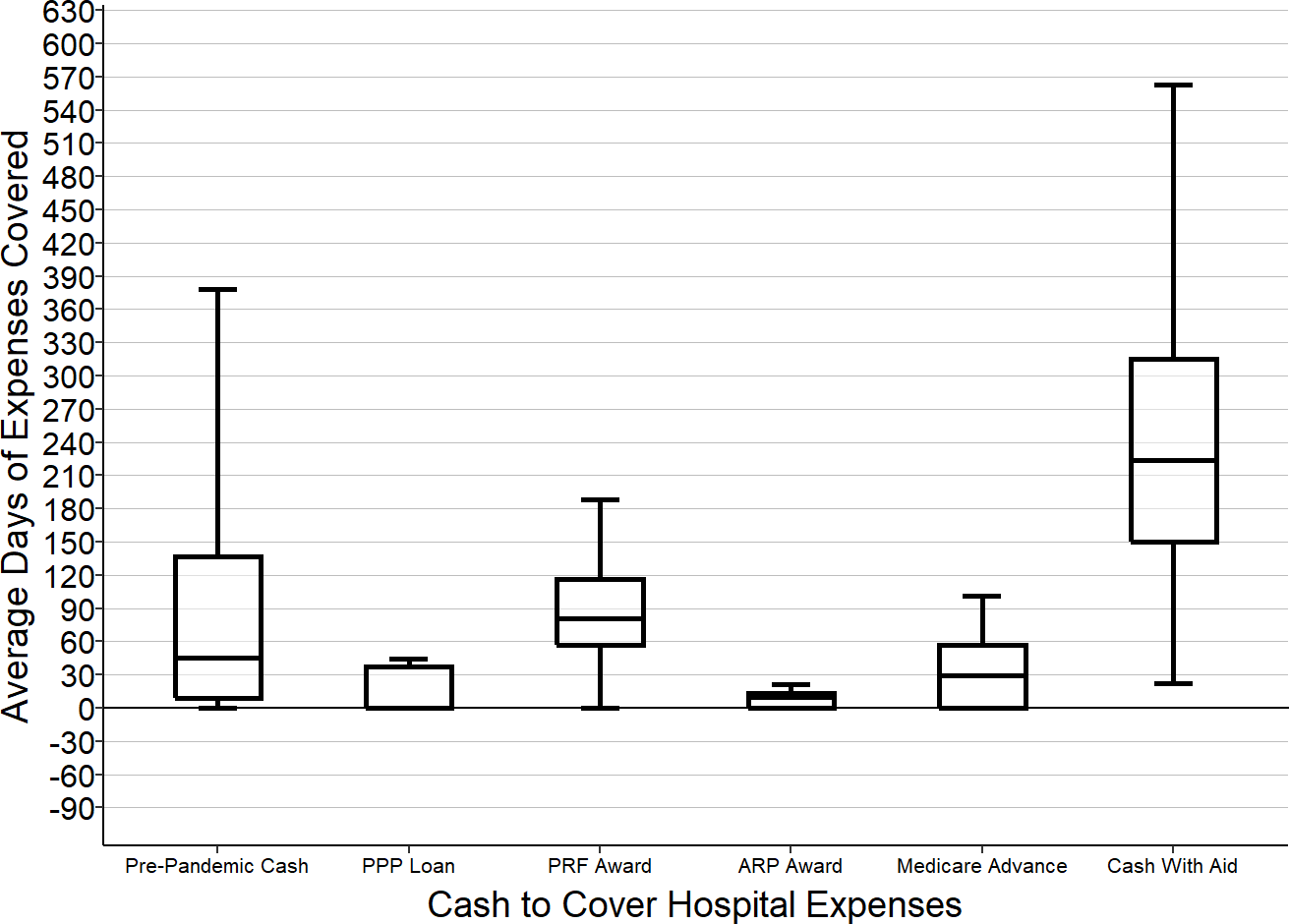

- “Days cash on hand” is a misleading measure of financial health. “Days cash on hand” is a metric commonly used to assess the financial health of a hospital; it represents the number of days that the hospital could cover its expenses if it received no additional revenues beyond the cash and short-term investments that it already has. Prior to the pandemic, most small rural hospitals had less than two months of cash on hand, and many had less than 30 days. By the end of their 2020 fiscal years, most small rural hospitals had more than 6 months of cash on hand. However, 1-2 months of that amount represented the payment advances from Medicare; as those advances are repaid, there will be a corresponding decrease in the hospitals’ cash on hand. In addition, a hospital was only be able to keep all of the Provider Relief Fund and American Rescue Plan funds it received if it incurred corresponding losses or higher costs due to COVID-19. Those losses and costs reduced the hospital’s cash reserves, offsetting the increase resulting from the awards. Consequently, days cash on hand in future years will decrease significantly from the levels in 2020-2021.

- Total margins are a misleading measure of financial health. Similarly, many rural hospitals reported a high total margin in 2021 because of the Provider Relief Fund, American Rescue Plan, and Paycheck Protection Loans they received, and this was also true for many hospitals in 2022. However, this does not mean that the hospitals’ services have suddenly become more profitable. Their total margins will decrease again after all of the federal funds have been used or returned.

Figure 32

Increase in “Days Cash on Hand” From Federal Pandemic Assistance

Rural Hospitals with Less Than $45 Million in Annual Expenses

“Cash” includes cash and short-term investments.

“Day of Expenses Covered” is the amount of cash divided by the hospital’s average expenses per day (not including depreciation).

“Cash with Aid” represents the cash on hand at the end of 2019 plus all four types of federal funds received during the pandemic. Because funds were provided at different times, and because the funding was used to cover expenses that occurred at different times, this amount will differ from the actual amount of cash available at the hospital at any specific point in time.

Differences by State

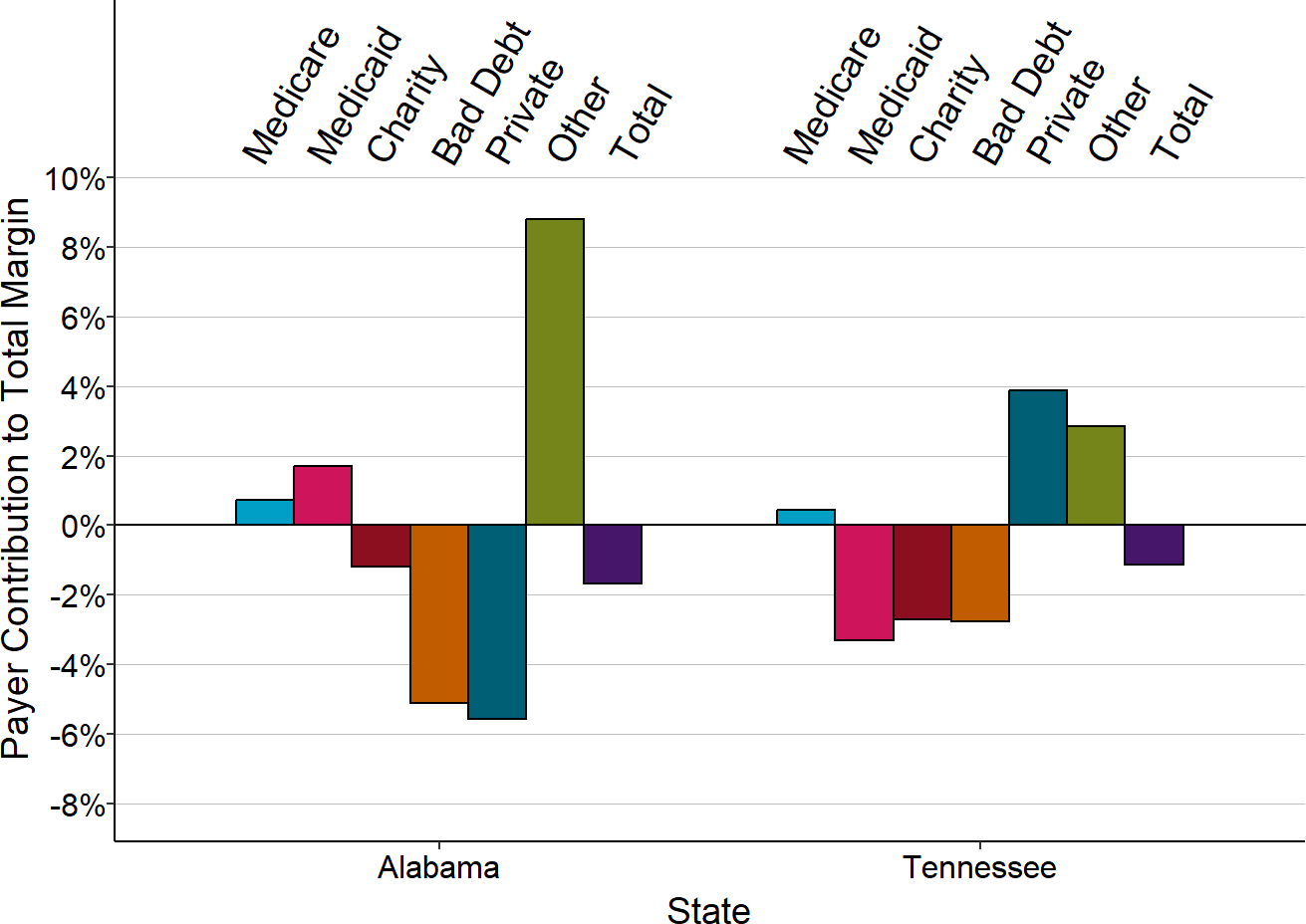

The analysis above demonstrates that in general, losses on services to patients with private insurance contribute more to low margins or losses at small rural hospitals than do losses on Medicaid or Medicare patients. However, not all small rural hospitals lose money, not all lose money on private-pay patients, and not all of them lose more on private-pay patients than on Medicaid or Medicare patients.

One of the primary determinants of this variation is the state in which the hospital is located. Payment amounts, patient cost-sharing, and eligibility in private insurance and Medicaid programs differ dramatically from state to state, and this causes the financial status of rural hospitals to also differ dramatically across states.

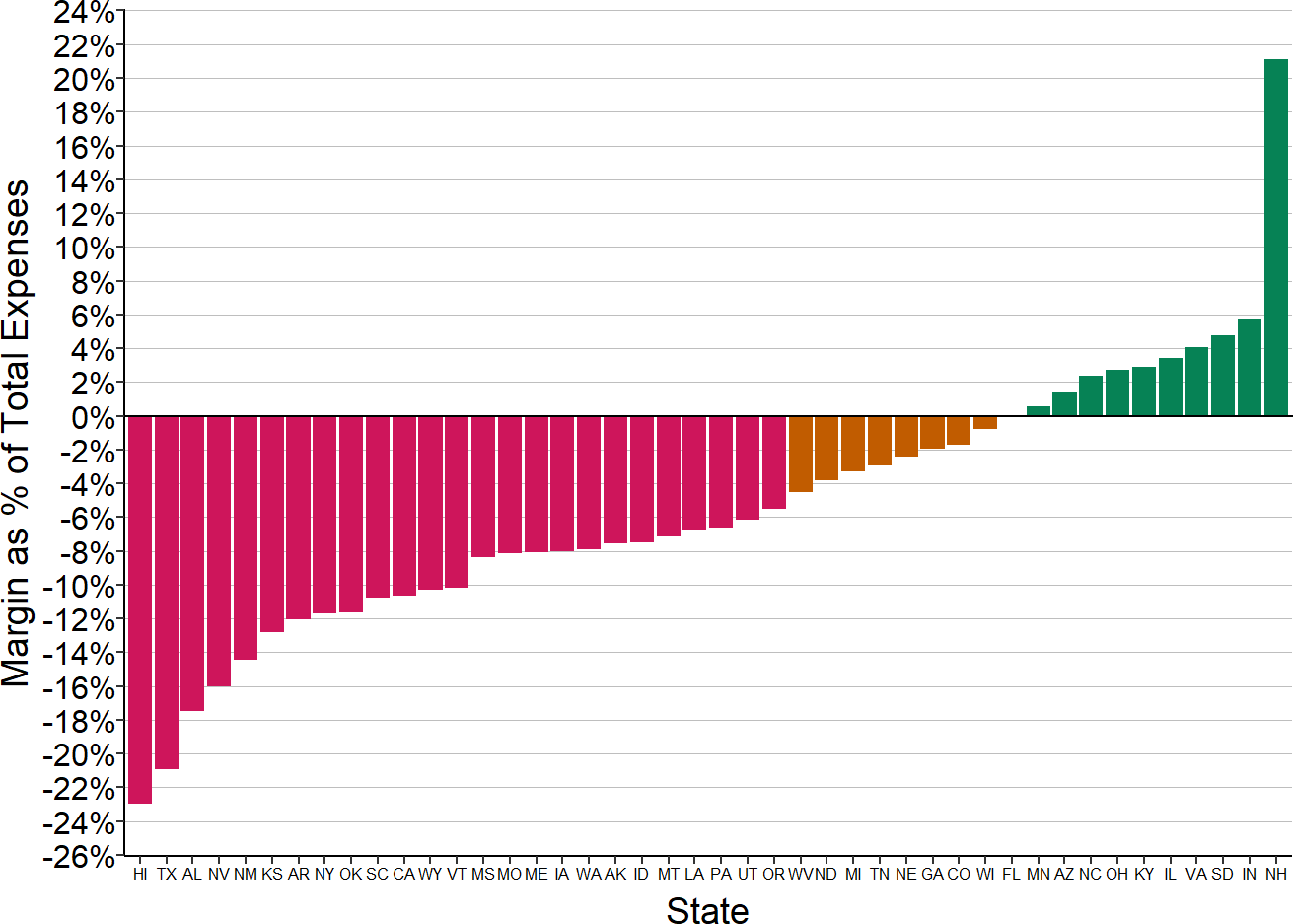

Variation in Total Margin

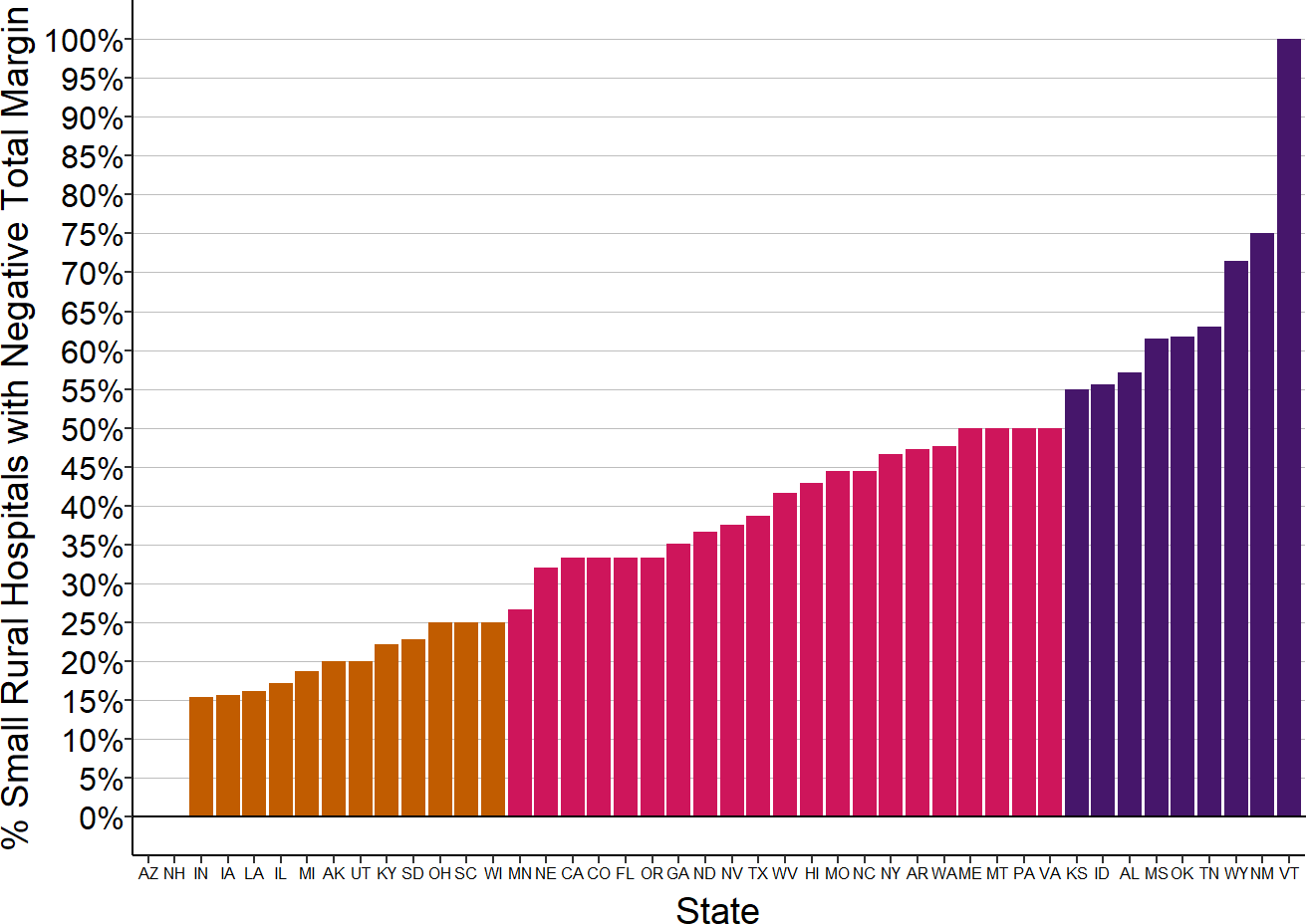

In the majority of states, at least one-fourth of small rural hospitals are losing money, and in four states, the majority of the small rural hospitals have had losses.41.

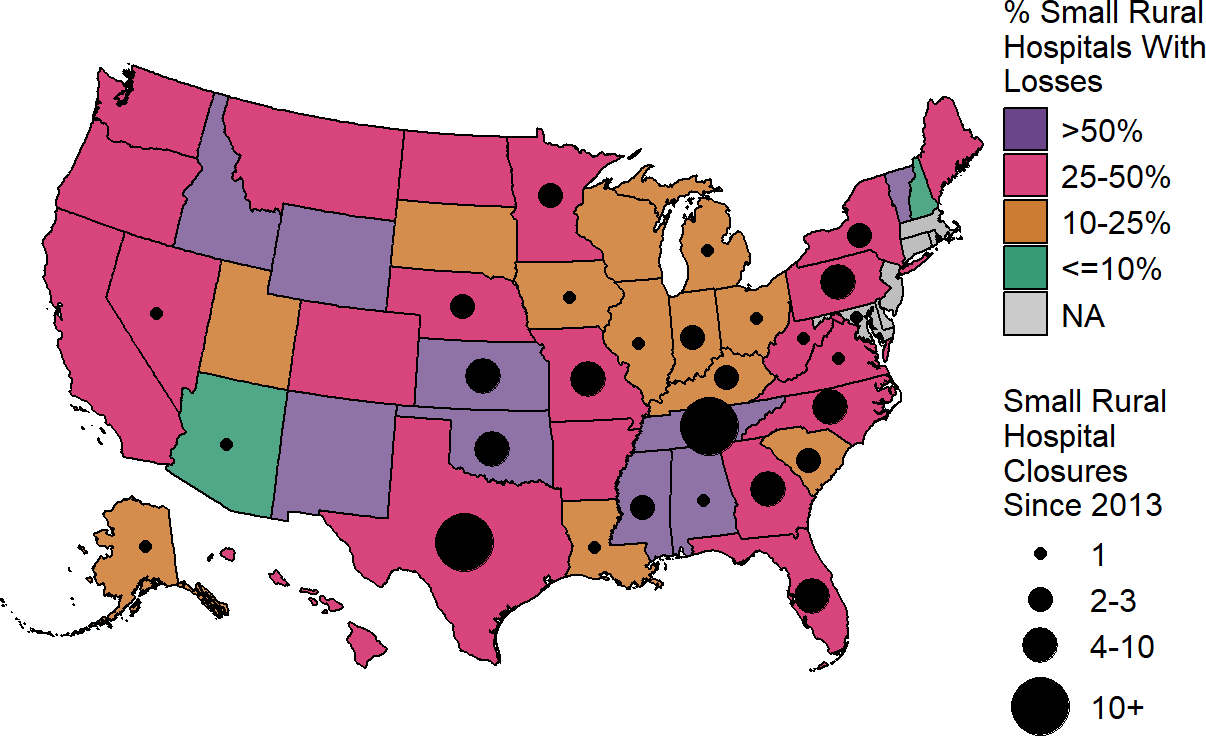

Many of the states in which a high percentage of small rural hospitals are currently losing money have also had many rural hospital closures over the past decade, as shown in the map below.

Figure 33

Percentage of Small Rural Hospitals with Negative Total Margins

Total margin for the most recent year available for rural hospitals located in the state with less than $45 million in expenses.

Figure 34

Percentage of Small Rural Hospitals with Negative Total Margins

and Number of Rural Hospital Closures

Total margin in most recent year available for rural hospitals located in the state with less than $45 million in expenses. Closures are those reported by the Sheps Center for Health Services Research. States shown in gray have no small rural hospitals.

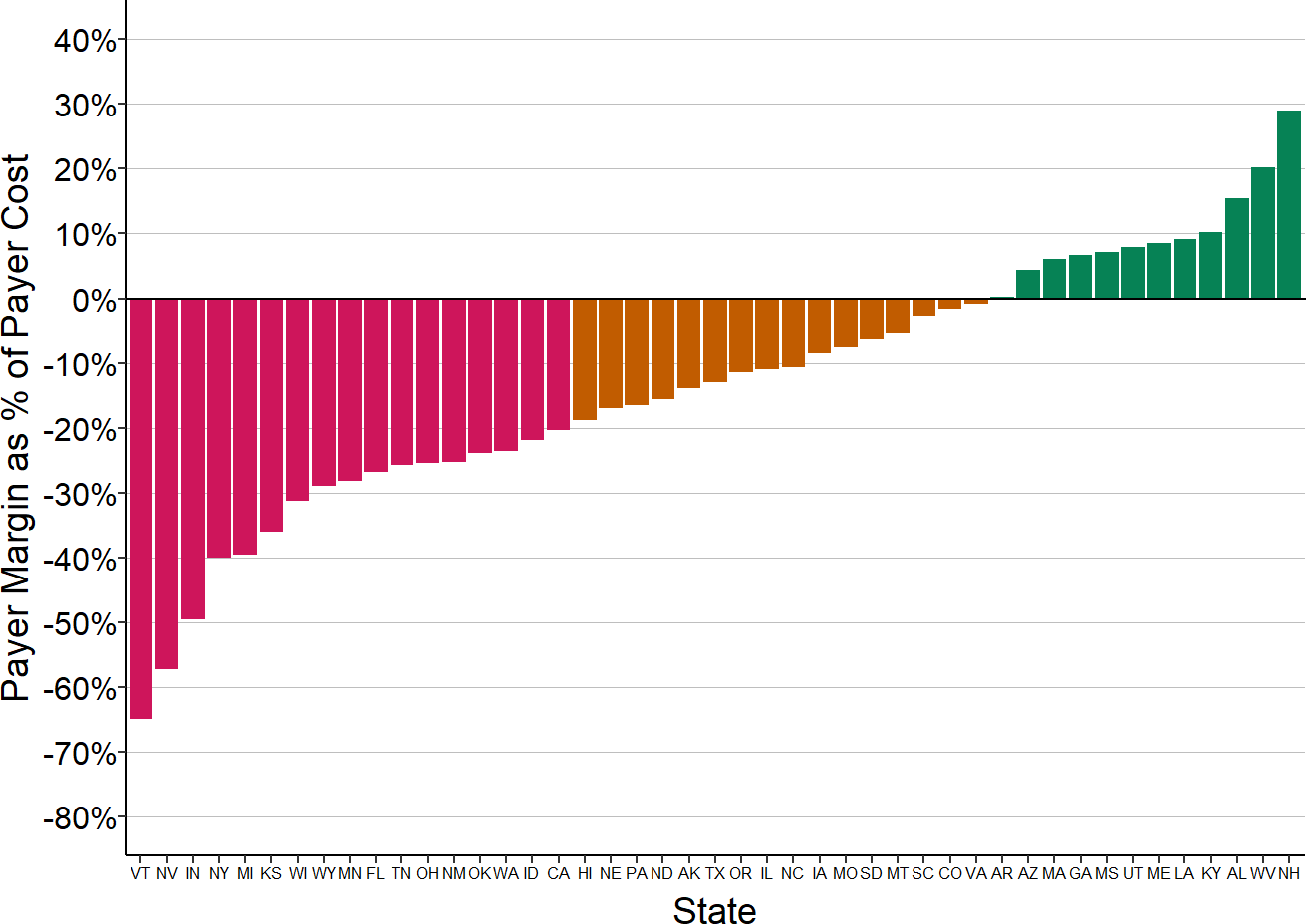

Variation in Private Payer Payments

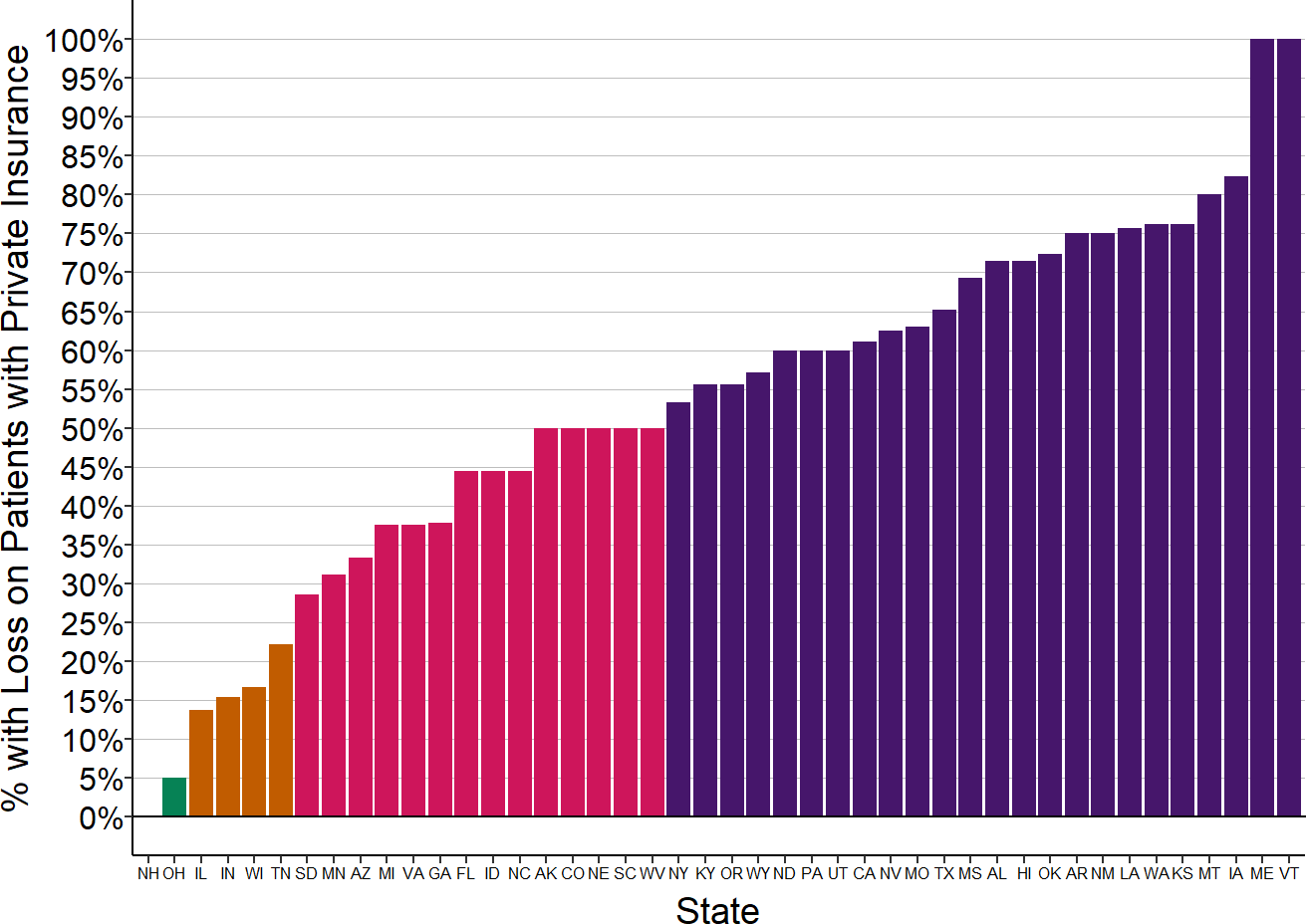

A major reason for the variation across states in the percentage of small rural hospitals losing money is the variation in the percentage losing money on private-pay patients. Although the median margin for patients with private insurance at small rural hospitals is 0%, there is wide variation above and below that median. More than one-fourth of the hospitals had losses of 15% or more, while one-fourth of the hospitals made profits of 15% or more.

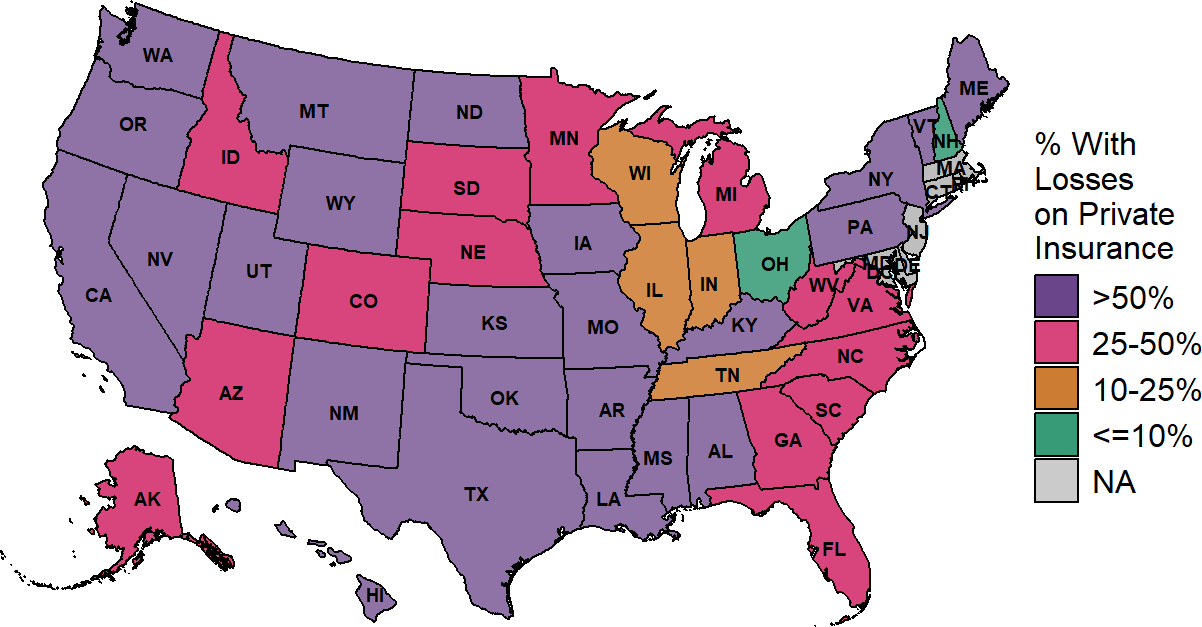

Much of that variation is driven by where the hospital is located. In more than half of the states, the majority of small rural hospitals lose money on patients with private insurance, and in 9 states, the majority of the small rural hospitals have had losses of 10% or more on private-pay patients.

Figure 35

Proportion of Small Rural Hospitals

With Losses on Patients with Private Insurance

Margins on services to patients with insurance from private health plans in the most recent year available for rural hospitals located in the state with less than $45 million in expenses.

Figure 36

Proportion of Small Rural Hospitals

With Losses on Patients with Private Insurance

Margin on services to patients with insurance from private health plans in the most recent year available for rural hospitals located in the state with less than $45 million in expenses.

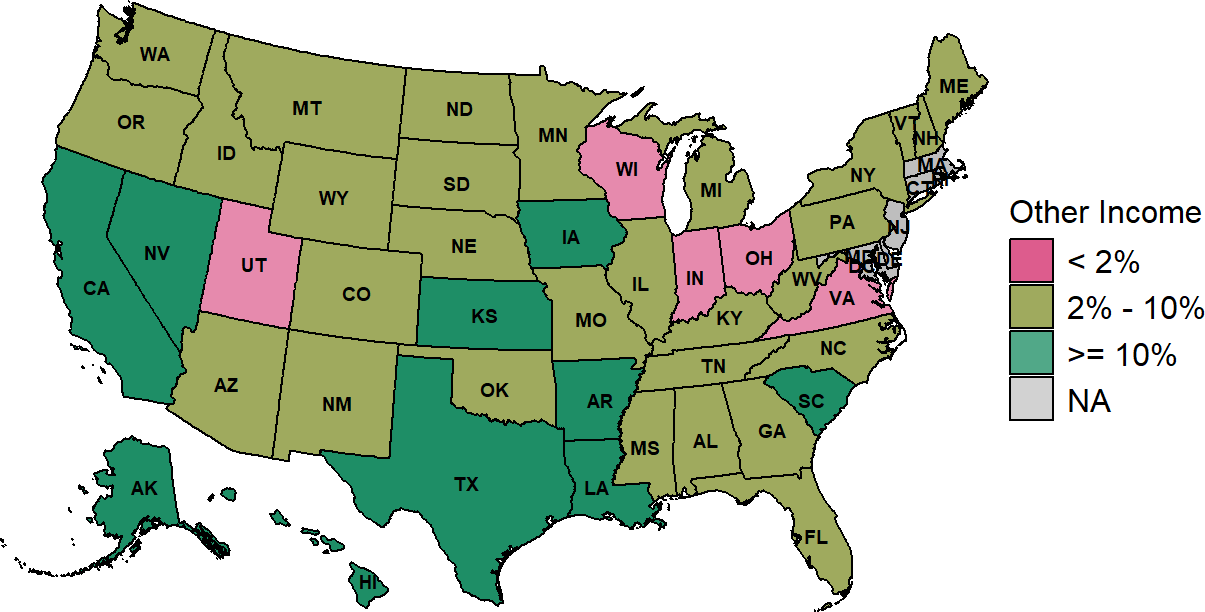

Variation in Patient Bad Debt

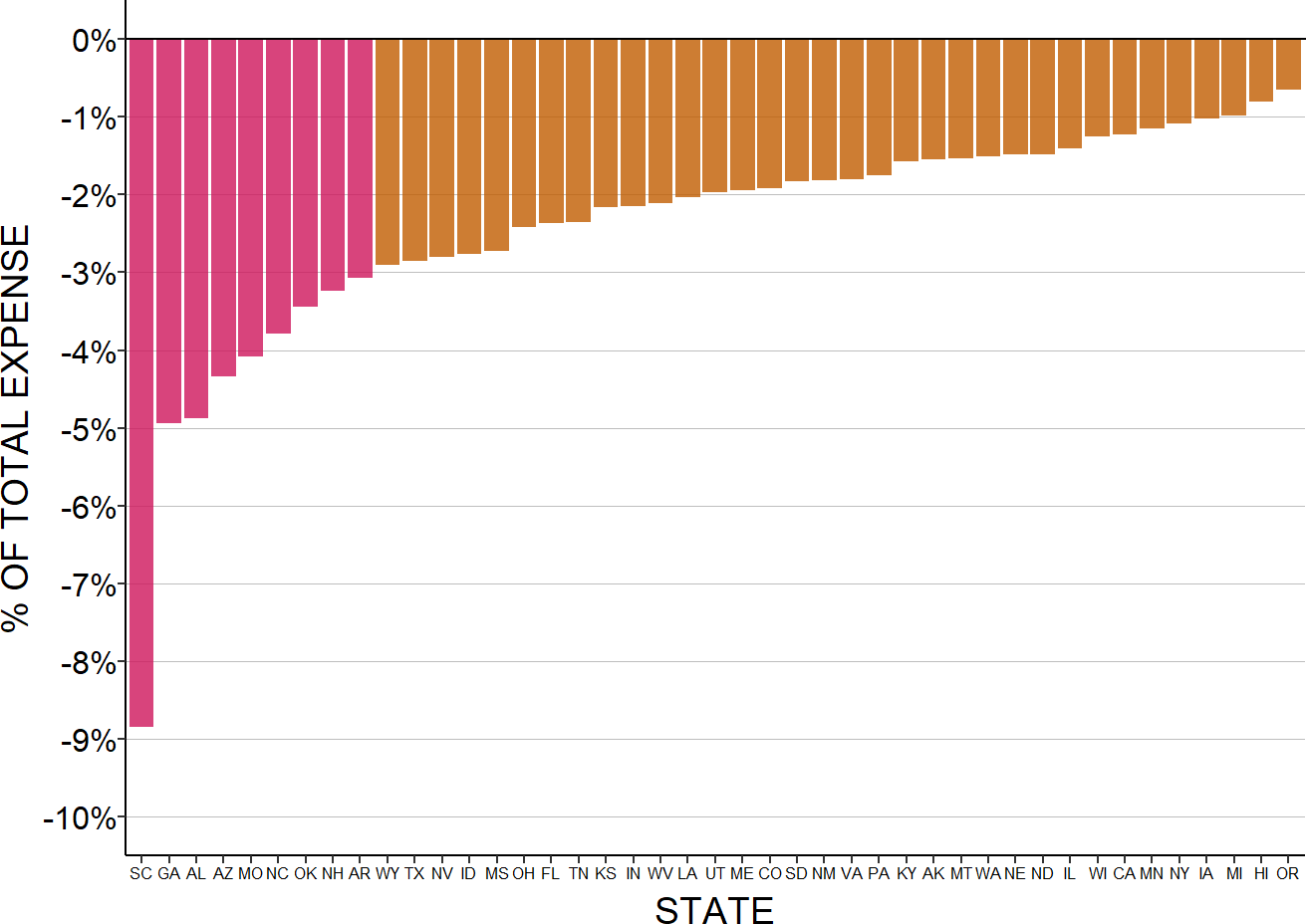

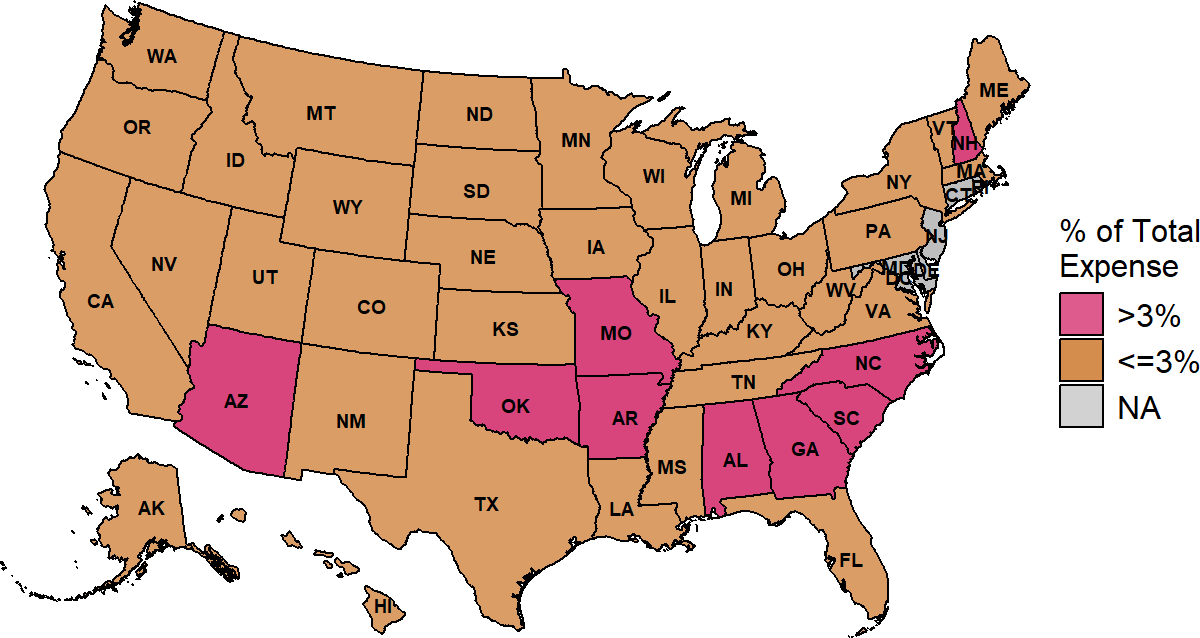

There are also significant differences across states in the amounts very small rural hospitals lose due to patient bad debt. In some states, this reduces hospital margins by only 1-2%, but for small rural hospitals in many states, the median loss is more than 3%.

Figure 37

Median Bad Debt as % of Expenses at Small Rural Hospitals

Median for the most recent three years available for rural hospitals located in the state with less than $45 million in expenses. Bad debt is only for patients with private insurance.

The highest losses on unpaid patient obligations are in the southeastern states. Rates of rural poverty are significantly higher in southern states than in other parts of the country, which makes it more likely that individuals living in those states will not have health insurance or be unable to afford cost-sharing amounts in their health insurance plans.

Figure 38

Median Bad Debt as % of Expenses at Small Rural Hospitals

The median is based on the three most recent years available at rural hospitals with less than $45 million in expenses. Bad debt is only for patients with private insurance.

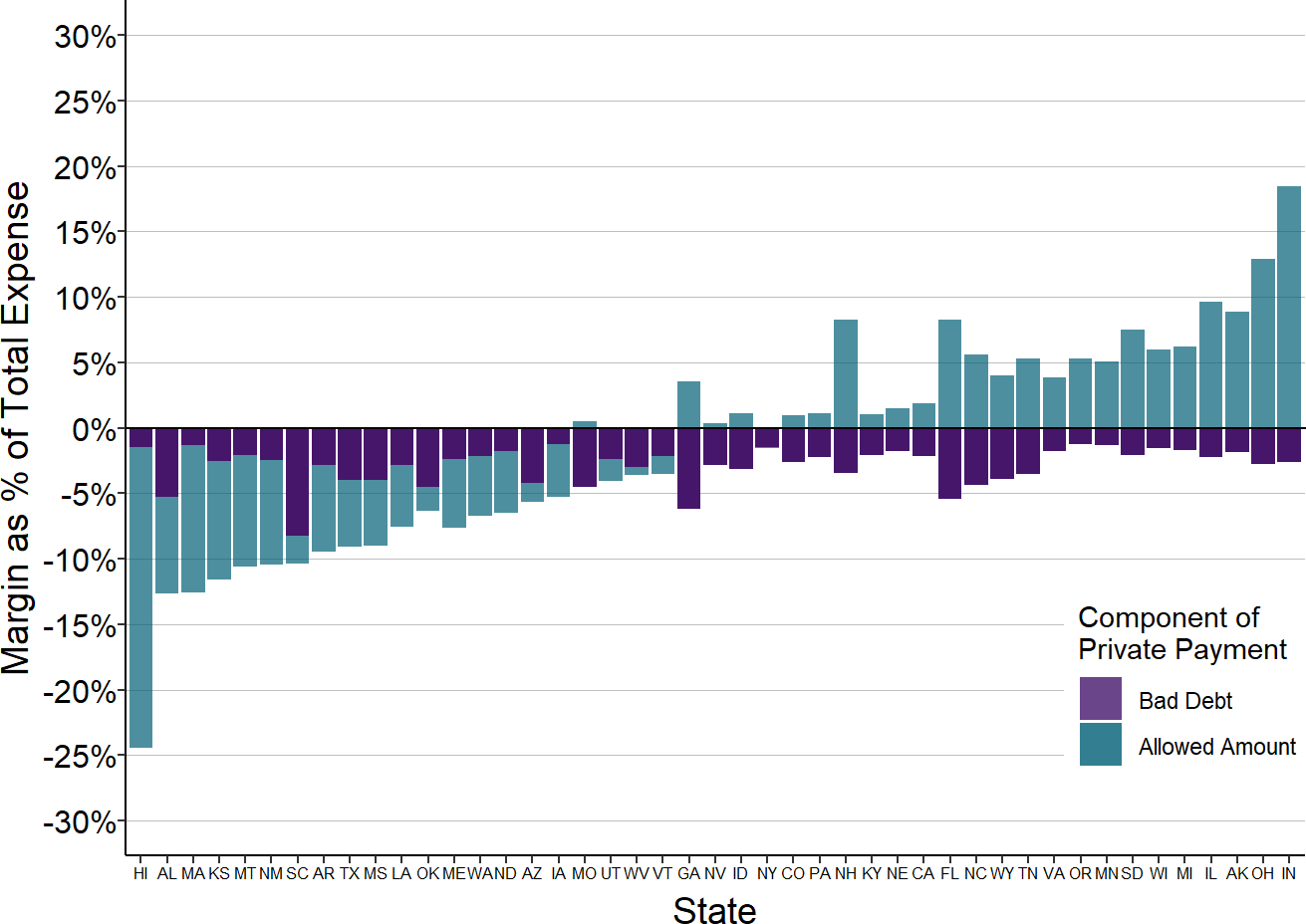

The margins for private-pay patients shown earlier are based on the total amounts the hospital expects to receive from both insurance plans and patients. Patient bad debt increases those losses and reduces the profits.

Figure 39

Median Contributions to Small Rural Hospital Margins

from Private Payer Allowed Amounts and Bad Debt

The median is based on the three most recent years available at rural hospitals with less than $45 million in expenses. Bad debt is only for private pay patients.

Variation in Medicaid Payments

There is also significant variation across states in the margins for Medicaid patients treated at small rural hospitals. Some state Medicaid programs use cost-based payment for services delivered by Critical Access Hospitals and special payment rates at other hospitals that result in positive margins or small losses for services delivered to Medicaid patients. In contrast, many other states have standard payment schedules for all hospitals that financially disadvantage small rural hospitals where the cost of delivering services is higher.42

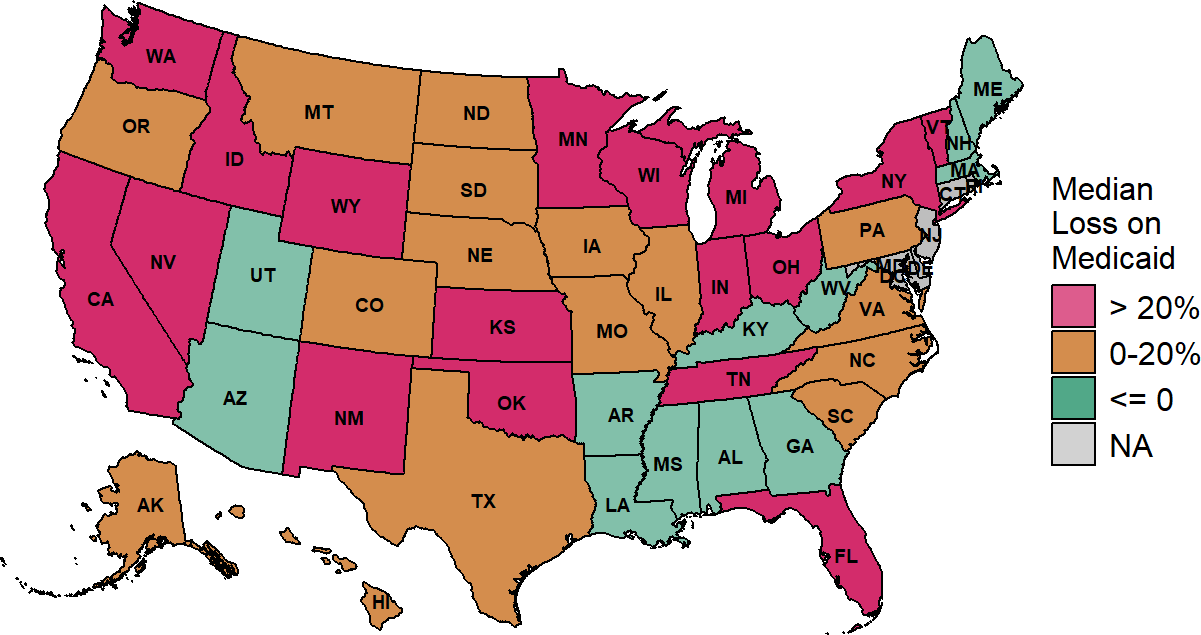

Losses on Medicaid patients are highest in states in the upper Midwest and West, whereas the majority of very small rural hospitals in the Southeast report positive margins on services to Medicaid patients.

Figure 40

Median Margin on Medicaid Patients

at Small Rural Hospitals

The median is based on the three most recent years available at rural hospitals with less than $45 million in expenses.

Figure 41

Median Margin on Medicaid Patients

at Small Rural Hospitals

The median is based on the three most recent years available at rural hospitals with less than $45 million in expenses.

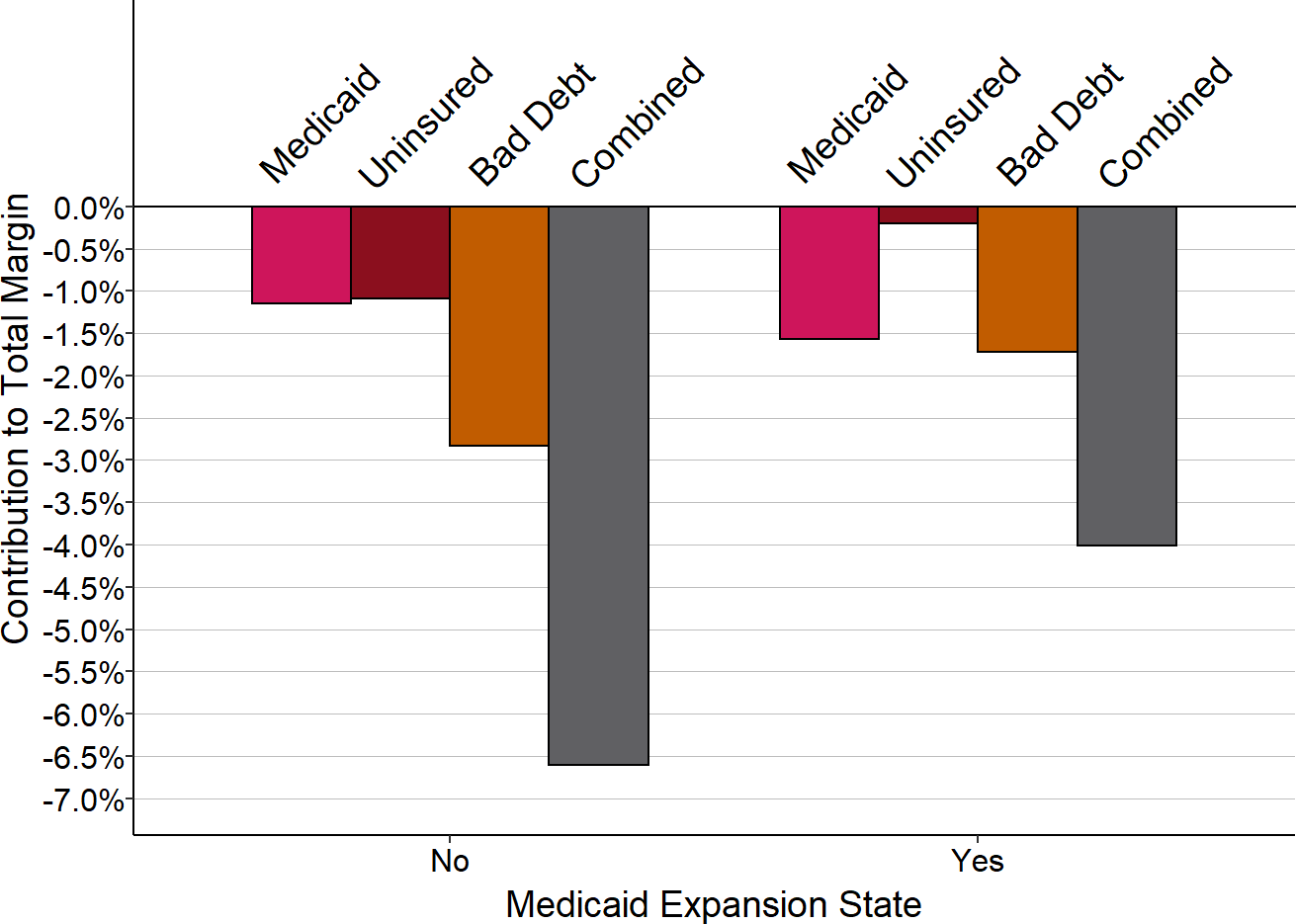

The Impact of Medicaid Expansion

Medicaid programs differ from state to state not only in the amounts paid for services, but in terms of eligibility requirements. The tighter the eligibility requirements in the state, the more likely it is that people living in rural areas will be uninsured or have insurance plans with high cost-sharing requirements. Consequently, some of the variation in patient bad debt across states could be due to variations in Medicaid eligibility requirements.

After the Affordable Care Act allowed states to broaden eligibility for Medicaid, some states increased income limits to the maximum amount permitted (i.e., “Expansion States”), while others have not done so. In Medicaid expansion states, losses from uninsured charity care cases and bad debt at very small rural hospitals are lower than in non-expansion states. However, losses on services delivered to patients who do have Medicaid are higher in the expansion states because the Medicaid payment rates are lower relative to costs than in the non-expansion states. The net effect is that small rural hospitals in Medicaid expansion states have smaller losses than hospitals in non-expansion states, but the difference is less than what one might expect or hope to see based on the difference in insurance coverage alone.

Figure 42

Median Contributions to Total Margin from

Medicaid, Uninsured, and Bad Debt

in States That Did and Did Not Expand Medicaid

The median is based on revenues and expenses in the most recent year available at rural hospitals with less than $45 million in expenses in each group of states.

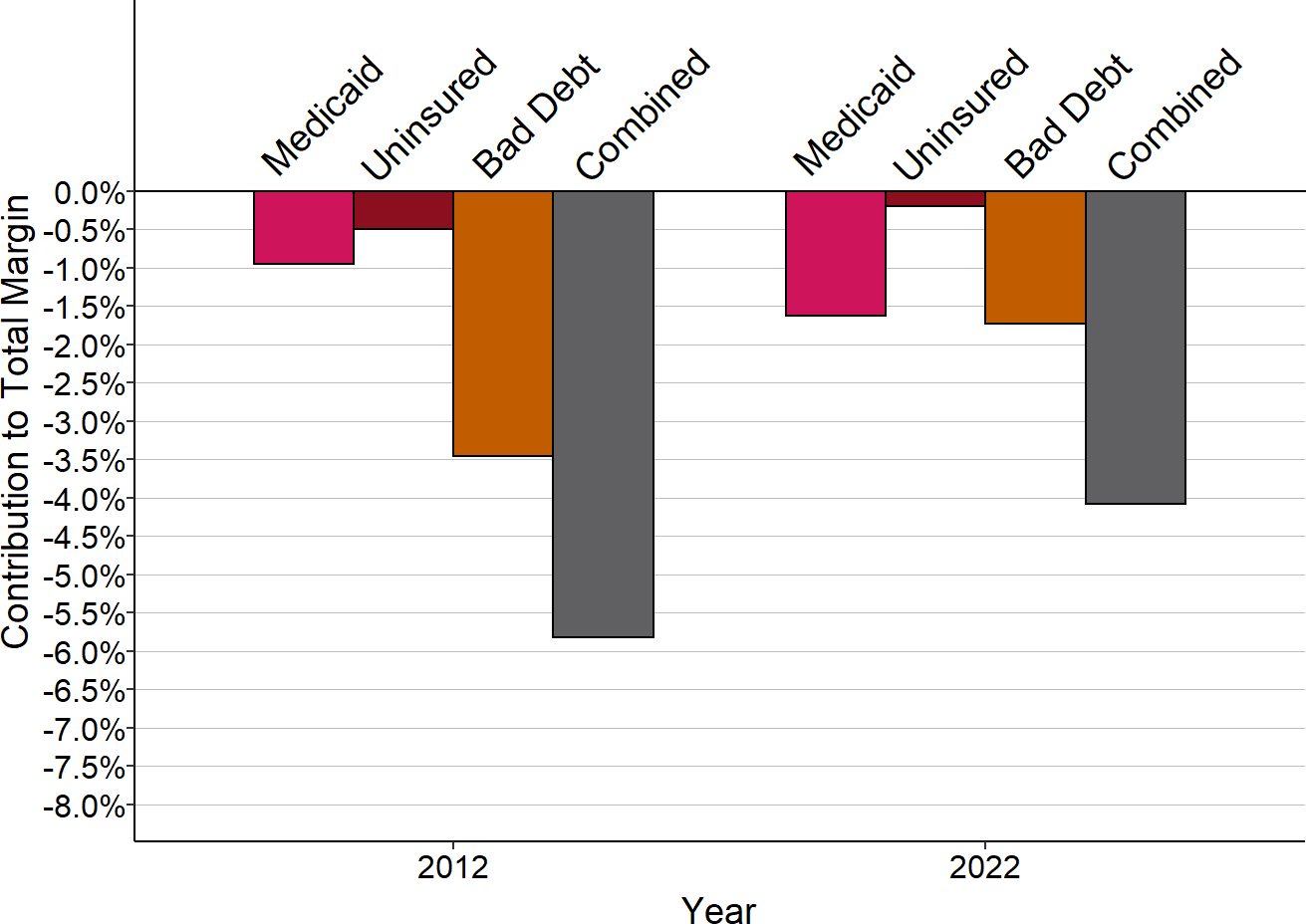

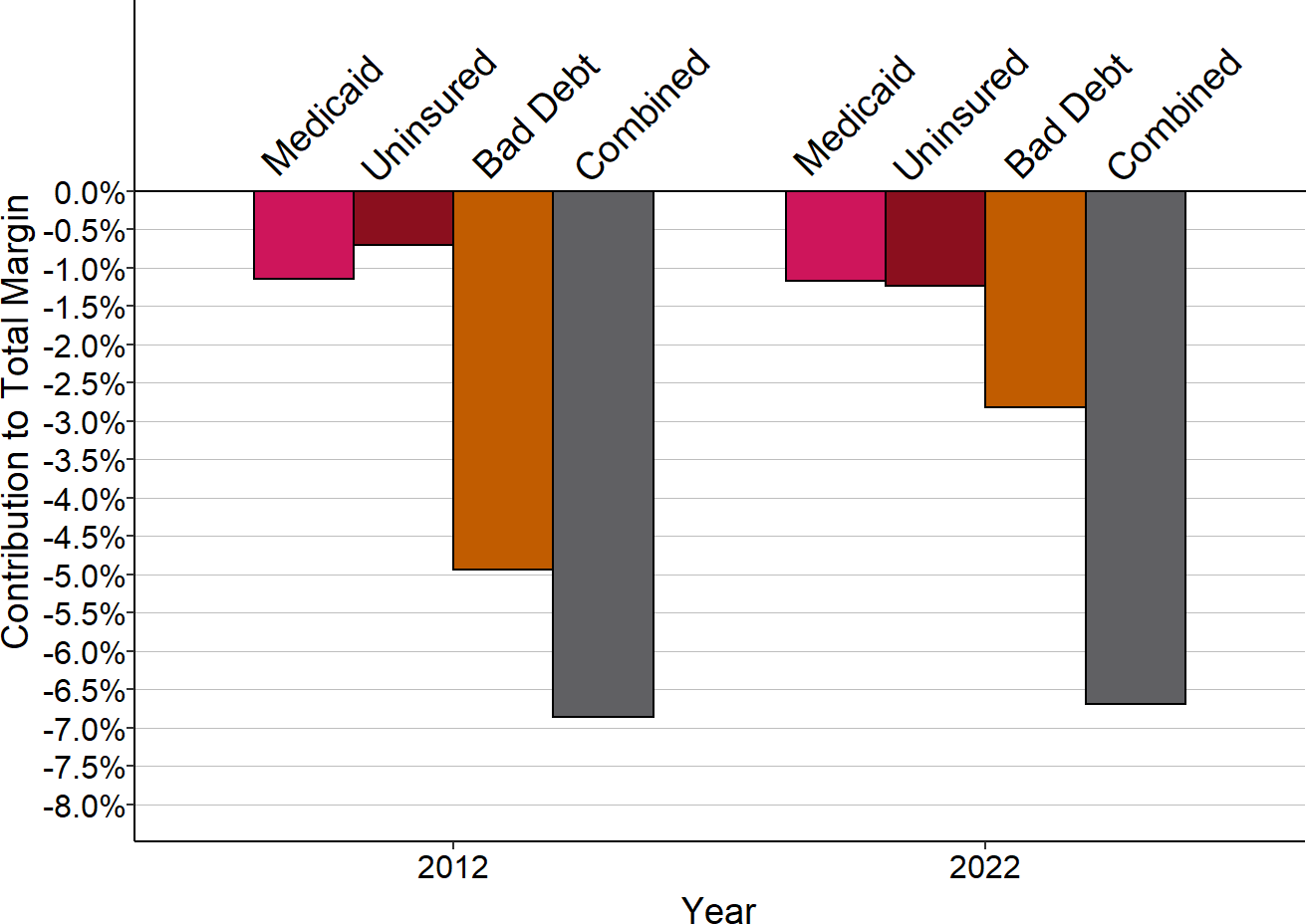

In Medicaid expansion states, median losses on both uninsured charity cases and bad debt decreased at small rural hospitals following expansion. In non-expansion states, although losses on uninsured charity cases at small rural hospitals increased, losses on bad debt decreased, resulting in a net reduction in combined losses from those two categories. The losses in both categories were lower in expansion states than in non-expansion states prior to expansion and the combined losses remained lower after expansion.

In expansion states, losses on services to Medicaid patients at small rural hospitals increased following expansion, whereas losses in non-expansion states decreased. It is possible that the funding used to pay for expansion limited the ability to increase Medicaid payments to hospitals in expansion states.43

The net effect was a reduction in the combined losses from all three categories in expansion states, and a smaller decrease in non-expansion states. However, most small rural hospitals in both expansion and non-expansion states continue to lose money on both Medicaid and uninsured patients.

Figure 43

Contributions to Small Rural Hospital Margins

in States That Expanded Medicaid

Small rural hospitals are those with total expenses below the median in each year. 2012 is pre-expansion, 2024 is post-expansion.

Figure 44

Contributions to Small Rural Hospital Margins

in States That Did Not Expand Medicaid

Small rural hospitals are those with total expenses below the median in each year.

Variation in Medicare Margins